NC Substitute W-9 Form 2018 free printable template

Show details

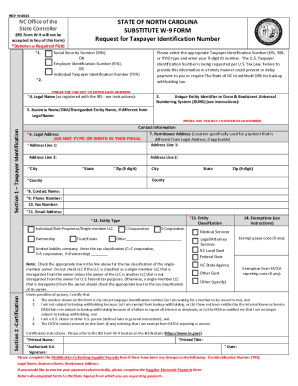

STATE OF NORTH CAROLINA

SUBSTITUTE W9 FORM

Request for Taxpayer Identification Number NC Office of the

State Controller(IRS Form W9 will not be

accepted in lieu of this form)*Denotes a Required Field

*1.

Social

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC Substitute W-9 Form

Edit your NC Substitute W-9 Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC Substitute W-9 Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC Substitute W-9 Form online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NC Substitute W-9 Form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC Substitute W-9 Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC Substitute W-9 Form

How to fill out NC Substitute W-9 Form

01

Download the NC Substitute W-9 Form from the official website.

02

Fill in your name in the 'Name' field at the top of the form.

03

Enter your business name, if applicable, in the 'Business Name' field.

04

Check the appropriate box for your tax classification (Individual, Corporation, Partnership, etc.).

05

Provide your taxpayer identification number (TIN) in the designated area.

06

Complete the address fields to include your street address, city, state, and zip code.

07

If applicable, enter your email address and phone number.

08

Sign and date the form at the bottom to certify the information is accurate.

Who needs NC Substitute W-9 Form?

01

Individuals or entities that provide services to North Carolina state agencies or are seeking to receive payments from them.

02

Freelancers, contractors, and vendors doing business with state authorities.

03

Taxpayers needing to confirm their taxpayer information for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Do you have to pay state income tax in North Carolina?

North Carolina has a flat 4.75 percent individual income tax rate. North Carolina also has a 2.50 percent corporate income tax rate. North Carolina has a 4.75 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 6.99 percent.

What happens if you don't file NC state taxes?

Returns filed after the due date are subject to a failure to file penalty of 5% of the net tax due for each month, or part of a month, the return is late (maximum 25% of the additional tax), If the return is filed under an extension, the late filing penalty will be assessed from the extended filing date rather than

Do I need to file NC state tax return?

You must file a North Carolina income tax return if you received income while being a resident of NC or received income from NC sources. If you had North Carolina income tax withheld but do not meet the filing requirements, you must file a North Carolina return in order to receive a refund for any withholdings.

Does North Carolina tax out of state income?

¶15-115, Nonresidents North Carolina imposes a tax on the taxable income of every nonresident who received income from: the ownership of any interest in real or tangible personal property in North Carolina; a business, trade, profession, or occupation carried on in North Carolina; or.

Where to get NC State tax forms?

To download forms from this website, go to NC Individual Income Tax Forms. To order forms, call 1-877-252-3052. Touch tone callers may order forms 24 hours a day, seven days a week. You may also obtain forms from a service center or from our Order Forms page.

Can a non US citizen fill out a w9?

What happens if I'm asked to complete Form W-9 and I'm not a US resident or citizen? All US residents and citizens, credit card holders, and those with green cards must complete Form W-9. If you're a foreign individual or entity, you'll need to complete a W-8.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NC Substitute W-9 Form in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your NC Substitute W-9 Form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find NC Substitute W-9 Form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the NC Substitute W-9 Form in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit NC Substitute W-9 Form on an Android device?

You can make any changes to PDF files, such as NC Substitute W-9 Form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is NC Substitute W-9 Form?

The NC Substitute W-9 Form is a document used by individuals and entities in North Carolina to provide their taxpayer identification information to a payer for tax reporting purposes.

Who is required to file NC Substitute W-9 Form?

Individuals or entities that receive payments from North Carolina government agencies or businesses may be required to file the NC Substitute W-9 Form.

How to fill out NC Substitute W-9 Form?

To fill out the NC Substitute W-9 Form, provide your name, business name (if applicable), address, taxpayer identification number (TIN), and certification of your TIN's accuracy.

What is the purpose of NC Substitute W-9 Form?

The purpose of the NC Substitute W-9 Form is to collect tax identification information for proper tax reporting and to ensure compliance with state and federal tax laws.

What information must be reported on NC Substitute W-9 Form?

The NC Substitute W-9 Form requires reporting of your name, business name (if applicable), address, taxpayer identification number (TIN), and your signature certifying the accuracy of the provided information.

Fill out your NC Substitute W-9 Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC Substitute W-9 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.