Get the free Trust tax return Trust information - ATO

Show details

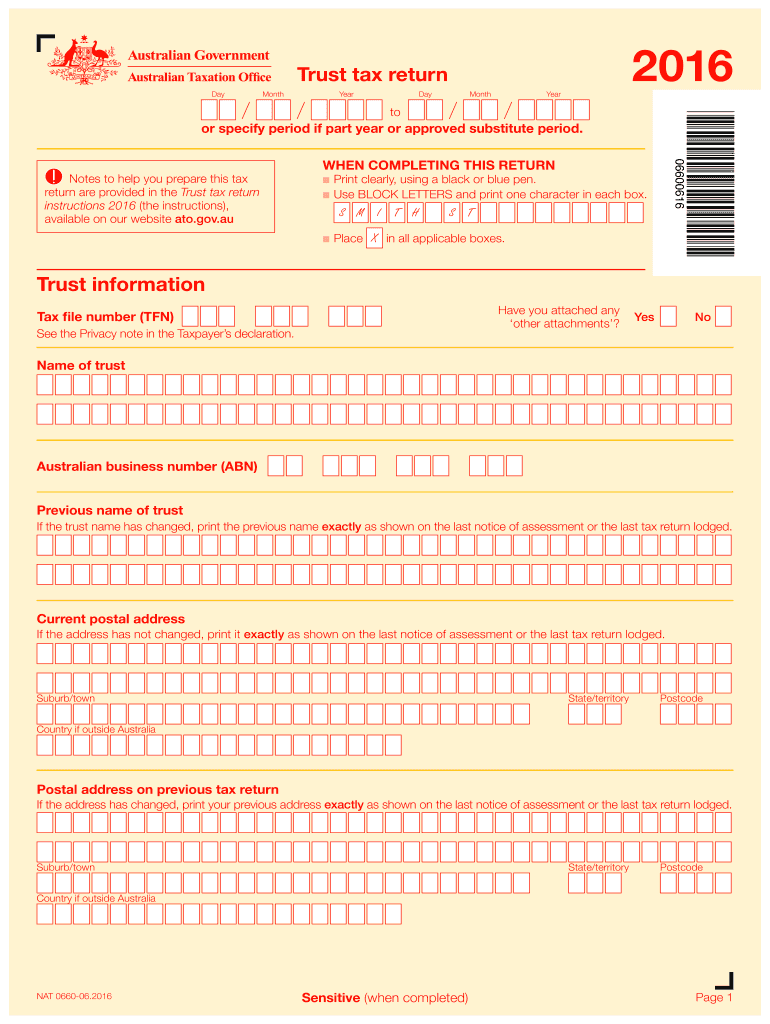

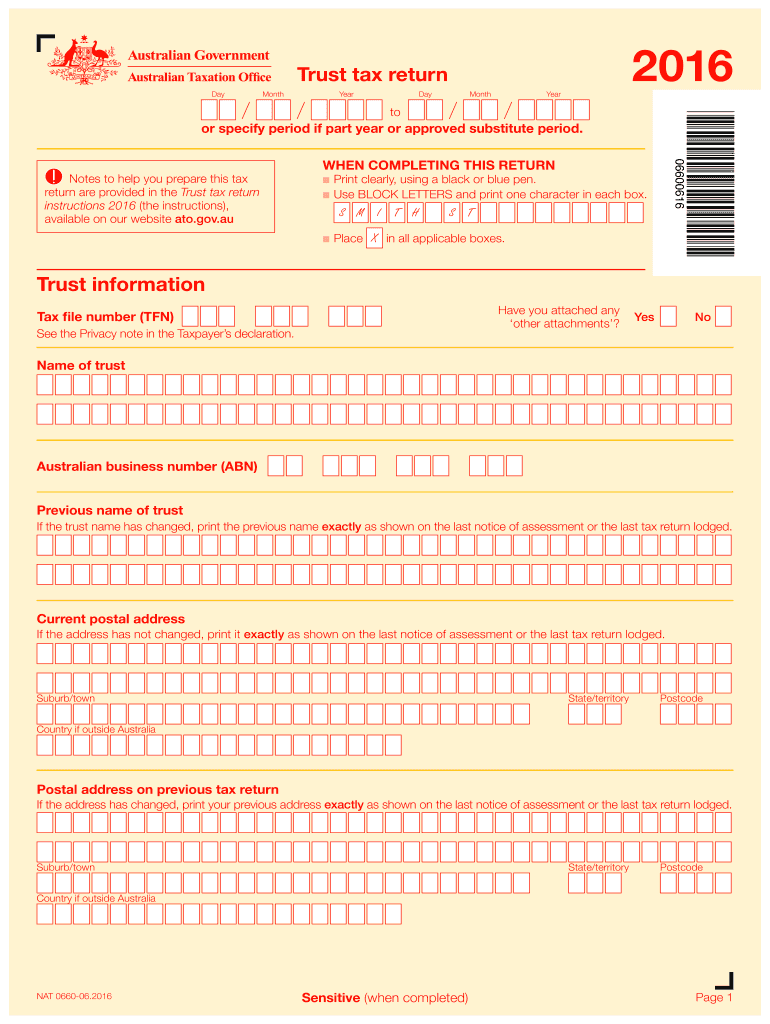

2016Trust tax return

DayMonthYearDayMonthYeartoor specify period if part year or approved substitute period.

06600616WHEN COMPLETING THIS RETURN

Notes to help you prepare this tax

return are provided

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trust tax return trust

Edit your trust tax return trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trust tax return trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing trust tax return trust online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit trust tax return trust. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trust tax return trust

01

To fill out a trust tax return, you will need to gather all the relevant financial information related to the trust. This includes any income generated by the trust, expenses incurred, and any distributions made to beneficiaries.

02

Use the appropriate tax form for trust tax returns, which is typically Form 1041. Make sure to carefully read the instructions and fill out the form accurately. You may also need to attach additional schedules and forms depending on the complexity of the trust.

03

Begin by providing the basic information about the trust, such as its name, address, and taxpayer identification number (TIN). If you haven't obtained a TIN for the trust, you will need to apply for one using Form SS-4.

04

Report all income generated by the trust on Schedule B of Form 1041. This includes interest, dividends, capital gains, rental income, and any other sources of income. Enter the income amounts accurately and ensure proper categorization according to the IRS guidelines.

05

Deduct any necessary expenses related to the administration of the trust, such as trustee fees, legal fees, and accounting fees. These expenses can be reported on Schedule A of Form 1041.

06

Determine whether the trust is entitled to any tax deductions or credits. This might include deductions for charitable contributions or certain distributions made to beneficiaries. Carefully review the tax laws and regulations to identify any applicable deductions or credits.

07

Calculate the trust's taxable income by subtracting the allowable deductions and credits from the total income. This will determine the trust's taxable income on which it is liable to pay taxes.

08

Determine the trust's tax liability by applying the appropriate tax rates to the taxable income. Trusts have different tax brackets compared to individuals, so refer to the IRS guidelines or consult a tax professional for accurate calculations.

09

Prepare Schedule K-1 for each beneficiary of the trust, which details their share of the trust's income, deductions, and credits. Distribute the Schedule K-1 to each beneficiary, as they will need this information to report their personal taxes.

10

Finally, make sure to submit the completed trust tax return along with any necessary schedules and forms to the IRS by the filing deadline. Keep copies of all documents for your records.

Trust tax returns are required for all trusts that meet certain criteria, such as generating income or having a TIN. Generally, any trust that is not considered a grantor trust or exempt from taxes must file a trust tax return. It is important to consult with a tax professional or refer to the IRS guidelines to determine whether your specific trust needs to file a tax return.

Fill

form

: Try Risk Free

People Also Ask about

What is a trust in ATO?

A trust is an obligation imposed on a person or other entity to hold property for the benefit of beneficiaries. While in legal terms a trust is a relationship not a legal entity, trusts are treated as taxpayer entities for the purposes of tax administration.

What is the return form for trust?

Who is eligible to file the ITR-7 Form? Return under section 139(4A) is required to be filed by every person in receipt of income derived from property held under trust or other legal obligation wholly for charitable or religious purposes or in part only for such purposes.

How does a trust show up on income tax return?

Income of a trust that has a tax identification number is reported to that tax identification number with a Form 1099, and a trust reports its income and deductions for federal income tax purposes annually on Form 1041.

What is the point of a trust?

A trust is a legal contract that ensures your assets are managed ing to your wishes during and after your lifetime. Among the many benefits trusts offer are potential tax benefits and the ability to set parameters for how and when your assets will be used and distributed.

Where is trust income reported on tax return?

Trusts and estates report their income and deductions on Form 1041 as well as the income distributed to beneficiaries of the trust or estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get trust tax return trust?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the trust tax return trust in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in trust tax return trust without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit trust tax return trust and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit trust tax return trust on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute trust tax return trust from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is trust tax return trust?

A trust tax return, or Form 1041, is a tax form used to report income, deductions, gains, and losses of a trust, and to distribute income to beneficiaries.

Who is required to file trust tax return trust?

Trust tax returns are typically required to be filed by any trust that has a gross income of $600 or more for the tax year or has any taxable income.

How to fill out trust tax return trust?

To fill out a trust tax return, gather financial information regarding the trust's income, deductions, and distributions. Complete Form 1041 by following the instructions provided, ensuring all relevant sections are filled accurately.

What is the purpose of trust tax return trust?

The purpose of filing a trust tax return is to report the income generated by the trust and determine the tax liabilities for the trust and its beneficiaries.

What information must be reported on trust tax return trust?

Information required includes the trust's name, taxpayer identification number, income types (such as dividends and interest), deductions, any distributions made to beneficiaries, and taxable income.

Fill out your trust tax return trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trust Tax Return Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.