Get the free PROMISSORY NOTE ACCOUNTING

Show details

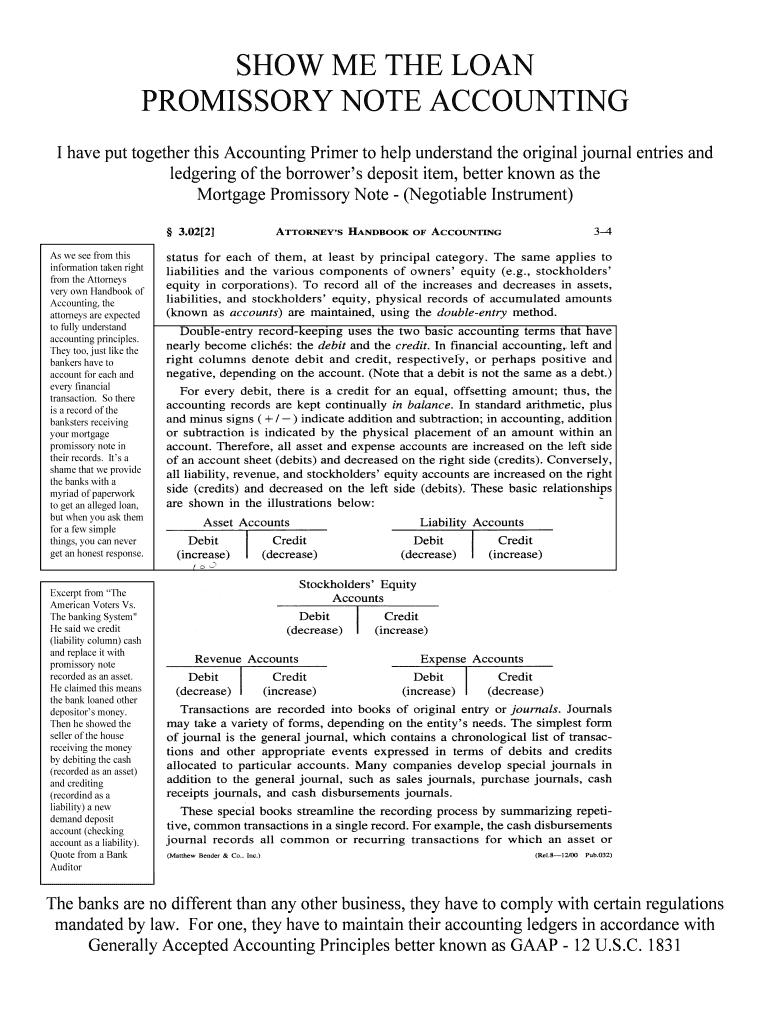

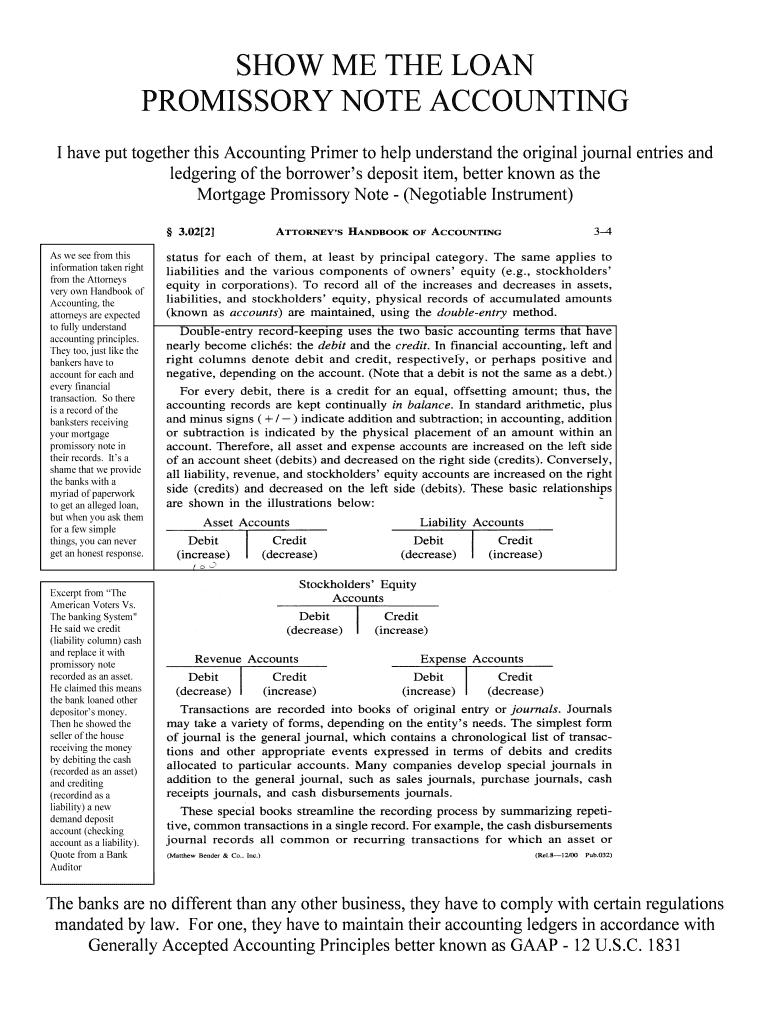

SHOW ME THE LOAN PROMISSORY NOTE ACCOUNTING I have put together this Accounting Primer to help understand the original journal entries and ledge ring of the borrowers deposit item, better known as

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign promissory note accounting

Edit your promissory note accounting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your promissory note accounting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing promissory note accounting online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit promissory note accounting. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out promissory note accounting

How to fill out promissory note accounting:

01

Begin by gathering all necessary information: Before filling out a promissory note, you need to collect the required details such as the names of the borrower and lender, the principal amount, the interest rate, and the repayment terms.

02

Create a template or use a pre-designed promissory note form: You can either design your own promissory note template or find a pre-made form online. Make sure the template includes all the essential elements, such as the names of the parties involved, the loan amount, the interest rate, the repayment schedule, and any collateral or security agreements.

03

Fill in the borrower and lender information: Write the legal names and addresses of both the borrower and lender. This ensures that the promissory note is legally binding and enforceable.

04

Specify the loan amount and interest rate: Clearly state the principal amount that the borrower owes, as well as the interest rate agreed upon. You may also include information about whether the interest is simple or compound, and if there are any penalties for late payments.

05

Determine the repayment schedule: Outline the repayment terms, including the frequency of payments (monthly, quarterly, etc.), the due date for each payment, and the total number of payments required to fully repay the loan.

06

Include any additional terms and conditions: If there are any special provisions or additional clauses that both parties agree upon, such as the use of collateral or a personal guarantee, be sure to include them in the promissory note.

07

Sign and date the promissory note: Both the borrower and lender should sign and date the promissory note to acknowledge their agreement to the terms and conditions stated in the document. It's essential to have witnesses or a notary present, depending on the legal requirements in your jurisdiction.

Who needs promissory note accounting?

Promissory note accounting is essential for various individuals or entities, including:

01

Lenders: Individuals or financial institutions who lend money to borrowers need to maintain promissory note accounting to track their outstanding loans, monitor repayment schedules, calculate interest earnings, and ensure compliance with legal requirements.

02

Borrowers: Borrowers who have taken loans and signed promissory notes are also responsible for promissory note accounting. They should keep records of the loan amounts, interest rates, repayment schedules, and ensure they make timely payments accordingly.

03

Legal Professionals: Lawyers and legal professionals involved in loan agreements and financial transactions often need to review and understand promissory note accounting to ensure the legality and enforceability of the promissory notes.

Overall, promissory note accounting serves as a crucial tool for both lenders and borrowers to maintain a clear record of loan agreements, repayment obligations, and financial transactions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my promissory note accounting directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your promissory note accounting and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an eSignature for the promissory note accounting in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your promissory note accounting directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Can I edit promissory note accounting on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign promissory note accounting on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is promissory note accounting?

Promissory note accounting is a formal record of a promise to pay a certain amount of money by a specific date.

Who is required to file promissory note accounting?

Individuals or businesses who have entered into a promissory note agreement are required to file promissory note accounting.

How to fill out promissory note accounting?

To fill out promissory note accounting, one must include details such as the amount of the promissory note, the interest rate, the due date, and any relevant terms and conditions.

What is the purpose of promissory note accounting?

The purpose of promissory note accounting is to keep a record of financial obligations and ensure that payments are made on time.

What information must be reported on promissory note accounting?

The information that must be reported on promissory note accounting includes the names of the parties involved, the principal amount, the interest rate, the due date, and any applicable fees or penalties.

Fill out your promissory note accounting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Promissory Note Accounting is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.