Get the free Property Tax Clearance Schedule Double - Indiana - tippecanoe in

Show details

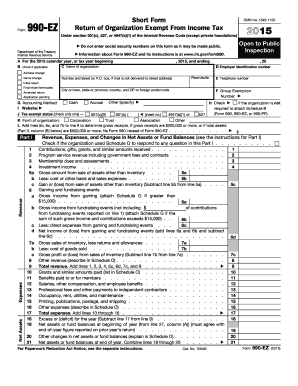

PROPERTY TAX CLEARANCE SCHEDULE FORM NO. 1 (For a Person Business Corporation) ATC permit number State Form 1462 (R5 / 10-01) Approved by State Board of Accounts, 1992 Expiration date (Month, day,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax clearance schedule

Edit your property tax clearance schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax clearance schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing property tax clearance schedule online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit property tax clearance schedule. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax clearance schedule

How to fill out a property tax clearance schedule:

01

Gather all relevant documentation: Before filling out the property tax clearance schedule, gather all necessary documents such as property ownership records, previous tax statements, and any relevant financial documents.

02

Review the schedule instructions: Carefully read and understand the instructions provided with the property tax clearance schedule. This will provide guidance on how to complete the form correctly and avoid any mistakes.

03

Begin by entering personal information: Start by entering your personal information, including your name, contact details, and property address. Make sure to provide accurate information to avoid any issues with the clearance process.

04

Provide property details: Fill in the specific details about the property, such as the property type, size, and any additional structures or improvements. Include any relevant rental or lease information if applicable.

05

Determine property value: Calculate the assessed value of the property based on the provided guidelines and market conditions. This may involve reviewing recent sales data or consulting with a real estate professional or appraiser.

06

Declare property income: If the property generates income, declare the rental or lease income obtained from the property. Include all financial details, such as income received, expenses incurred, and any applicable deductions.

07

Disclose property taxes paid: Account for the property taxes paid during the specified timeframe covered by the clearance schedule. Provide accurate details of payment dates, amounts paid, and any supporting documentation.

08

Include any exemptions or deductions: If you qualify for any property tax exemptions or deductions, clearly indicate them on the schedule. This may include exemptions for primary residences, senior citizens, or military personnel.

09

Attach supporting documents: Attach any relevant supporting documents that validate the information provided in the schedule. This may include receipts for property tax payments, income statements, or any necessary proofs for claimed exemptions or deductions.

10

Review and submit the schedule: Before submitting the completed property tax clearance schedule, thoroughly review all the information provided. Ensure that all fields are accurately filled out and that supporting documents are properly attached. Once confident, submit the schedule according to the specified instructions.

Who needs property tax clearance schedule?

01

Property owners: Individuals who own property, whether residential or commercial, may need a property tax clearance schedule to fulfill their legal obligations and provide accurate information to the tax authorities.

02

Real estate investors: Investors who own multiple properties or have real estate as part of their investment portfolio might require a property tax clearance schedule to stay compliant with tax regulations and track their property tax liabilities.

03

Financial institutions: In certain situations, financial institutions may request a property tax clearance schedule from property owners as part of the loan application or mortgage process. This helps the lender assess the property's tax status and determine its value for lending purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is an Indiana certificate of clearance?

A tax clearance is an official confirmation provided by the Indiana Department of Revenue (DOR) that no tax is due by the business or individual.

How do I get a tax clearance certificate in Indiana?

To receive a tax clearance for any of the above licenses, you must meet the following requirements: All tax returns must be filed up-to-date. All outstanding delinquencies must be paid in full. All payments must be made using guaranteed funds.

Where do I pay my property taxes in Tippecanoe County Indiana?

Staff Directory Jennifer Weston. County Auditor. Phone: 765-423-9207. Treasurer. Email the Treasurer. Physical Address View Map. 20 N 3rd Street. 2nd Floor. Lafayette, IN 47901. 20 N 3rd Street 2nd Floor Lafayette IN 47901. Directions. Phone: 765-423-9273. Hours. Monday - Friday. 8 a.m. - 4:30 p.m.

How long can you go without paying property taxes in Indiana?

Redemption Period in Indiana (Ind. Code § 6-1.1-25-4). In some cases, though, the redemption period is 120 days.

What are property taxes in Tippecanoe County Indiana?

Summary Statistics for this County and the State Property Tax Rates in Tippecanoe County, INProperty Tax Rates in StateHighest2.88478.811Lowest1.3250.8447Median1.72.08

Where do I get a clearance certificate?

This report can be issued by any Local Criminal Record Centre (LCRC). The prescribed fee is R80,00 per report. The Police Clearance Report issued must be handed to the applicant in person upon collection. Proof of identity must be presented when the report is collected.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my property tax clearance schedule directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your property tax clearance schedule and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send property tax clearance schedule to be eSigned by others?

When you're ready to share your property tax clearance schedule, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I fill out property tax clearance schedule on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your property tax clearance schedule from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is property tax clearance schedule?

The property tax clearance schedule is a form that property owners must fill out and submit to the tax authorities to ensure that all property taxes have been paid.

Who is required to file property tax clearance schedule?

Property owners who own real estate or property are required to file the property tax clearance schedule.

How to fill out property tax clearance schedule?

Property owners must provide their personal information, property details, and proof of property tax payments when filling out the property tax clearance schedule.

What is the purpose of property tax clearance schedule?

The purpose of the property tax clearance schedule is to verify that property taxes have been paid in full and to ensure compliance with tax laws.

What information must be reported on property tax clearance schedule?

Property owners must report their personal details, property address, tax payments, and any outstanding taxes on the property tax clearance schedule.

Fill out your property tax clearance schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Clearance Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.