IA 31-014a 2018-2025 free printable template

Show details

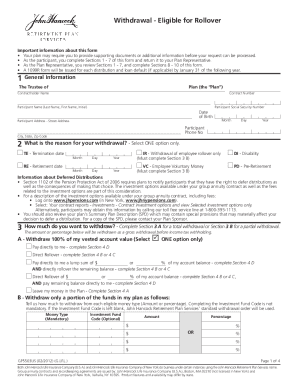

Iowa Sales/Use/Excise Tax Exemption Certificate https://tax.iowa.gov This document is to be completed by a purchaser when claiming exemption from sales/use/excise tax. Certificates are valid for up

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign iowa sales tax exemption

Edit your iowa sales tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your iowa sales tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit iowa sales tax exemption online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit iowa sales tax exemption. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out iowa sales tax exemption

How to fill out IA 31-014a

01

Begin by downloading the IA 31-014a form from the official website.

02

Carefully read the instructions provided on the form.

03

Fill in your personal information at the top, including your name, address, and contact details.

04

Provide the necessary details in the sections for your application, ensuring all information is accurate.

05

Include any required documentation or attachments as specified in the instructions.

06

Review the completed form to ensure everything is filled out correctly.

07

Sign and date the form at the designated area.

08

Submit the form as instructed, either electronically or via mail.

Who needs IA 31-014a?

01

Individuals seeking specific services or benefits related to IA 31-014a.

02

Applicants who must complete this form to comply with regulatory requirements.

03

Anyone involved in processes that require formal application submissions.

Fill

form

: Try Risk Free

People Also Ask about

How do I qualify for farm tax exemption in Iowa?

Iowa Family Farm Tax Credit Eligibility: All land used for agricultural or horticultural purposes in tracts of 10 acres or more and land of less than 10 acres if contiguous to qualifying land of more than 10 acres. The owner or designated person must be actively engaged in farming the land.

At what age do you stop paying property tax in Iowa?

In addition to the homestead tax credit, eligible claimants who own the home they live in and are 65 years of age or older on or before January 1 of the assessment year are now eligible for a homestead tax exemption. For the assessment year beginning on January 1, 2023, the exemption is for $3,250 of taxable value.

Who qualifies for low income exemption in Iowa?

If you are using filing status 1 (single), you are exempt from Iowa tax if you meet either of the following conditions: Your net income from all sources, line 26, is $9,000 or less and you are not claimed as a dependent on another person's Iowa return ($24,000 if you are 65 or older on 12/31/22).

Who is exempt from Iowa income tax?

The following individuals qualify for the exclusion: Those who are 55 years of age or older. Those who are disabled*. Surviving spouses or other qualifying survivors who receive retirement income due to the death of an individual who would have qualified for the exclusion.

How do I become sales tax exempt in Iowa?

In Iowa, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers. Any items which are used in the construction and agriculture are considered to be exempt. In addition, any equipment which is used for farming or for building does not require a sales tax to be levied.

What is the personal exemption credit in Iowa?

You may claim a $40 personal exemption credit even if you are claimed as a dependent on another person's Iowa return. If you were 65 or older on or before January 1, 2023, you may take an additional personal credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit iowa sales tax exemption in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your iowa sales tax exemption, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the iowa sales tax exemption in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your iowa sales tax exemption and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit iowa sales tax exemption on an iOS device?

You certainly can. You can quickly edit, distribute, and sign iowa sales tax exemption on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

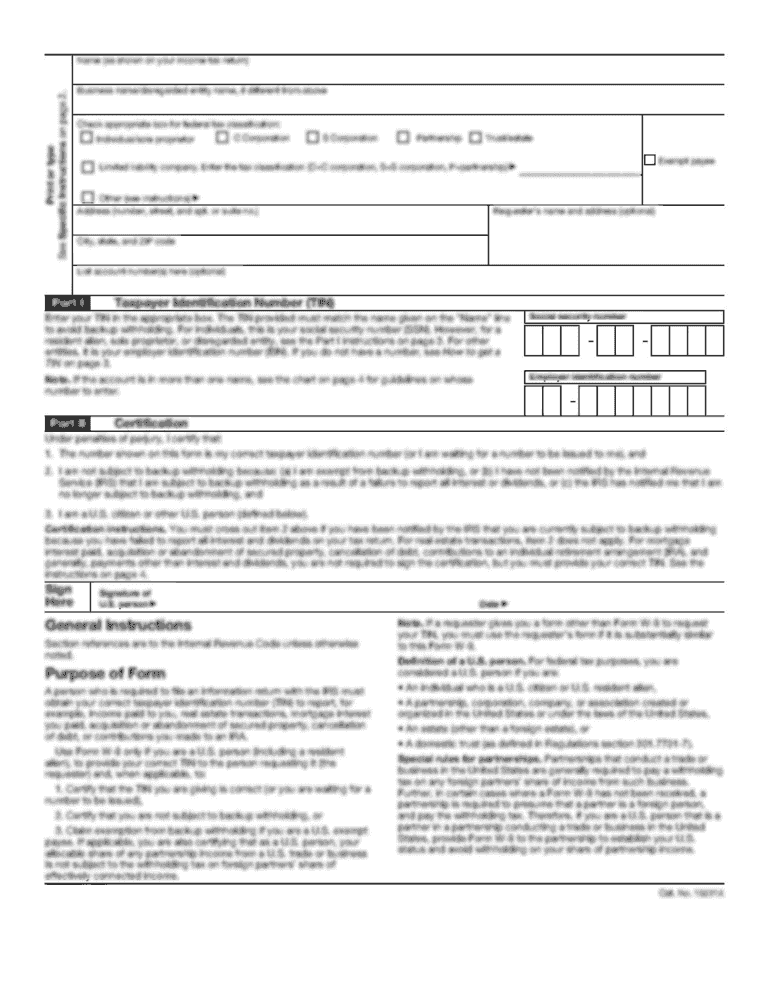

What is IA 31-014a?

IA 31-014a is a specific tax form used in Iowa for reporting certain types of income and expenses by individuals and businesses.

Who is required to file IA 31-014a?

Individuals and businesses that have income or expenses categorized under the specific tax provisions outlined in Iowa tax law are required to file IA 31-014a.

How to fill out IA 31-014a?

To fill out IA 31-014a, one should gather all relevant financial documents, follow the instructions provided with the form, enter the required information accurately, and ensure to sign and date the form before submission.

What is the purpose of IA 31-014a?

The purpose of IA 31-014a is to report income and expenses to the Iowa Department of Revenue for tax assessment and compliance purposes.

What information must be reported on IA 31-014a?

IA 31-014a must report detailed information regarding income earned, allowable deductions, credits, and other relevant financial data as stipulated by Iowa tax regulations.

Fill out your iowa sales tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Iowa Sales Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.