Get the free AUTOMATIC CONTRIBUTION AUTHORIZATION I hereby authorize ...

Show details

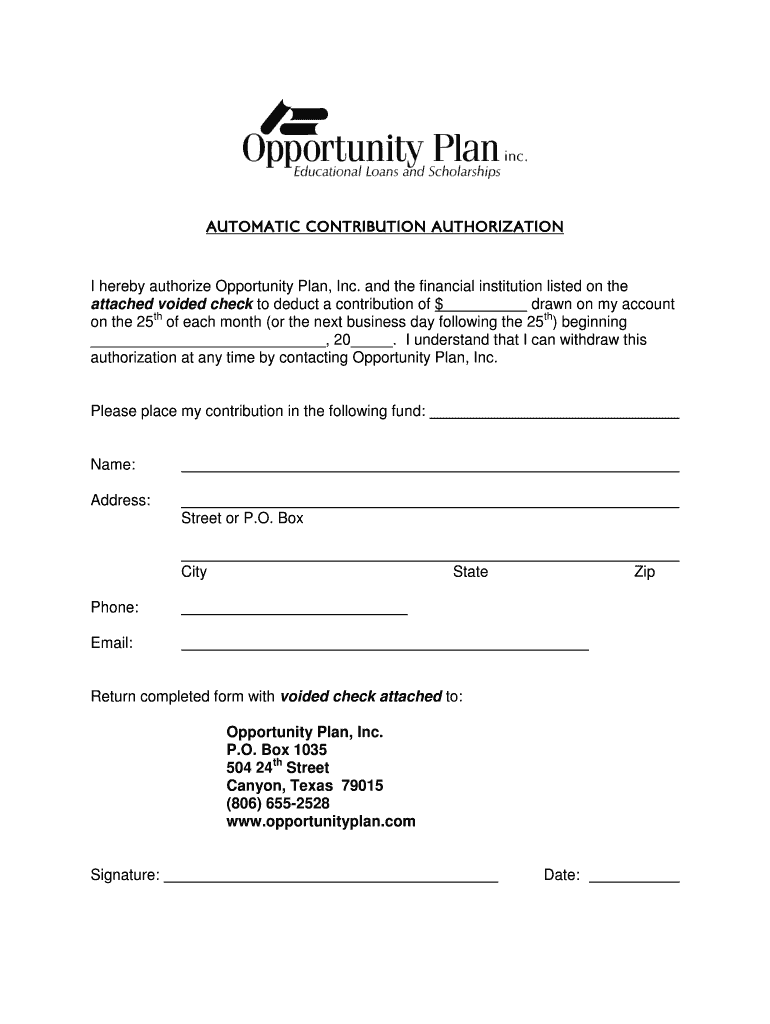

AUTOMATIC CONTRIBUTION AUTHORIZATION I hereby authorize Opportunity Plan, Inc. and the financial institution listed on the attached voided check to deduct a contribution of $ drawn on my account TH

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automatic contribution authorization i

Edit your automatic contribution authorization i form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automatic contribution authorization i form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automatic contribution authorization i online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit automatic contribution authorization i. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automatic contribution authorization i

How to fill out automatic contribution authorization i:

01

Start by obtaining the automatic contribution authorization i form from your employer or retirement plan administrator. This form may also be available online.

02

Carefully read and understand the instructions provided on the form. Become familiar with the terms and conditions associated with automatic contribution authorization.

03

Begin by providing your personal information on the form, such as your full name, address, social security number, and contact details.

04

Indicate the percentage or amount that you would like to contribute automatically from your paycheck to your retirement plan. This could be a fixed dollar amount or a percentage of your salary.

05

If applicable, specify the type of contribution you would like to make, such as pretax (traditional) or after-tax (Roth). Consider consulting with a financial advisor to determine which option is most beneficial for your situation.

06

Review and understand the investment options available within your retirement plan. Select the investment or portfolio that aligns with your risk tolerance and long-term goals.

07

If necessary, designate a beneficiary who will receive the remaining balance of your retirement account in the event of your death.

08

Sign and date the automatic contribution authorization i form. Make sure to include any required witness signatures or notarization if specified.

09

Retain a copy of the completed form for your records, and submit the original form to your employer or retirement plan administrator as instructed.

Who needs automatic contribution authorization i:

01

Individuals who are employed and have access to an employer-sponsored retirement plan, such as a 401(k) or 403(b), may need to consider automatic contribution authorization i.

02

For those who wish to save for retirement and take advantage of tax advantages or employer matching contributions, automatic contribution authorization can be a useful tool.

03

Automatic contribution authorization i may be beneficial for individuals who prefer a systematic and disciplined approach to saving for retirement, as it ensures a consistent contribution is made from each paycheck.

04

Employees who want to take advantage of the convenience and automatic savings feature of their retirement plan may also find automatic contribution authorization i valuable.

05

It is recommended to consult with a financial advisor or retirement plan specialist to determine whether automatic contribution authorization i is suitable for your personal financial goals and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify automatic contribution authorization i without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like automatic contribution authorization i, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send automatic contribution authorization i for eSignature?

Once your automatic contribution authorization i is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Where do I find automatic contribution authorization i?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the automatic contribution authorization i in a matter of seconds. Open it right away and start customizing it using advanced editing features.

What is automatic contribution authorization i?

Automatic contribution authorization i is a form that allows an employer to automatically deduct contributions from an employee's wages for retirement savings or other benefits.

Who is required to file automatic contribution authorization i?

Employers who want to implement a system of automatic deductions from employee wages for benefits or retirement savings are required to file automatic contribution authorization i.

How to fill out automatic contribution authorization i?

Automatic contribution authorization i can typically be filled out by providing information such as employee name, wage deduction amount, frequency of deduction, and benefit or retirement savings plan details.

What is the purpose of automatic contribution authorization i?

The purpose of automatic contribution authorization i is to streamline the process of deducting contributions from employee wages for benefits or retirement savings, making it easier for both employers and employees.

What information must be reported on automatic contribution authorization i?

Information that must be reported on automatic contribution authorization i includes employee name, wage deduction amount, frequency of deduction, and details of the benefit or retirement savings plan.

Fill out your automatic contribution authorization i online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automatic Contribution Authorization I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.