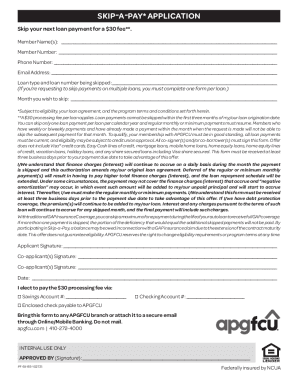

APGFCU Skip-a-Pay Application 2014 free printable template

Show details

SINALOAN PAYMENT APPLICATION Member Name(s): Member Number: Phone Number: Email Address: Loan suffix being skipped: (if requesting to skip payments on multiple loans, you must complete one form per

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign APGFCU Skip-a-Pay Application

Edit your APGFCU Skip-a-Pay Application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your APGFCU Skip-a-Pay Application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing APGFCU Skip-a-Pay Application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit APGFCU Skip-a-Pay Application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

APGFCU Skip-a-Pay Application Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out APGFCU Skip-a-Pay Application

How to fill out APGFCU Skip-a-Pay Application

01

Obtain the APGFCU Skip-a-Pay Application form from the APGFCU website or a local branch.

02

Fill in your personal information, including your name, account number, and contact details.

03

Specify the loan type you wish to skip a payment on.

04

Indicate which month you would like to skip your payment.

05

Review the terms and conditions associated with the Skip-a-Pay program.

06

Sign and date the application to confirm your request.

07

Submit the completed application form to APGFCU, either in person or through electronic submission if available.

Who needs APGFCU Skip-a-Pay Application?

01

Members of APGFCU who are experiencing temporary financial hardship.

02

Individuals with an eligible loan account who wish to defer a payment for financial relief.

03

Borrowers looking for flexibility in managing their monthly budgets.

Fill

form

: Try Risk Free

People Also Ask about

How many deferred payments can I get?

They may allow just one deferment or multiple deferments. The amount of times you can defer your car loan largely depends on the language in your loan contract. Your lender could limit how many times you can defer your loan by year, or by the overall loan term.

Does deferring a car payment hurt credit?

Deferments do not hurt your credit score. Unlike simply missing a payment or paying it late, a deferred payment counts as “paid ing to agreement,” since you arranged it with your lender ahead of time. That's especially important if you're already in the kind of emergency that would call for a deferment.

How can I skip a payment?

Some lenders offer loan forbearance in times of crisis. A forbearance gives you a temporary pause on payments while you are experiencing hardship. You'll have to contact your lender directly to request a forbearance because in most cases, this is not something that a lender will automatically offer or grant.

How many times can I defer my car payment?

Each lender will have a different policy for deferment, so the exact number of times you can defer a car payment will vary. It may be that your lender only allows one deferment, others could allow two or even more.

Is deferring a car payment bad?

Your auto loan continues to accrue interest while your payment is deferred. This means you could end up paying more interest in the end than you would have if the payment were made on time.

Can I skip a car payment with global lending?

You're short on cash and are wondering whether you can skip a car payment with Global Lending Services? The answer is yes, you can defer one or more payments on your existing auto loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my APGFCU Skip-a-Pay Application directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your APGFCU Skip-a-Pay Application and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get APGFCU Skip-a-Pay Application?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the APGFCU Skip-a-Pay Application. Open it immediately and start altering it with sophisticated capabilities.

How can I fill out APGFCU Skip-a-Pay Application on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your APGFCU Skip-a-Pay Application. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is APGFCU Skip-a-Pay Application?

APGFCU Skip-a-Pay Application is a service offered by APG Federal Credit Union that allows eligible members to skip a scheduled loan payment on certain loans.

Who is required to file APGFCU Skip-a-Pay Application?

Members of APGFCU who wish to skip a loan payment and meet the eligibility criteria must file the Skip-a-Pay Application.

How to fill out APGFCU Skip-a-Pay Application?

To fill out the APGFCU Skip-a-Pay Application, members should complete the application form with their account information, select the loan they wish to skip a payment for, and submit it to APGFCU.

What is the purpose of APGFCU Skip-a-Pay Application?

The purpose of the APGFCU Skip-a-Pay Application is to provide financial relief to members who may need temporary assistance by allowing them to postpone a loan payment.

What information must be reported on APGFCU Skip-a-Pay Application?

The information that must be reported on the APGFCU Skip-a-Pay Application includes member's personal information, loan details, and the desired month in which to skip the payment.

Fill out your APGFCU Skip-a-Pay Application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

APGFCU Skip-A-Pay Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.