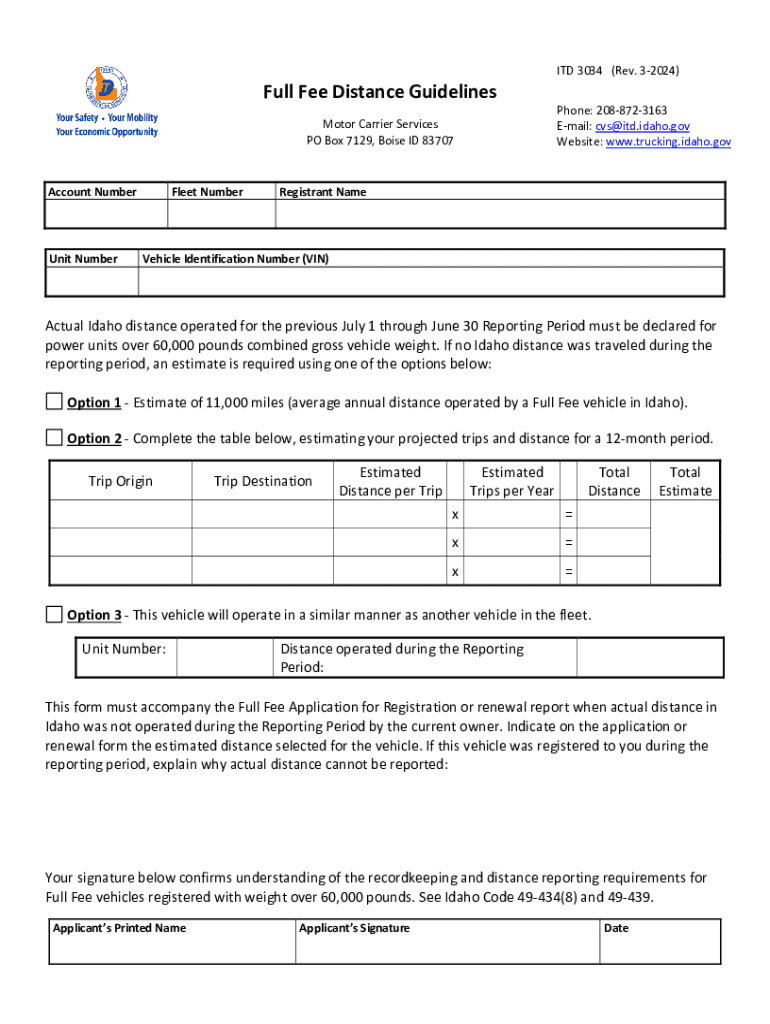

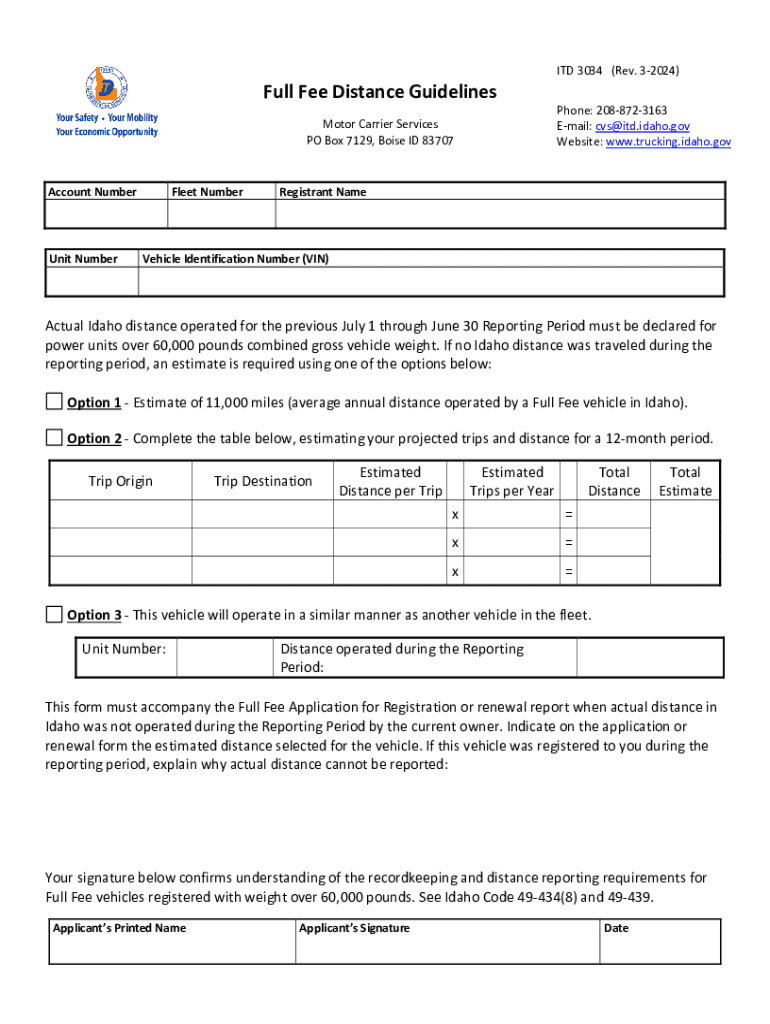

ID ITD 3034 2024-2026 free printable template

Get, Create, Make and Sign ID ITD 3034

How to edit ID ITD 3034 online

Uncompromising security for your PDF editing and eSignature needs

ID ITD 3034 Form Versions

How to fill out ID ITD 3034

How to fill out full fee mileage guidelines

Who needs full fee mileage guidelines?

Comprehensive Guide to Full Fee Mileage Guidelines Form

Understanding full fee mileage guidelines

Full fee mileage guidelines are essential for both individuals and organizations as they outline the policies and procedures for reimbursing employees and contractors when they use their personal vehicles for work-related travel. The primary purpose of these guidelines is to ensure that all relevant expenses are accurately documented and compensated, which is crucial for maintaining financial integrity and trust between parties.

Understanding full fee mileage guidelines is vital for reimbursement purposes, as they serve to standardize the process of claiming travel expenses. This is important not only for compliance with government regulations but also for ensuring that individuals receive fair compensation for their business travel. Inconsistent or unclear mileage policies can lead to disputes and dissatisfaction among employees or contractors.

Who needs the full fee mileage guidelines form?

The full fee mileage guidelines form is an essential tool for various stakeholders in a business context. Primarily, individuals such as freelancers and contractors who frequently use their personal vehicles for business purposes need to be familiar with the form. This helps them accurately report their mileage and ensure proper compensation for business-related travel.

Teams within organizations also need to utilize this form. Employees traveling for meetings, trainings, or client consultations should adhere to the guidelines to guarantee that their travel expenses are reimbursed properly. This is especially important for companies that aim to maintain consistent reimbursement policies across different departments and team members.

Components of the full fee mileage guidelines form

The full fee mileage guidelines form typically contains several key sections that need to be filled out correctly. Understanding these components ensures that all necessary information is collected and that reimbursements are processed smoothly. Most forms will include Personal Information, Trip Details, Mileage Calculation, and Expense Reporting as their primary sections.

Beginning with Personal Information, this section requires basic details such as the individual's name, contact information, and any employee or contractor identification numbers. Trip Details will demand accurate documentation of each trip taken, including the date, purpose, and destination. The Mileage Calculation section is critical and outlines how to determine the distance traveled, whereas Expense Reporting should address any additional expenses incurred, such as parking fees or tolls.

Step-by-step guide to filling out the form

Filling out the full fee mileage guidelines form requires careful attention to detail to ensure that all necessary information is accurately reported. To begin, the first step is to gather all necessary documentation. This may include travel logs, receipts for any expenses incurred, and potential mileage tracking apps that automatically record your trips.

Next, proceed to fill out your Personal Information accurately. This step is crucial as incomplete or incorrect information could impede reimbursement. After detailing personal information, focus on documenting Trip Details effectively. Record the purpose of the trip, the date it occurred, and specifics about the destination for transparency.

In the Mileage Calculation section, leverage technologies like Google Maps or dedicated mileage tracking software to ensure accuracy. After calculating your mileage, report any additional expenses in the Expense Reporting section by clearly detailing what qualifies for reimbursement – this may include parking fees, tolls, or even meals if stipulated by your company's policies.

Finally, conduct a review of the completed form. Double-check all your entries for accuracy before submission. Even minor errors can result in delays or missed reimbursements, making this final step essential.

Common mistakes to avoid

When submitting the full fee mileage guidelines form, it's important to be aware of common pitfalls that can result in reimbursement delays or rejections. One major mistake is inaccurate mileage reporting. This can have serious repercussions, as initiating the process with incorrect figures can taint the entire reimbursement claim and lead to disputes or audits.

Additionally, missing documentation is another frequent issue that hampers the reimbursement process. Proper receipts and logs should accompany all claims; otherwise, claims may be rejected outright. It's also pivotal to adhere to the correct submission protocol; not following company guidelines or policies can lead to confusion and unprocessed claims. Lastly, neglecting to review the company's specific reimbursement policies can result in oversights regarding eligible expenses.

Tips for maximizing mileage reimbursement

To maximize mileage reimbursement, it is essential to adopt best practices for tracking mileage. Utilizing dedicated mileage tracking apps can significantly streamline the process, allowing you to automatically record trips and avoid manual errors. Some apps even provide extensive reporting features that can aid in documentation. Keeping consistent logs of your travel details assists you in promptly filing claims and ensures accuracy.

Understanding your employer's policies is equally important. Make sure to reach out to HR or payroll to clarify any questions you may have regarding eligible expenses or reimbursement rates. Knowing the finer points of your company’s policies can make a difference in your reimbursement outcomes and ultimately lead to greater financial satisfaction.

Interactive tools for easier management

pdfFiller offers a comprehensive suite of features that make the management of the full fee mileage guidelines form seamless. With editing and eSigning capabilities, users can fill out their forms directly within the platform, facilitating easy adjustments as needed. The advantage of cloud storage further allows access from anywhere, which is crucial for individuals frequently on the move.

To leverage pdfFiller for completing the form, users can follow simple step-by-step instructions. Start by selecting the form template, fill out the necessary sections, and utilize built-in tools for estimating mileage or reporting expenses accurately. This integrated approach not only saves time but also enhances user experience when managing mileage reimbursements.

FAQs around full fee mileage guidelines

For those navigating the full fee mileage guidelines form, several questions frequently arise. One of the most common inquiries involves reimbursement rates; generally, the current IRS rates serve as a benchmark for mileage reimbursements, though companies may have specific rates depending on their policy frameworks. Understanding the typical reimbursement rate is a great starting point for individuals seeking to estimate their potential claims.

Other frequently asked questions include the frequency with which forms can be submitted, who to approach if miles exceed accepted limits, and how taxes may impact mileage reimbursements. It's crucial for individuals to familiarize themselves with these aspects to ensure they fully understand their rights and obligations when it comes to vehicle use for business purposes.

Examples and case studies

Real-life scenarios can illustrate the importance of accurately completing the full fee mileage guidelines form. Consider a contractor who frequently travels between job sites. By adhering to the guidelines and accurately documenting his mileage, he can successfully claim reimbursements that significantly contribute to his overall earnings. His meticulous record-keeping ensures he doesn't lose any eligible compensation.

Alternatively, a corporate team may face challenges if their submission processes are not uniform across departments. One team member might overlook documenting travel for a critical meeting, leading to questions or disputes later. Such discrepancies can hamper overall reimbursement efforts and breed frustration. Effective adherence to outlined mileage guidelines very often translates to smoother processes and improved morale.

Support and assistance

If complications arise while filling out the full fee mileage guidelines form, individuals can seek support from various sources. Often, reaching out to HR or payroll departments can be the first step in resolving any issues related to reimbursements. These departments typically possess the necessary expertise regarding the company's specific policies and practices.

Additionally, utilizing pdfFiller's customer support services can offer helpful insights and solutions to potential problems. Their teams can assist with navigating their platform effectively and addressing any queries related to form completion, signing, or document management. Having multiple support channels enhances the overall user experience, aiding users in managing their mileage reimbursements effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in ID ITD 3034 without leaving Chrome?

How do I fill out the ID ITD 3034 form on my smartphone?

How do I complete ID ITD 3034 on an iOS device?

What is full fee mileage guidelines?

Who is required to file full fee mileage guidelines?

How to fill out full fee mileage guidelines?

What is the purpose of full fee mileage guidelines?

What information must be reported on full fee mileage guidelines?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.