Get the free SALARY DEFERRAL AND WAIVER FORM

Show details

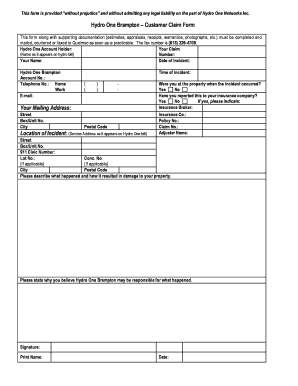

CAB 401(k) Retirement Savings Plan SALARY DEFERRAL AND WAIVER FORM Name: Effective Date of Election: Information on the Plans traditional 401(k) pretax employee salary deferral contribution (Pretax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign salary deferral and waiver

Edit your salary deferral and waiver form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your salary deferral and waiver form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit salary deferral and waiver online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit salary deferral and waiver. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out salary deferral and waiver

How to fill out salary deferral and waiver

01

To fill out a salary deferral and waiver form, follow these steps:

02

Obtain the salary deferral and waiver form from your employer or HR department.

03

Read the instructions carefully to understand the purpose and implications of the form.

04

Provide your personal details such as name, employee ID, and contact information as required.

05

Indicate the specific period for which you are deferring or waiving your salary by entering the start and end dates.

06

Specify the percentage or amount of salary you wish to defer or waive during the mentioned period.

07

If there are any special conditions or considerations, clearly communicate them in the provided sections or attach an additional written explanation if necessary.

08

Sign and date the form to acknowledge your understanding and agreement with the terms.

09

Submit the completed form to your employer or HR department following the designated process or deadline.

10

Retain a copy of the filled form for your records.

11

Keep track of any changes or updates related to the salary deferral or waiver arrangement as communicated by your employer.

Who needs salary deferral and waiver?

01

Salary deferral and waiver is generally needed by employees who may be facing financial challenges or seeking flexibility in their income. It can be beneficial for individuals who want to temporarily reduce their salary to manage a cash flow issue, prioritize other financial obligations, or accommodate a special circumstance.

02

Additionally, some organizations offer salary deferral and waiver programs as part of their compensation packages to provide employees with the option to defer a portion of their salary to a future date or waive it entirely. This can be valuable for individuals who prefer to adjust their income distribution to align with their financial goals or needs.

03

However, the specific criteria and eligibility for salary deferral and waiver may vary between employers and jurisdictions. It is advisable to consult with your employer or HR department to determine if you qualify for such provisions and understand the specific terms and conditions associated with the process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit salary deferral and waiver from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your salary deferral and waiver into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the salary deferral and waiver in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your salary deferral and waiver in seconds.

How can I edit salary deferral and waiver on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing salary deferral and waiver, you need to install and log in to the app.

What is salary deferral and waiver?

Salary deferral is when a portion of an employee's salary is set aside as savings or investment before it is paid out. A waiver is when an employee agrees to give up a portion of their salary.

Who is required to file salary deferral and waiver?

Employers and employees who have agreed to a salary deferral or waiver are required to file the necessary forms.

How to fill out salary deferral and waiver?

Salary deferral and waiver forms can typically be filled out electronically through the HR department or payroll provider.

What is the purpose of salary deferral and waiver?

The purpose of salary deferral and waiver is to allow employees to save or invest a portion of their salary, and for employers to provide additional benefits to their employees.

What information must be reported on salary deferral and waiver?

The forms typically require information on the amount of salary being deferred or waived, the agreed upon terms, and signatures from both the employer and employee.

Fill out your salary deferral and waiver online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Salary Deferral And Waiver is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.