Get the free Note: in order for Form W-8BEN-E to be complete, you must complete the highlighted f...

Show details

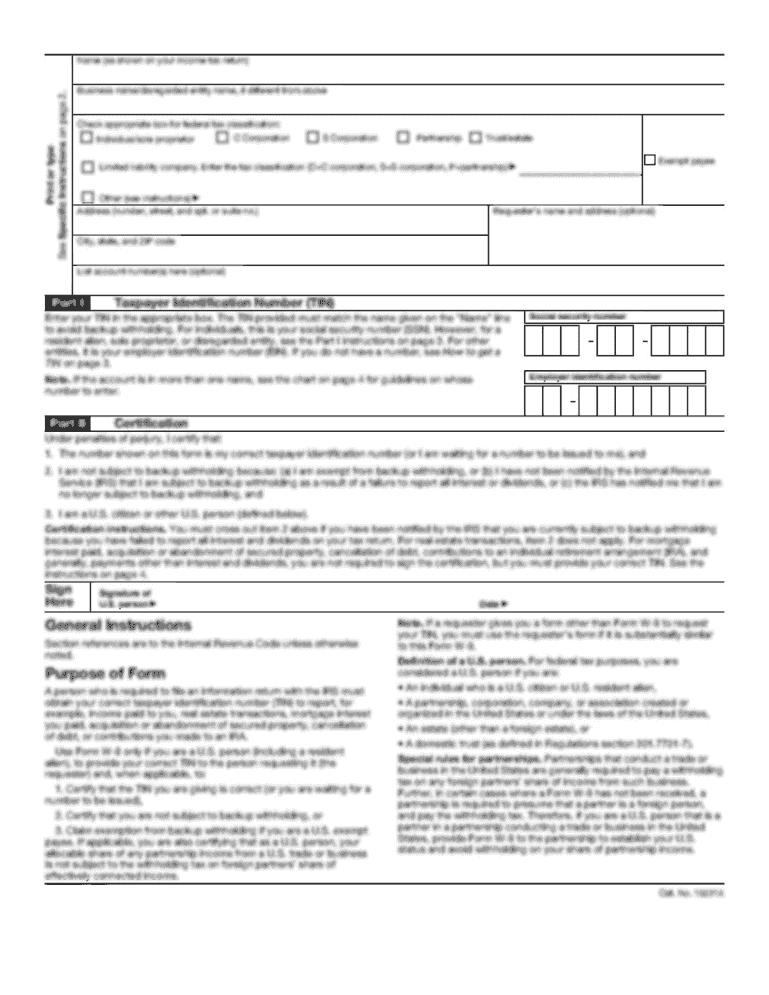

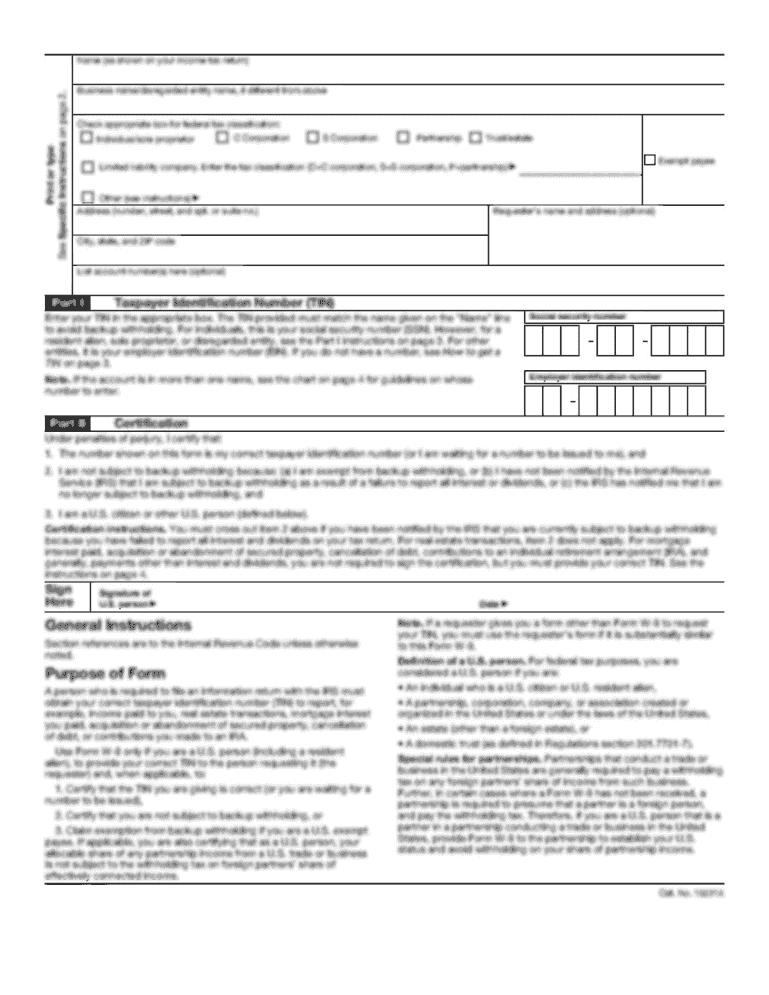

Form W-8BEN-E February 2014 Substitute Form for Non-FATCA Payments Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting Entities For use by entities. Individuals must use Form W-8BEN* Section references are to the Internal Revenue Code. Information about Form W-8BEN-E and its separate instructions is at www*irs*gov/formw8bene. Give this form to the withholding agent or payer. Do not send to the IRS* Instead use Form Do NOT use this form for FATCA...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign note in order for

Edit your note in order for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your note in order for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit note in order for online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit note in order for. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out note in order for

01

First, start by writing the purpose of the note at the top. This will help the recipient understand the reason for the note.

02

Next, provide a brief introduction or background information related to the purpose of the note. This will give the recipient context and help them understand the importance of the information being conveyed.

03

Then, clearly state the main points or important details that need to be addressed or communicated in the note. Be concise and specific, using bullet points or numbered lists if necessary.

04

It is important to ensure that the note is organized and easy to read. Use headings, subheadings, or paragraphs to separate different sections or ideas. Consider using bullet points, numbered lists, or bold font to highlight key points or important information.

05

In terms of formatting, use a professional tone and language. Avoid using jargon or complicated terms that the recipient may not understand. Keep the note concise and to the point, focusing on the necessary details.

06

Finally, make sure to proofread the note before sending it. Check for any spelling or grammar errors, and ensure that the information is accurate and clearly conveyed.

Who needs note in order for?

01

Anyone who wants to communicate important information or instructions to another person or group.

02

Organizations or businesses that need to keep a record of the information communicated or shared.

03

Individuals who need to provide documentation or written evidence of a conversation or agreement.

Fill

form

: Try Risk Free

People Also Ask about

What is the written explanation of W8BEN?

An IRS Form W-8BEN form is a Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting purposes. By completing a Form W-8BEN, you confirm to us that you are not a U.S. Taxpayer and you will avoid having taxes withheld from your interest payments.

What is irs form W-8BEN-E used for?

Form W-8 BEN-E is used by foreign entities to document their status for purposes of chapter 3 and chapter 4, as well as other code provisions.

How do I fill out a W-8BEN form as an Indian?

0:24 7:49 How to Fill W-8BEN Form India - Including Tax Treaty Details (In The YouTube Start of suggested clip End of suggested clip Code. So i'm entering the pin code as. Well. So once this is entered please enter the country. AgainMoreCode. So i'm entering the pin code as. Well. So once this is entered please enter the country. Again. Next mailing address now mailing addresses say for example.

What is the difference between irs form W-8BEN and W-8BEN-E?

Form W-8BEN is used by foreign individuals who receive nonbusiness income in the U.S., whereas W-8BEN-E is used by foreign entities who receive this type of income.

Do I need to complete a W-8BEN form?

Is Form W-8BEN Required? Yes. Form W-8BEN is required to be filed with withholding agents, payers, and FFIs by non-resident alien individuals who may be subject to withholding of U.S. taxes at a 30% tax rate on payment amounts received from U.S. sources, regardless of their ability to claim a withholding exemption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my note in order for in Gmail?

note in order for and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I modify note in order for without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your note in order for into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I fill out the note in order for form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign note in order for and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is note in order for?

A note in order for is a formal written document used to indicate a request or instruction regarding a specific transaction, typically for legal, financial, or business purposes.

Who is required to file note in order for?

Individuals or entities involved in a transaction, including businesses, lenders, or clients, who are party to the agreement typically are required to file a note in order for.

How to fill out note in order for?

To fill out a note in order for, provide the date, the names of the parties involved, a clear description of the terms and conditions, any applicable amounts, and signatures of the parties involved.

What is the purpose of note in order for?

The purpose of a note in order for is to create a legally binding record that outlines the responsibilities, obligations, and rights of the parties involved in a transaction.

What information must be reported on note in order for?

The information that must be reported on a note in order for includes the names of the parties, date of the agreement, terms of the agreement, payment details, and any relevant legal provisions or conditions.

Fill out your note in order for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Note In Order For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.