Get the free 2018 Maximum Allowable Contribution Worksheet

Show details

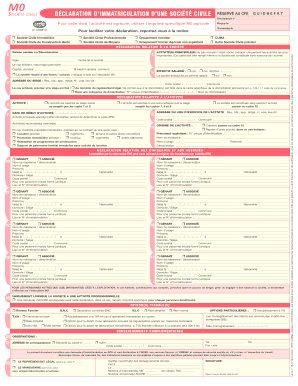

2018 Maximum Allowable Contribution Worksheet Participant Instructions The 2018 Maximum Allowable Contribution Worksheet Part 1 is to be used to determine the maximum dollar amount that you may contribute

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2018 maximum allowable contribution

Edit your 2018 maximum allowable contribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2018 maximum allowable contribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2018 maximum allowable contribution online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2018 maximum allowable contribution. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2018 maximum allowable contribution

How to fill out 2018 maximum allowable contribution

01

To fill out the 2018 maximum allowable contribution, follow these steps:

02

Determine the maximum allowable contribution limit for 2018. This can be found by checking the official IRS guidelines or consulting a tax professional.

03

Calculate your individual or business contributions for 2018. This includes any personal or employer contributions to retirement accounts or other eligible investment accounts.

04

Ensure that your contributions do not exceed the maximum allowable contribution limit for 2018. It is important to stay within the legal limits to avoid any penalties or tax implications.

05

Keep track of your contributions by maintaining accurate records and documentation. This will be helpful during tax season or for future reference.

06

Consult with a financial advisor or tax specialist if you have any questions or concerns regarding the maximum allowable contribution or any other related matters.

Who needs 2018 maximum allowable contribution?

01

Various individuals and businesses may need to consider the 2018 maximum allowable contribution, including:

02

- Individuals who want to maximize their retirement savings and take advantage of tax benefits offered by contributing the maximum allowable amount to their retirement accounts.

03

- Business owners or employers who offer retirement plans or investment options to their employees and need to ensure compliance with contribution limits.

04

- Self-employed individuals or freelancers who want to save for retirement and take advantage of tax benefits available through individual retirement accounts (IRAs).

05

- Investors looking to contribute the maximum allowable amount to eligible investment accounts to take advantage of tax deductions or other financial incentives.

06

- Anyone interested in financial planning or wealth management, as the maximum allowable contribution may influence overall financial strategies and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 2018 maximum allowable contribution electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your 2018 maximum allowable contribution.

Can I create an electronic signature for signing my 2018 maximum allowable contribution in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your 2018 maximum allowable contribution right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the 2018 maximum allowable contribution form on my smartphone?

Use the pdfFiller mobile app to fill out and sign 2018 maximum allowable contribution on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is maximum allowable contribution worksheet?

The maximum allowable contribution worksheet is a document that calculates the maximum amount an individual or entity can contribute towards a certain fund or investment.

Who is required to file maximum allowable contribution worksheet?

Individuals or entities who are making contributions towards a fund or investment that has a maximum allowable limit are required to file the worksheet.

How to fill out maximum allowable contribution worksheet?

The worksheet must be filled out by providing accurate financial information and following the instructions provided on the form.

What is the purpose of maximum allowable contribution worksheet?

The purpose of the worksheet is to ensure that contributors do not exceed the maximum allowable contribution limit set for a specific fund or investment.

What information must be reported on maximum allowable contribution worksheet?

The worksheet typically requires information such as the contributor's income, previous contributions made, and any other relevant financial details.

Fill out your 2018 maximum allowable contribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2018 Maximum Allowable Contribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.