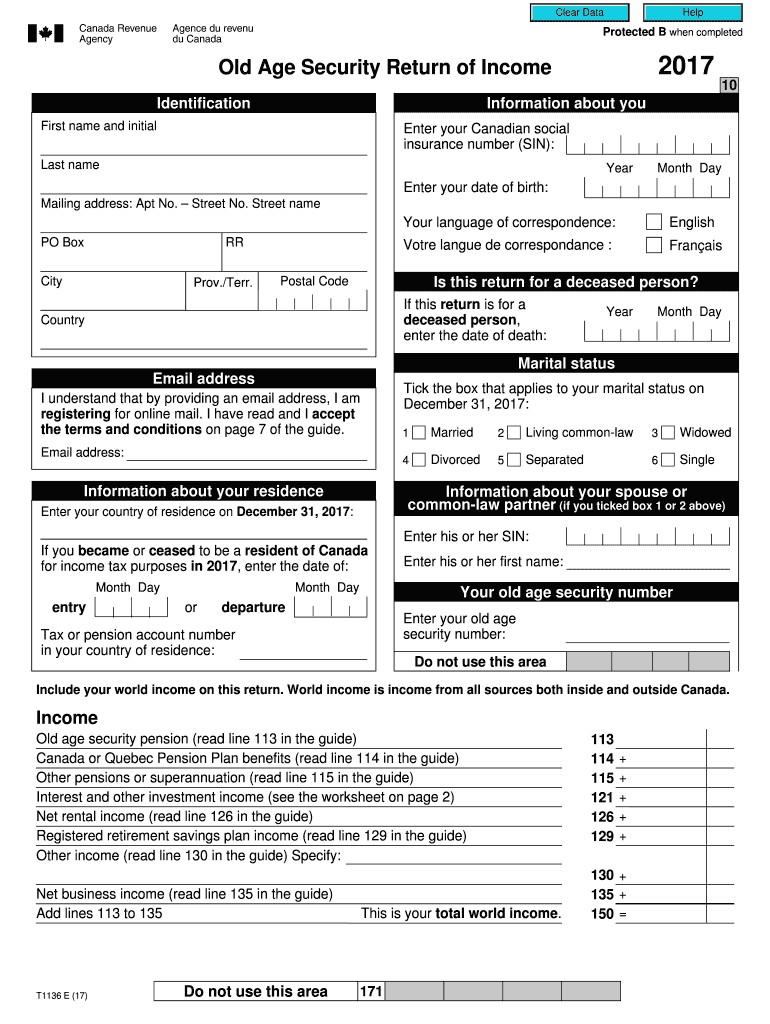

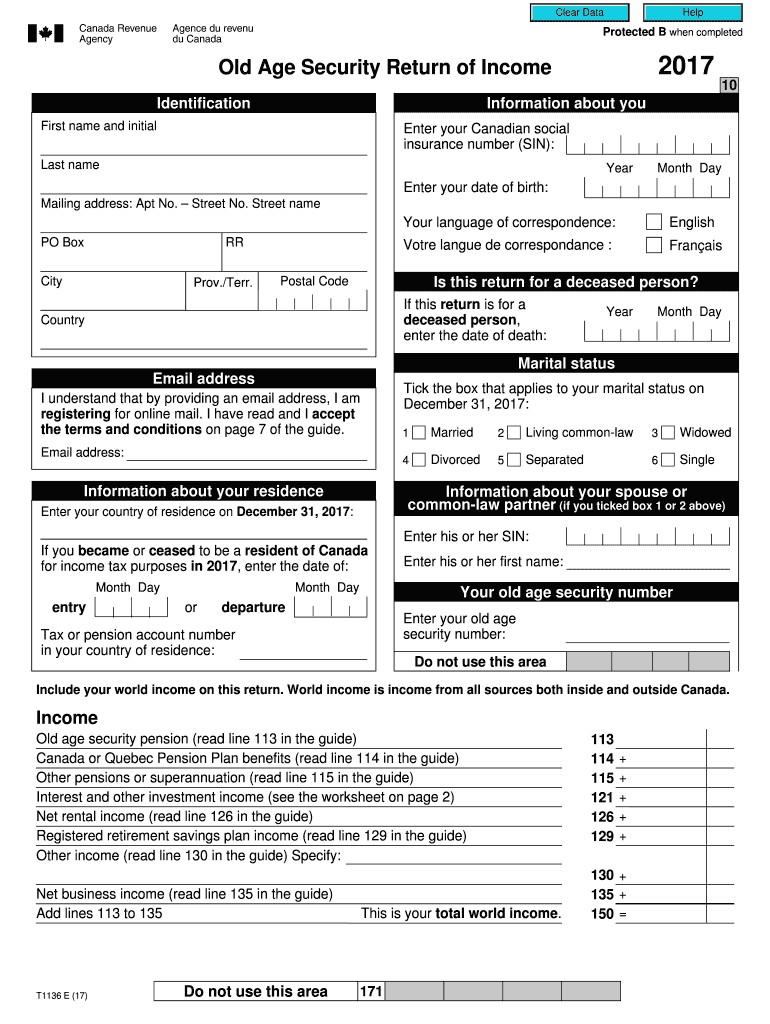

Canada T1136 E 2017 free printable template

Get, Create, Make and Sign Canada T1136 E

Editing Canada T1136 E online

Uncompromising security for your PDF editing and eSignature needs

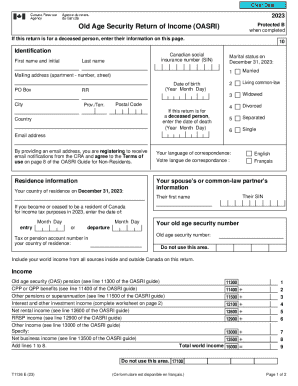

Canada T1136 E Form Versions

How to fill out Canada T1136 E

How to fill out Canada T1136 E

Who needs Canada T1136 E?

Instructions and Help about Canada T1136 E

This is the first in a series of three videos that explains the benefits available to those over the age of 65 in Canada the three benefits that we'll be talking about are old age security also known as OAS guaranteed income supplement also known as GIS and the Canada Pension Plan also known as CPP in this video we'll be focusing on old age security this is Canada's largest pension program, and it is funded out of the general revenues of the Government of Canada which means that you do not pay directly into it OAS is not dependent on your employment history you can still get the supplement if you have never worked or if you are still employed the old age security pension is a taxable monthly benefit available to most Canadians 65 years of age and older there are several situations in which you may be eligible for OAS to receive Old Age Security pension you must be 65 years of age or older be a Canadian citizen or a legal resident in Canada and you must have lived in Canada for at least 10 years after turning 18 if you live outside Canada you must have had legal status on the day before you left Canada and you must have lived in Canada for at least 20 years after turning 18 if you're working for or have worked for a Canadian employer outside of Canada your time abroad could be counted as a residency in Canada if this situation applies to you would clean financial wellness coaches can provide more information on your individual cases the first and most important thing to know about OS is that it is your responsibility to make sure that the benefit is set up correctly approximately one month after your 64th birthday most individuals who are potentially eligible to receive OAS will receive a notification from the government this will either be a letter stating potential eligibility to receive OAS and an application will need to be submitted or a letter indicating selection for automatic enrollment in the OAS program even if you're automatically enrolled it is your responsibility to ensure that the information is correct the government may request supporting documentation to be sent with your application if you were born in Canada and have lived here all your life this will not apply to you but if you were born outside of Canada or have become a citizen of another country you may have to provide proof of citizenship if you were born outside of Canada you will need to submit one of the following documents to confirm your Canadian citizenship or legal status if you are a Canadian citizen you can provide a certificate of Canadian citizenship naturalization certificate or Canadian passport issued in 1970 or later if you are a permanent resident formerly known as landed immigrant you can provide Canadian immigration documents or Canadian immigration stamp on your passport if you are a resident under a temporary residence permit formerly known as minister's permit you will need to provide a copy of your temporary residence permit if you have not lived in...

People Also Ask about

Is OAS a taxable income?

Do you get a T4 for OAS?

How do I get my T4 and OAS from CPP?

How do I get my T4 from Ontario government?

Have not received CPP and OAS tax slips?

How do I get my T4 slip from CRA?

Are CPP and OAS T4 mailed 2022?

What is a T1141?

What is Form T2203?

Are CPP and OAS T4 mailed?

Do you need to file taxes for OAS?

What is T1136 form?

What is net world income Canada?

When can I expect my T4A?

How do I get my T4 slips for CPP and OAS?

Is there a CPP clawback?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify Canada T1136 E without leaving Google Drive?

How can I fill out Canada T1136 E on an iOS device?

How do I complete Canada T1136 E on an Android device?

What is Canada T1136 E?

Who is required to file Canada T1136 E?

How to fill out Canada T1136 E?

What is the purpose of Canada T1136 E?

What information must be reported on Canada T1136 E?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.