Get the free Local Sales Tax Rate Changes Effective April 2018

Show details

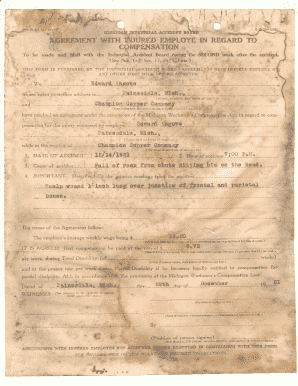

A11/2percentlocalsalesandusetaxwillbecomeeffectiveApril1,2018inthecitieslistedbelow. NICKNAME LOCALE DOCTORATE TOLERATE Brock(Parker Co) 2184142 .020000 .082500 Brock West(Parker Co) 2184160 .020000

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign local sales tax rate

Edit your local sales tax rate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your local sales tax rate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit local sales tax rate online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit local sales tax rate. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out local sales tax rate

How to fill out local sales tax rate

01

To fill out the local sales tax rate, follow these steps:

02

Gather the necessary information: Look for the current local sales tax rate for your area. This information is usually available on the website of your local government or tax authority.

03

Determine the applicable local tax rate: Identify the specific local sales tax rate that applies to your business. In some cases, different localities within the same state may have different tax rates.

04

Update your accounting software or POS system: If you use accounting software or a point-of-sale (POS) system, update the tax rates to reflect the local sales tax rate. This ensures that your invoices and receipts accurately include the correct tax amount.

05

Train your staff: If you have employees who handle sales transactions, make sure to train them on the correct procedures for calculating and applying the local sales tax rate. This helps ensure compliance and minimize errors.

06

Keep records: Maintain accurate records of the local sales tax rate for each transaction. This will be helpful during tax audits or when reconciling your sales tax liabilities.

07

Stay informed: Monitor any changes in the local sales tax rate as they can be revised periodically. Stay updated with the latest information to avoid errors or non-compliance.

08

By following these steps, you can effectively fill out the local sales tax rate for your business.

Who needs local sales tax rate?

01

Various individuals and entities need to be aware of the local sales tax rate, including:

02

- Business owners: It is crucial for business owners to know and understand the local sales tax rate as they are responsible for collecting and remitting the tax to the appropriate authorities.

03

- Accountants and bookkeepers: Professionals handling the financial aspects of a business, such as accountants and bookkeepers, need to be aware of the local sales tax rate to maintain accurate records and compliance.

04

- Sales and retail staff: Employees involved in sales and retail operations should have knowledge of the local sales tax rate to ensure they apply it correctly during transactions.

05

- Government and tax authorities: Local government agencies and tax authorities need information about the local sales tax rate to enforce tax laws and regulations.

06

By knowing who needs the local sales tax rate, you can understand its significance in the context of business operations and compliance with tax regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify local sales tax rate without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your local sales tax rate into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Where do I find local sales tax rate?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific local sales tax rate and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit local sales tax rate online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your local sales tax rate and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

What is local sales tax rate?

Local sales tax rate is the percentage of tax applied to a sale of goods or services in a specific area.

Who is required to file local sales tax rate?

Businesses selling goods or services in a specific area are required to file local sales tax rate.

How to fill out local sales tax rate?

Local sales tax rate can be filled out by submitting a tax return form provided by the local tax authority.

What is the purpose of local sales tax rate?

The purpose of local sales tax rate is to generate revenue for local governments to fund public services and projects.

What information must be reported on local sales tax rate?

Information such as total sales amount, taxable sales amount, and tax amount collected must be reported on local sales tax rate.

Fill out your local sales tax rate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Local Sales Tax Rate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.