SD Streamlined Sales and Use Tax Certificate of Exemption 2018 free printable template

Show details

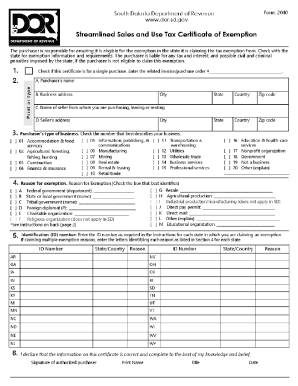

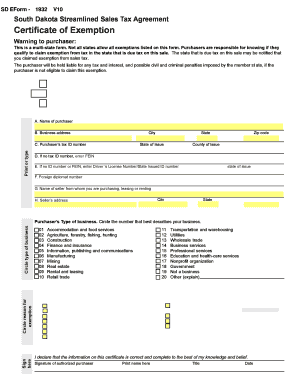

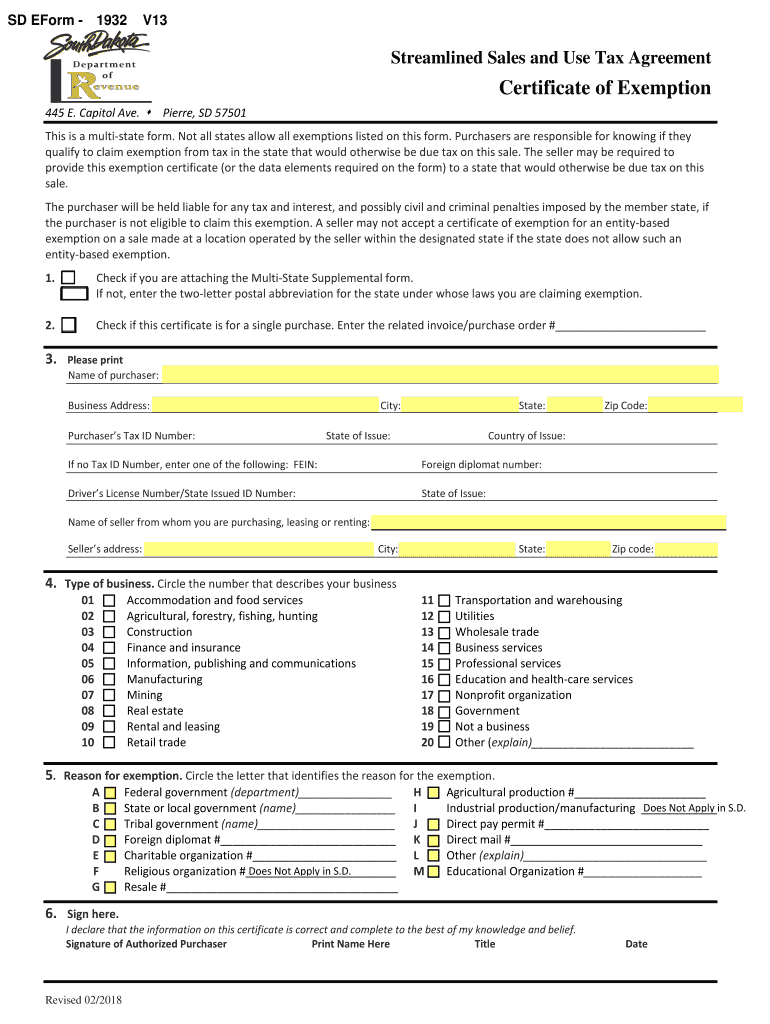

SDE Form 1932V13HELPComplete and use the button at the end to print for mailing. Streamlined Sales and Use Tax AgreementCertificate of Exemption 445 E. Capitol Ave. Pierre, SD 57501 This is a multistate

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SD Streamlined Sales and Use Tax

Edit your SD Streamlined Sales and Use Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SD Streamlined Sales and Use Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SD Streamlined Sales and Use Tax online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit SD Streamlined Sales and Use Tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SD Streamlined Sales and Use Tax Certificate of Exemption Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SD Streamlined Sales and Use Tax

How to fill out SD Streamlined Sales and Use Tax Certificate

01

Obtain the SD Streamlined Sales and Use Tax Certificate form from the appropriate state department website or office.

02

Fill in the name of the purchaser, which should be the person or business making the purchase.

03

Provide the address of the purchaser, including city, state, and ZIP code.

04

Enter the purchaser's sales tax registration number if applicable.

05

Indicate the seller's information, including name and address.

06

Specify the reason for exemption, such as resale, manufacturing, or other valid reasons.

07

Sign and date the certificate to validate it as the purchaser's declaration of tax-exempt status.

Who needs SD Streamlined Sales and Use Tax Certificate?

01

Businesses or individuals who are purchasing goods and services that are exempt from sales tax.

02

Retailers who intend to resell products and need to claim exemption at the point of sale.

03

Organizations or entities qualifying for tax exemption under applicable state laws.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a reseller permit in South Dakota?

The first step you need to take in order to get a resale certificate, is to apply for a South Dakota Sales Tax License. This license will furnish a business with a unique Sales Tax Number, otherwise referred to as a Sales Tax ID Number. Once you have that, you are eligible to issue a resale certificate.

Do South Dakota sales tax exemption certificates expire?

11 states (Alabama, Florida, Illinois, Indiana, Kansas, Kentucky, Maryland, Nevada, Pennsylvania, South Dakota, and Virginia) currently require entities to file a renewal application to maintain their exempt status. There is typically no fee to renew an exemption.

How long does it take to get a sales tax license in South Dakota?

The good news is that you can get a South Dakota Sales Tax License and be ready to do business 1-5 days after you submit your application.

Are services subject to sales tax in South Dakota?

Sales tax applies to the gross sales or transactions including selling, renting, or leasing products or services (including products delivered electronically) into South Dakota.

Can you still go exempt in 2022?

The personal exemption amount remains zero in 2022. The Tax Cuts and Jobs Act suspended the personal exemption through tax tax year 2025, balancing the suspension with an enhanced Child Tax Credit for most taxpayers and a near doubling of the standard deduction amount.

Does North Dakota have resale certificates?

North Dakota provides resellers with certificates of resale. If you wish to buy items for resale, fill out the entire certificate and present it to your vendor. You can find a blank form here.

What is certificate of tax exemption?

A Certificate to be accomplished and issued by a Payor to recipients of income not subject to withholding tax. This Certificate should be attached to the Annual Income Tax Return - BIR Form 1701 for individuals, or BIR Form 1702 for non-individuals.

Do Co sales tax exemption certificates expire?

How long is my California sales tax exemption certificate good for? The exemption certificate is considered to be valid until the user themselves, in writing, revokes the certificate. In some cases however, when the certificate is issued for a specific transaction, the certificate is usually valid for one year.

Do I need a sales tax license in South Dakota?

Businesses are required to have a South Dakota sales tax license and must collect and remit sales tax on taxable transactions if: the business has a physical presence in South Dakota.

How do I get a resale certificate in South Dakota?

South Dakota does not require registration with the state for a resale certificate. How can you get a resale certificate in South Dakota? To get a resale certificate in South Dakota, you will need to fill out the South Dakota Exemption Certificate (Form 2040).

Does South Dakota require a resale certificate?

A retailer purchases products from a manufacturer or wholesaler to resell to the consumer. A retailer that sells products in South Dakota must have a South Dakota tax permit. The retailer must provide an exemption certificate to the supplier to purchase products exempt from sales tax.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out SD Streamlined Sales and Use Tax using my mobile device?

Use the pdfFiller mobile app to fill out and sign SD Streamlined Sales and Use Tax. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit SD Streamlined Sales and Use Tax on an Android device?

You can make any changes to PDF files, such as SD Streamlined Sales and Use Tax, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

How do I complete SD Streamlined Sales and Use Tax on an Android device?

On Android, use the pdfFiller mobile app to finish your SD Streamlined Sales and Use Tax. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is SD Streamlined Sales and Use Tax Certificate?

The SD Streamlined Sales and Use Tax Certificate is a document used by sellers in South Dakota to collect sales tax and ensure compliance with state tax regulations.

Who is required to file SD Streamlined Sales and Use Tax Certificate?

Sellers operating within South Dakota, as well as out-of-state sellers who have a significant presence in the state, are required to file the SD Streamlined Sales and Use Tax Certificate.

How to fill out SD Streamlined Sales and Use Tax Certificate?

To fill out the SD Streamlined Sales and Use Tax Certificate, provide the seller's name, address, sales tax identification number, and purchaser information along with details about the transaction, including dates and amounts.

What is the purpose of SD Streamlined Sales and Use Tax Certificate?

The purpose of the SD Streamlined Sales and Use Tax Certificate is to facilitate the collection of sales tax in a consistent manner, reducing the compliance burden for sellers and ensuring proper tax collection for the state.

What information must be reported on SD Streamlined Sales and Use Tax Certificate?

The certificate must include the seller's name, address, tax identification number, purchaser's information, type of transaction, and the amount of sales tax collected.

Fill out your SD Streamlined Sales and Use Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SD Streamlined Sales And Use Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.