Get the free Goods and Service tax in India: Effect on state government revenue - faculty maxwell...

Show details

Goods and Service tax in India: Effect on state government revenue

By: Transit Singh Deal

India has been trying to implement the Goods and Service Tax (GST) for last few years but due

to political

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign goods and service tax

Edit your goods and service tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your goods and service tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit goods and service tax online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit goods and service tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out goods and service tax

How to fill out goods and service tax:

01

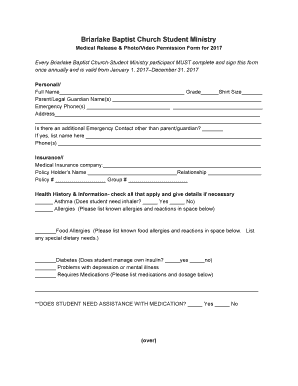

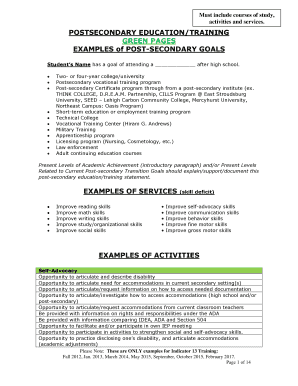

Collect all the necessary information and documents: Before filling out the goods and service tax (GST) form, make sure you have all the required details and paperwork handy. This includes your business registration details, invoices, purchase and sales records, and any other supporting documents.

02

Understand the GST form: Familiarize yourself with the structure and sections of the GST form. This will help you navigate through the form more efficiently and accurately fill in the required information. Take note of any specific fields or guidelines mentioned in the form instructions.

03

Provide accurate business information: Begin by entering your business details accurately in the designated sections of the GST form. This includes your business name, address, contact information, and your Goods and Services Tax Identification Number (GSTIN) or any other unique identifier.

04

Report your turnover and taxes: In the GST form, you will need to report your business turnover and taxes accurately. Provide the necessary figures for your taxable supplies, exempt supplies, zero-rated supplies, and non-GST supplies. Calculate and enter the applicable taxes such as Central Goods and Services Tax (CGST), State Goods and Services Tax (SGST), Integrated Goods and Services Tax (IGST), or Union Territory Goods and Services Tax (UTGST).

05

Maintain proper documentation: Keep a record of all the filed GST forms, invoices, and supporting documents for future reference and audit purposes. Maintain a systematic filing system to easily retrieve the necessary documents when required.

Who needs goods and service tax?

01

Business entities: Any business entity engaged in the supply of goods or services with an annual turnover exceeding the prescribed threshold, as per the GST regulations in their respective country, needs to register for goods and service tax. This includes enterprises, companies, partnerships, sole proprietorships, and any other legal entities involved in commercial activities.

02

Service providers: Businesses that provide services are also required to comply with goods and service tax regulations. This includes professionals such as accountants, lawyers, consultants, or any other service-oriented enterprises that surpass the turnover threshold defined by GST legislation.

03

Goods suppliers: Businesses involved in the supply of goods, whether manufactured, imported, or traded, need to register for goods and service tax. This encompasses retailers, wholesalers, manufacturers, distributors, and any entity engaged in the supply chain of tangible products.

04

E-commerce operators: Online platforms or marketplaces that facilitate the sale of goods or services and exceed the defined threshold are required to register and adhere to goods and service tax regulations. This includes operators of e-commerce websites, mobile applications, or any digital platform where sellers can list their products or services.

05

Importers and exporters: Importers and exporters engaging in cross-border trade need to comply with goods and service tax regulations. They are required to register and report their transactions accurately, including the payment of Integrated Goods and Services Tax (IGST) or any other applicable taxes on imports and exports.

Note: The requirements for goods and service tax may vary depending on the specific country or jurisdiction. It is advisable to consult the official guidelines and regulations of the respective tax authorities for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get goods and service tax?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific goods and service tax and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out goods and service tax using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign goods and service tax and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit goods and service tax on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign goods and service tax on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is goods and service tax?

Goods and Service Tax (GST) is a consumption tax that is levied on the supply of goods and services in a country.

Who is required to file goods and service tax?

Businesses and individuals who supply goods and services are required to file GST.

How to fill out goods and service tax?

GST can be filled out online through a GST portal provided by the tax authorities.

What is the purpose of goods and service tax?

The purpose of GST is to simplify the taxation system, eliminate the cascading effect of taxes, and create a common market.

What information must be reported on goods and service tax?

Information such as the value of goods and services supplied, input tax credit claimed, and tax payable must be reported on GST.

Fill out your goods and service tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Goods And Service Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.