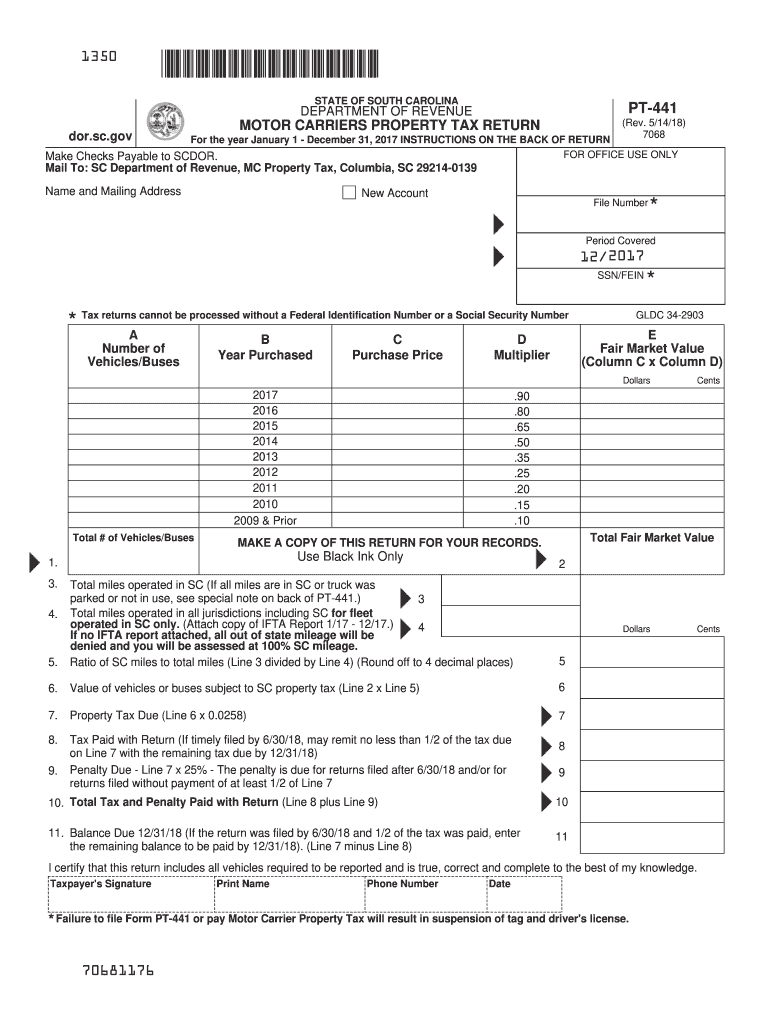

What is Form PT-441?

Form PT-441 is known as the Motor Carriers Property Tax Return. It must be submitted by an individual who owns, operates, controls, leases or manages a bus or a motor vehicle for the transportation of people or property.

What is Form PT-441 for?

This form is used to report your tax return of the motor carriers' property. The document is only one page and easy to complete. If you fail to file this form, you may face the suspension of your driver’s license.

When is Form PT-441 Due?

For the calendar year this form is due by June 30.

Is Form PT-441 Accompanied by Other Documents?

Yes, first you must attach the copy of your IFTA report. You must attach it to claim out of state mileage. That is the only important document that may be required.

What Information do I Include in Form PT-441?

On the top of the form you will find the block only for office use. You do not fill it out. The officer will indicate the file number, covered period, social security number or employer identification number. After that you will see a table that must be completed. It includes such information as the number of buses or vehicles, the year of purchase, its price, a multiplier and a fair market value. Then you must write the total number of vehicles and total market value. There are several more points to indicate:

-

The total of operated miles;

-

Vehicles’ and buses’ value;

-

Property tax due;

-

Balance due;

-

Taxpayer signature, phone number and date.

Where do I Send Form PT-441?

You must mail your form to the SC Department of Revenue, MC Property Tax, Columbia, State of California, 29 214-0139.