Get the free Historic Preservation Tax Incentives - dahp wa

Show details

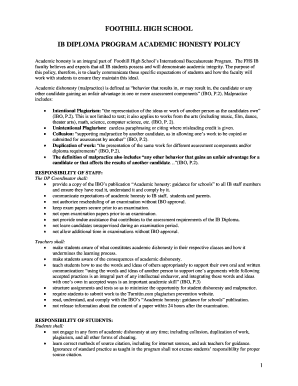

Historic

Preservation

Tax IncentivesNational Park Service

U.S. Department of the Interior

Technical Preservation ServicesQuick References booklet describes the Federal HistoricPreservation Tax Incentives2What

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign historic preservation tax incentives

Edit your historic preservation tax incentives form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your historic preservation tax incentives form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing historic preservation tax incentives online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit historic preservation tax incentives. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out historic preservation tax incentives

How to fill out historic preservation tax incentives

01

Understand the eligibility requirements for historic preservation tax incentives. These requirements may vary depending on the country or region you are in.

02

Research and gather all necessary documentation related to the property you want to preserve. This may include historical records, photographs, and architectural plans.

03

Consult with a preservation professional or an architect with experience in historic preservation. They can provide guidance on the specific requirements and design guidelines for preserving the property.

04

Familiarize yourself with the specific tax incentives available in your area. This may include grants, tax credits, or property tax exemptions.

05

Complete the application forms for the historic preservation tax incentives. Pay close attention to any documentation or evidence required to support your application.

06

Submit your application to the relevant government or local authority responsible for administering the tax incentives.

07

Await review and approval of your application. This process may take some time depending on the volume of applications received and the complexity of the project.

08

If approved, ensure you comply with any conditions or restrictions specified in the approval. Failure to meet these requirements may result in the revocation of the tax incentives.

09

Keep records of all expenses related to the preservation project. This will be necessary when claiming any tax credits or deductions.

10

Consult with a tax professional to accurately complete your tax returns and properly claim the historic preservation tax incentives.

11

Monitor any changes to the tax laws or regulations related to historic preservation tax incentives. This will ensure you stay informed and continue to benefit from the incentives.

Who needs historic preservation tax incentives?

01

Property owners who own historically significant buildings or structures may seek historic preservation tax incentives. These incentives can provide financial support for the preservation, restoration, or rehabilitation of the property.

02

Non-profit organizations or community groups focused on historic preservation may also benefit from these incentives. They can use the financial assistance to undertake preservation projects that promote historical and cultural heritage.

03

Local governments or authorities responsible for the preservation of historical sites and landmarks may utilize historic preservation tax incentives to support their conservation efforts.

04

Architects, contractors, and preservation professionals may also have a need for historic preservation tax incentives as they work on projects involving historically significant properties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send historic preservation tax incentives to be eSigned by others?

Once your historic preservation tax incentives is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I sign the historic preservation tax incentives electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your historic preservation tax incentives in seconds.

How do I fill out the historic preservation tax incentives form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign historic preservation tax incentives. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is historic preservation tax incentives?

Historic preservation tax incentives are financial incentives provided to property owners who rehabilitate historic buildings.

Who is required to file historic preservation tax incentives?

Property owners who rehabilitate historic buildings are required to file for historic preservation tax incentives.

How to fill out historic preservation tax incentives?

Historic preservation tax incentives can be filled out by submitting the required forms and documentation to the appropriate government agency.

What is the purpose of historic preservation tax incentives?

The purpose of historic preservation tax incentives is to encourage the preservation and rehabilitation of historic buildings.

What information must be reported on historic preservation tax incentives?

Information such as the cost of rehabilitation, the historic significance of the building, and the impact of the rehabilitation on the community must be reported on historic preservation tax incentives.

Fill out your historic preservation tax incentives online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Historic Preservation Tax Incentives is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.