Get the free rajtax - rajtax gov

Show details

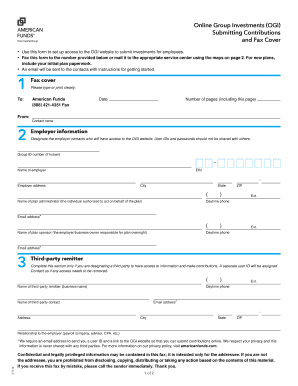

Form VAT -12 See Rule 19(3)(g) Sales Return Register Details of sales out of which sales return is made S. VAT No. Invoice No. Date Place: Date: To Whom Issued Name of Goods. Details of sales return

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rajtax - rajtax gov

Edit your rajtax - rajtax gov form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rajtax - rajtax gov form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rajtax - rajtax gov online

Follow the steps down below to take advantage of the professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit rajtax - rajtax gov. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rajtax - rajtax gov

How to Fill out Rajtax:

01

Make sure you have the necessary documents and information ready. This includes your personal details, income information, and any deductions you may qualify for.

02

Start by visiting the official Rajtax website or downloading the latest forms from the website.

03

Begin filling out the form by providing your personal information such as your name, address, and PAN (Permanent Account Number) details.

04

Provide details of your income sources, such as salary, business income, rental income, or any other sources as required.

05

Calculate your taxable income by subtracting any eligible deductions or exemptions from your total income. Common deductions could include expenses for education, healthcare, or investments like house rent or home loan repayments.

06

Ensure you accurately report your income and deductions to avoid any penalties or legal issues.

07

Once you have calculated your taxable income, determine the tax amount you owe based on the applicable tax slab rates.

08

If you have already paid taxes through TDS (Tax Deducted at Source), mention the details in the form.

09

Double-check all the information provided and make sure it is accurate.

10

Sign and submit the form along with any supporting documents if required.

Who Needs Rajtax:

01

Individuals with taxable income: Any individual whose total income surpasses the minimum tax exemption limit set by the government is required to file Rajtax.

02

Business owners or self-employed individuals: If you run a business, whether as a sole proprietor or in partnership, you are liable to file Rajtax regardless of your income level.

03

Freelancers or professionals: Individuals who earn income from freelance work or through the practice of a profession, such as doctors, lawyers, architects, etc., are obligated to file Rajtax.

04

Property owners: If you own one or multiple properties and earn rental income from them, you must include this income in your Rajtax filing.

05

Individuals with capital gains: If you have made profits from selling investments, such as stocks, bonds, or property, you are required to report these capital gains and file Rajtax.

06

NRI (Non-Resident Indian): NRIs who earn income in India or have Indian assets exceeding the exemption limit are also mandated to file Rajtax.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete rajtax - rajtax gov online?

With pdfFiller, you may easily complete and sign rajtax - rajtax gov online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my rajtax - rajtax gov in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your rajtax - rajtax gov and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

Can I edit rajtax - rajtax gov on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as rajtax - rajtax gov. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is rajtax?

Rajtax is a tax imposed by the government of Rajasthan on certain goods and services.

Who is required to file rajtax?

Businesses and individuals engaged in the sale of taxable goods and services in Rajasthan are required to file rajtax.

How to fill out rajtax?

Rajtax can be filled out online through the official website of Rajasthan government or through designated tax filing software.

What is the purpose of rajtax?

The purpose of rajtax is to generate revenue for the state government and regulate the sale of taxable goods and services.

What information must be reported on rajtax?

Information such as sales figures, tax collected, and details of taxable goods and services must be reported on rajtax.

Fill out your rajtax - rajtax gov online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rajtax - Rajtax Gov is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.