Get the free request for certificate of tax residency

Show details

This form is used to request a Certificate of Tax Residency from the Inland Revenue Department in Malta for individual taxpayers, requiring supporting documentation and compliance with tax return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign request for certificate of tax residency

Edit your request for certificate of tax residency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your request for certificate of tax residency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit request for certificate of online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit request for certificate of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

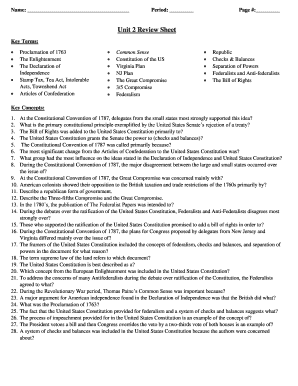

How to fill out request for certificate of tax residency

How to fill out request for certificate of tax residency

01

Visit the official website of the tax authority in your country.

02

Locate the section dedicated to certificates of tax residency.

03

Download the request form for a certificate of tax residency.

04

Fill out the form with your personal information including your name, address, and taxpayer identification number.

05

Provide details regarding your residency status and the purpose of the request.

06

Attach any necessary supporting documents, such as proof of residency or income.

07

Review the completed form to ensure all information is accurate and complete.

08

Submit the form online or mail it to the appropriate tax authority office as instructed on the website.

09

Keep a copy of the submitted request for your records.

Who needs request for certificate of tax residency?

01

Individuals residing in one country who need to prove their tax residency status for tax treaty purposes in another country.

02

Businesses operating in multiple jurisdictions seeking to secure tax benefits or avoid double taxation.

03

Foreign investors needing to establish their tax residency for compliance with local tax laws.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim a tax certificate?

How to request your Tax Compliance Status via eFiling Selecting the Tax Compliance Status Request option and the type of TCS for which you would like to apply. You will have the following options: Good standing. Tender. Complete the Tax Compliance Status Request and submit it to SARS.

What makes you a resident for tax purposes?

You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31). Certain rules exist for determining your residency starting and ending dates.

How do I get my tax residency certificate?

A resident of India who earns income from countries with which India has a DTAA agreement can get a TRC from the Indian IT department. Such residents of India can submit TRC to claim the benefits of tax treaty. In order to get a TRC, the person would have to make a Form no. 10FA application to the assessing officer.

How do I get an IRS residency certificate?

To obtain Form 6166, a letter of U.S. Residency Certification, you must submit a completed Form 8802, Application for United States Residency Certification. A user fee is charged to process all Forms 8802.

How are non residents taxed in Malta?

A non-resident individual is taxed only on income and chargeable gains arising in Malta. Individuals are subject to tax on income arising in a calendar year (i.e. the basis year), which is assessed to tax in the year following the year in which it arises (i.e. the year of assessment).

What are the requirements to be tax resident in Malta?

When an individual is present in Malta for more than 183 days (in any particular year) they will be considered as tax residence in Malta for that year, regardless of the purpose and the nature of the individual's stay in Malta.

How do you qualify for resident tax?

Resident status is determined by reference to the number of days an individual is present in Malaysia. Generally, an individual who is in Malaysia for a period or periods amounting to 182 days or more in a calendar year will be regarded as a tax resident.

How long does it take to get a tax residency certificate?

Typically, it takes 4-6 weeks to receive your U.S. Tax Residency Certificate. It's important to note that you cannot file Form 6166 if you haven't filed a required U.S. tax return or if you have filed a U.S tax return as a nonresident.

What is tax credit Malta?

An annual tax credit is available to individuals who make contributions to a PRS of 25% of the aggregate amount of the qualifying contributions made during a year, up to a maximum of EUR 750.

What is tax certificate Malta?

A tax compliance certificate is a document that details the tax compliance status of a person as regards Income Tax, VAT and FSS tax.

What is a tax status certificate?

What is a California Tax Status Compliance Certificate? In California a Tax Status Compliance Certificate is called an Entity Status Letter and is issued by the California Franchise Tax Board for a Company or Sole Proprietor which has met all of its California tax obligations.

What is the purpose of a tax residence certificate?

A Tax Residence Certificate (TRC) is needed in order to benefit from the application of double tax treaties and comply with local tax regulations.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is request for certificate of tax residency?

A request for a certificate of tax residency is a formal application made by an individual or entity to their tax authority to obtain a document confirming their residency status for tax purposes in a specific country.

Who is required to file request for certificate of tax residency?

Individuals or entities that need to provide proof of their tax residency status, typically for the purposes of avoiding double taxation on income or benefiting from tax treaties must file a request for a certificate of tax residency.

How to fill out request for certificate of tax residency?

To fill out the request, one must complete the designated form provided by the relevant tax authority, providing necessary details such as personal or business information, tax identification numbers, and relevant documentation to verify residency.

What is the purpose of request for certificate of tax residency?

The purpose of the request is to obtain an official confirmation of tax residency status, which is often required to claim benefits under international tax treaties and to provide assurance to foreign tax authorities.

What information must be reported on request for certificate of tax residency?

The information that must be reported typically includes the applicant's name, address, tax identification number, the country of tax residency being claimed, and any supporting documentation that may be needed to establish residency.

Fill out your request for certificate of tax residency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Request For Certificate Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.