Get the free Tax Incentive Program Power of Attorney for Real Property - co fairfield oh

Show details

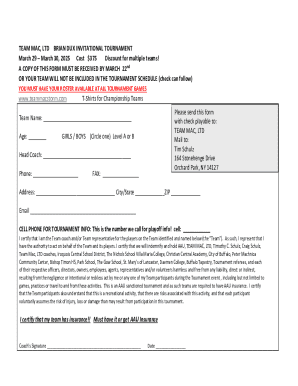

Reset Form DUE 24P Prescribed 04/05 County name Tax Incentive Program Power of Attorney for Real Property Tax Exemption Application Office Use Only County application number DUE application number

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax incentive program power

Edit your tax incentive program power form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax incentive program power form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax incentive program power online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax incentive program power. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax incentive program power

How to fill out tax incentive program power:

01

Obtain the necessary forms: Visit the official website of the tax authority or contact them directly to obtain the forms required to apply for the tax incentive program power. These forms may include application forms, disclosure forms, and supporting documents.

02

Gather relevant information: Collect all the necessary information required to fill out the forms accurately. This may include personal information, financial data, business details, and any other relevant information specified by the tax authority.

03

Read instructions carefully: Carefully review the instructions provided on the forms or any accompanying documentation. Make sure you understand the eligibility criteria, deadlines, and any specific requirements for the tax incentive program power.

04

Complete the forms: Fill out the forms accurately, providing all the requested information. Ensure that you provide correct and up-to-date information to avoid any processing delays or potential legal issues.

05

Attach supporting documents: As per the instructions, attach any supporting documents required to substantiate your application. This may include proof of income, tax returns, business licenses, or any other relevant documents specified by the tax authority.

06

Review and double-check: Before submitting your application, carefully review all the filled-out forms and attached documents. Double-check for any errors or omissions that could affect the processing of your application.

07

Submit the application: Once you are satisfied with the accuracy and completeness of your application, submit it to the designated tax authority. Follow the specified submission method, whether it is through an online portal, mail, or in-person submission.

08

Follow up: After submitting your application, follow up with the tax authority to ensure that it has been received and is being processed. If you have any questions or need further clarification, contact the appropriate department or person responsible for handling tax incentive programs.

09

Keep records: Maintain copies of all the documents and forms submitted for your records. This will come in handy for future reference or in case any discrepancies or issues arise during the application process.

Who needs tax incentive program power?

01

Small businesses: Small businesses can benefit from tax incentive program power to reduce their tax liability and promote growth. These programs often provide incentives to invest in new equipment, hire additional employees, or expand business operations.

02

Renewable energy companies: Tax incentive program power is often utilized by renewable energy companies to encourage the development and utilization of clean energy sources. These programs may offer tax credits or grants to companies that invest in renewable energy projects.

03

Startups and entrepreneurs: Tax incentive program power can be advantageous for startups and entrepreneurs looking to establish their businesses. Such programs can provide tax benefits or access to funding, helping these individuals in the early stages of their ventures.

04

Real estate developers: Tax incentive program power is commonly used by real estate developers to promote economic development and revitalization in specific areas. These programs may offer tax breaks or incentives to developers who invest in certain designated zones or properties.

05

Research and development firms: Tax incentive program power plays a significant role in encouraging research and development activities. These programs often provide tax credits or deductions to companies that engage in innovative research or develop new technologies.

06

Certain industries: Some tax incentive program power is industry-specific, targeting sectors such as manufacturing, technology, agriculture, or tourism. These incentives are designed to attract investment, spur job creation, and drive economic growth within these particular industries.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax incentive program power in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your tax incentive program power, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit tax incentive program power on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign tax incentive program power on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete tax incentive program power on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your tax incentive program power by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is tax incentive program power?

The tax incentive program power is a program designed to provide financial incentives to businesses or individuals to encourage certain behaviors or investments.

Who is required to file tax incentive program power?

Businesses or individuals who qualify for the tax incentive program power are required to file.

How to fill out tax incentive program power?

To fill out the tax incentive program power, individuals or businesses must provide detailed information about their qualifying behaviors or investments.

What is the purpose of tax incentive program power?

The purpose of the tax incentive program power is to promote specific behaviors or investments by providing financial incentives.

What information must be reported on tax incentive program power?

Information such as qualifying behaviors or investments, financial data, and other relevant details must be reported on the tax incentive program power.

Fill out your tax incentive program power online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Incentive Program Power is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.