TX Fort Bend Central Appraisal District Mailing Address Change Request 2015 free printable template

Show details

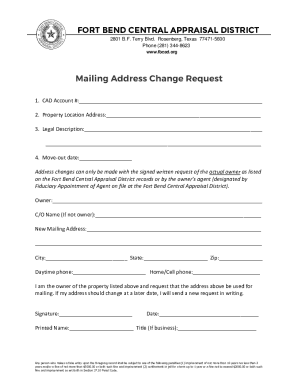

FORT BEND CENTRAL APPRAISAL DISTRICT 2801 B.F. Terry Blvd. Rosenberg, Texas 77471-5600 (281) 344-8623 Mailing Address Change Request 1. CAD Account # : 2. Property Location Address: 3. Legal Description:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Fort Bend Central Appraisal District

Edit your TX Fort Bend Central Appraisal District form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Fort Bend Central Appraisal District form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Fort Bend Central Appraisal District online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX Fort Bend Central Appraisal District. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

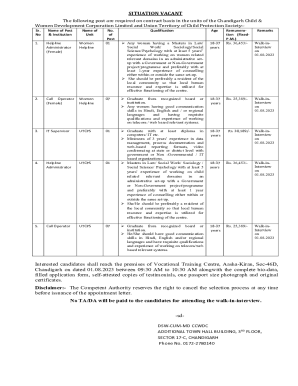

TX Fort Bend Central Appraisal District Mailing Address Change Request Form Versions

Version

Form Popularity

Fillable & printabley

4.8 Satisfied (172 Votes)

4.4 Satisfied (26 Votes)

How to fill out TX Fort Bend Central Appraisal District

How to fill out TX Fort Bend Central Appraisal District Mailing

01

Visit the TX Fort Bend Central Appraisal District website.

02

Locate the 'Mailing' section on the homepage.

03

Download the TX Fort Bend Central Appraisal District Mailing form.

04

Fill out your personal information, including name, address, and contact details.

05

Provide the property identification number or account number associated with your property.

06

Indicate the reason for mailing, if required.

07

Review the completed form for accuracy.

08

Sign and date the form.

09

Submit the form via mail to the specified address or via the instructed method.

Who needs TX Fort Bend Central Appraisal District Mailing?

01

Property owners in Fort Bend County who want to update their mailing information.

02

Individuals or entities seeking to file for exemptions or other property-related requests.

03

Anyone needing to communicate with the Central Appraisal District regarding their property assessments.

Fill

form

: Try Risk Free

People Also Ask about

What is the over 65 exemption in Fort Bend County?

Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 residence homestead exemption for school district taxes, in addition to the $40,000 exemption for all homeowners.

Where can I find my property tax statement in Texas?

You can find out how much your current taxes are and make your payment by going to the Property Tax Account Lookup application or you may request a statement by calling us at 972-547-5020 during business hours.

How much is property tax in Fort Bend County?

Fort Bend County collects, on average, 2.48% of a property's assessed fair market value as property tax. Fort Bend County has one of the highest median property taxes in the United States, and is ranked 57th of the 3143 counties in order of median property taxes.

Are property taxes going up in Fort Bend County?

Thus the combined General Fund and Drainage taxes will increase by an average of $111 per household. Total county tax rate, including General Fund and Drainage District will be 45.12 cents per $100 valuation for Tax Year 2022. The 2021 total rate is 45.28 cents per $100 valuation.

Who is the chief appraiser for Fort Bend?

Jordan T. Wise - Chief Appraiser - Fort Bend Central Appraisal District | LinkedIn.

How do I contact Fort Bend Appraisal District?

CONTACT THE TAX OFFICE VIA PHONE: Feel free to call our office at 281-341-3710.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my TX Fort Bend Central Appraisal District directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your TX Fort Bend Central Appraisal District and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send TX Fort Bend Central Appraisal District to be eSigned by others?

When you're ready to share your TX Fort Bend Central Appraisal District, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out TX Fort Bend Central Appraisal District on an Android device?

Use the pdfFiller Android app to finish your TX Fort Bend Central Appraisal District and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is TX Fort Bend Central Appraisal District Mailing?

TX Fort Bend Central Appraisal District Mailing refers to the official correspondence and notifications sent by the Fort Bend Central Appraisal District regarding property appraisals, assessments, and related matters.

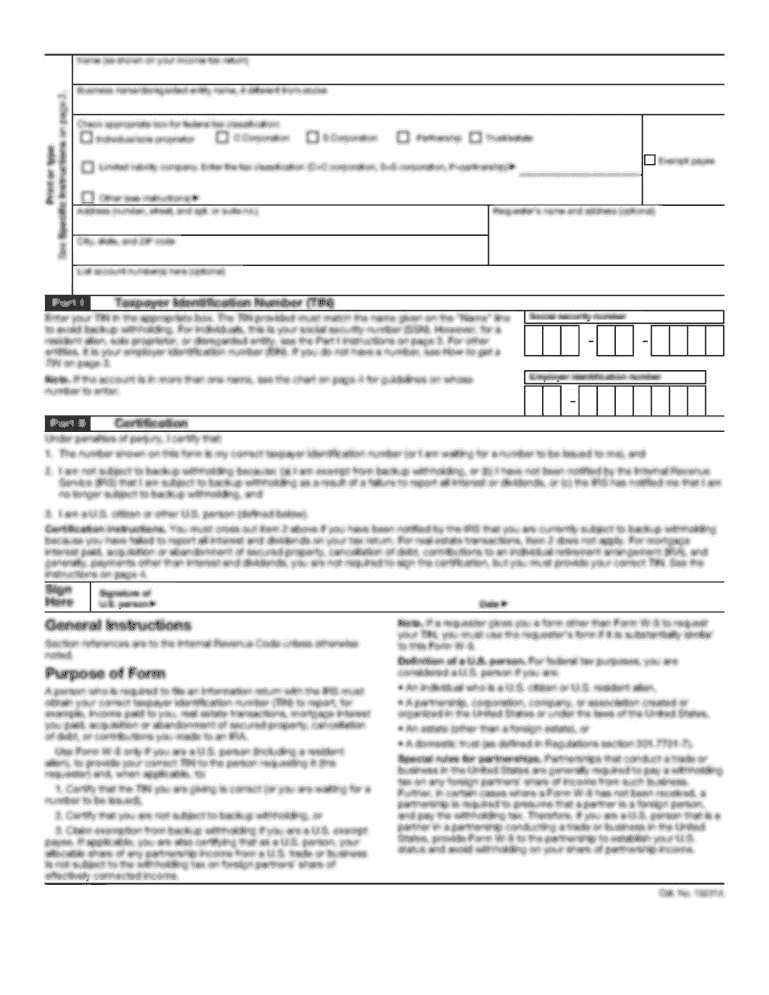

Who is required to file TX Fort Bend Central Appraisal District Mailing?

Property owners and individuals who have taxable property in Fort Bend County are required to file the necessary forms and respond to any communications from the TX Fort Bend Central Appraisal District.

How to fill out TX Fort Bend Central Appraisal District Mailing?

To fill out the TX Fort Bend Central Appraisal District Mailing, one must complete the required forms provided by the district, ensuring all property details, ownership information, and applicable exemptions are accurately reported.

What is the purpose of TX Fort Bend Central Appraisal District Mailing?

The purpose of TX Fort Bend Central Appraisal District Mailing is to inform property owners of their appraisal values, to communicate deadlines for filing protests or exemptions, and to provide updates on property tax assessments.

What information must be reported on TX Fort Bend Central Appraisal District Mailing?

The information that must be reported includes property identification details, the owner's name and contact information, property characteristics, and any claimed exemptions or protests.

Fill out your TX Fort Bend Central Appraisal District online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Fort Bend Central Appraisal District is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.