Get the free Special Credits & Assessments Team - dor wa

Show details

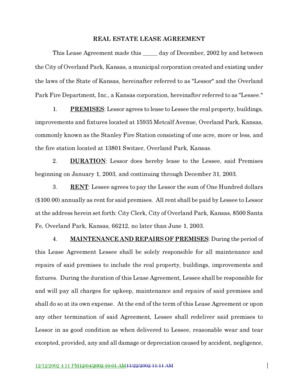

Washington State Department of Revenue Taxpayer Account Administration Special Credits & Assessments Team PO Box 47476 Olympia WA 985047476Rural Area Application for B&O Tax Credit on New Employees

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign special credits amp assessments

Edit your special credits amp assessments form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your special credits amp assessments form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing special credits amp assessments online

To use the professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit special credits amp assessments. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out special credits amp assessments

How to fill out special credits amp assessments

01

To fill out special credits amp assessments, follow these steps:

02

Gather all necessary information and documentation related to the special credits and assessments.

03

Understand the specific requirements and guidelines for filling out the special credits and assessments.

04

Fill out the required forms or online applications accurately and completely.

05

Double-check all the information provided to ensure accuracy and completeness.

06

Submit the filled-out special credits and assessments forms or applications as per the designated method (online, mail, in-person, etc.).

07

Keep copies of all the submitted forms and supporting documents for your records.

08

Follow up with the appropriate authorities or organizations to track the progress of your special credits and assessments.

09

If any additional information or documents are requested, provide them promptly.

10

Await the decision or outcome of your special credits and assessments, which may be communicated through mail, email, or any other designated method.

11

If approved, ensure that you comply with any further instructions or requirements regarding the utilization of the special credits.

Who needs special credits amp assessments?

01

Special credits amp assessments are typically required by individuals or organizations seeking financial assistance, benefits, or certain privileges.

02

Specific cases where individuals may need special credits amp assessments include:

03

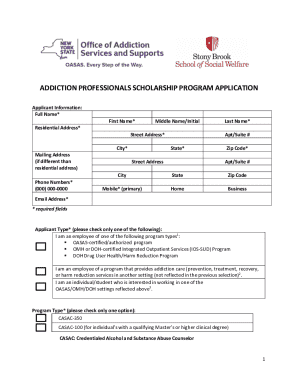

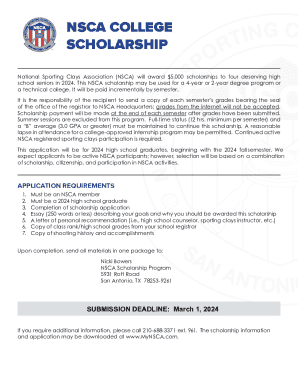

- Students applying for scholarships or educational grants

04

- Individuals seeking loans with special interest rates or repayment plans

05

- Applicants for government-funded programs or initiatives

06

- People with disabilities or unique healthcare needs applying for medical benefits or support

07

Additionally, businesses or organizations may require special credits amp assessments in situations such as:

08

- Companies applying for tax credits or incentives for specific industries or initiatives

09

- Organizations seeking grants or funding for research, development, or community projects.

10

It's important to note that the exact requirements for special credits amp assessments vary depending on the specific situation and the authorities or organizations involved.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute special credits amp assessments online?

With pdfFiller, you may easily complete and sign special credits amp assessments online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit special credits amp assessments on an Android device?

You can make any changes to PDF files, like special credits amp assessments, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

How do I fill out special credits amp assessments on an Android device?

Use the pdfFiller mobile app and complete your special credits amp assessments and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is special credits amp assessments?

Special credits and assessments are specific financial obligations that a company or individual must pay in addition to regular taxes or fees.

Who is required to file special credits amp assessments?

The requirement to file special credits and assessments varies depending on the specific financial obligations and regulations in place. It is important to consult with a tax professional or regulatory authority to determine who is required to file.

How to fill out special credits amp assessments?

Special credits and assessments are typically filled out on specific forms provided by the relevant taxing authority or regulatory body. The forms will usually require detailed information about the financial obligations being reported.

What is the purpose of special credits amp assessments?

The purpose of special credits and assessments is to ensure that specific financial obligations are paid in a timely manner and that individuals and companies are in compliance with relevant tax laws and regulations.

What information must be reported on special credits amp assessments?

The specific information that must be reported on special credits and assessments will vary depending on the financial obligations being reported. Typically, information such as the amount owed, the due date, and any relevant supporting documentation will need to be included.

Fill out your special credits amp assessments online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Special Credits Amp Assessments is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.