AU Hesta 5051 2017 free printable template

Show details

VESTA income stream

lump sum withdrawal form

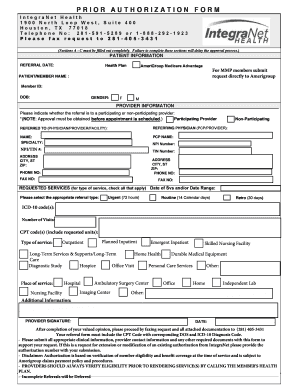

Use this form to make a lump sum withdrawal from your VESTA Income Stream or Transition to Retirement Income Stream (if eligible).

Please consult a financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU Hesta 5051

Edit your AU Hesta 5051 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU Hesta 5051 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU Hesta 5051 online

Follow the steps down below to use a professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AU Hesta 5051. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU Hesta 5051 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU Hesta 5051

How to fill out AU Hesta 5051

01

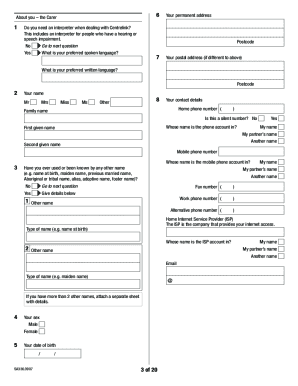

Begin by gathering all necessary personal information such as your name, address, date of birth, and contact details.

02

Ensure you have your tax file number (TFN) ready, as it will be required.

03

Complete the section related to your employment details, including your employer's name and your job title.

04

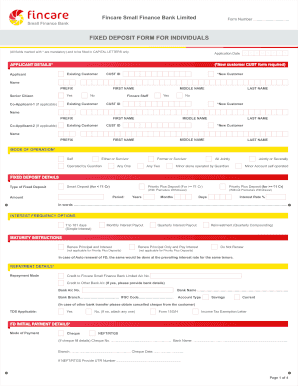

Include details about your superannuation account, such as the fund name and account number.

05

Fill out any relevant sections that pertain to your financial situation or any dependents you may have.

06

Review all information for accuracy before submitting the form.

07

Submit the form as directed, either online or through postal mail.

Who needs AU Hesta 5051?

01

Individuals who are applying for a specific superannuation fund or need to transfer their superannuation.

02

Employees looking to consolidate their superannuation accounts into a single fund.

03

Anyone who needs to make changes to their existing superannuation details or beneficiaries.

Fill

form

: Try Risk Free

People Also Ask about

What is the lump sum for HESTA?

$10,000 once every 12 months if you meet eligibility criteria in point 1 (above). Any amount if you meet eligibility criteria in point 2 (above). The amount is paid and taxed as a lump sum.

Can I withdraw all my super from HESTA?

When you reach preservation age you can withdraw your super as a lump sum if you permanently retire or transfer your super to a HESTA Income Stream under the transition to retirement rules, if you're not permanently retired.

Can I access my HESTA super early?

Yes, you can. You can open a HESTA Transition to Retirement (TTR) Income Stream to start accessing your super even before you retire, as long as you're eligible. Most HESTA members use a TTR Income Stream strategy to boost their savings before they retire (and save on tax).

How do I withdraw from HESTA?

For the ATO to agree to release the funds from your super, you'll need to prove you're unable to meet the expenses for one or more of the following: medical treatment and medical transport for you or a dependant. palliative care for you or a dependant.

Can I access my super HESTA?

Yes, you can. You can open a HESTA Transition to Retirement (TTR) Income Stream to start accessing your super even before you retire, as long as you're eligible. Most HESTA members use a TTR Income Stream strategy to boost their savings before they retire (and save on tax).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my AU Hesta 5051 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your AU Hesta 5051 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete AU Hesta 5051 online?

pdfFiller has made it simple to fill out and eSign AU Hesta 5051. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the AU Hesta 5051 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your AU Hesta 5051 in seconds.

What is AU Hesta 5051?

AU Hesta 5051 is a specific form used for reporting and managing superannuation in Australia, particularly in relation to Hesta superannuation funds.

Who is required to file AU Hesta 5051?

Employers who manage superannuation funds for their employees, specifically those who contribute to Hesta superannuation, are required to file AU Hesta 5051.

How to fill out AU Hesta 5051?

To fill out AU Hesta 5051, you need to provide details such as the employer's information, employee contributions, and any relevant transaction data as specified in the guidelines.

What is the purpose of AU Hesta 5051?

The purpose of AU Hesta 5051 is to ensure accurate reporting of superannuation contributions and to facilitate compliance with Australian superannuation laws.

What information must be reported on AU Hesta 5051?

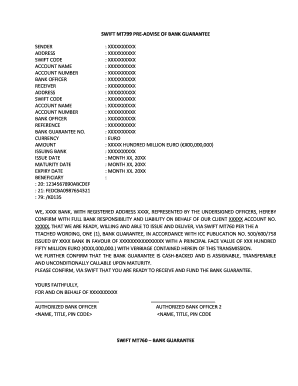

Information that must be reported on AU Hesta 5051 includes employer details, employee identifiers, contribution amounts, payment dates, and any applicable deductions or adjustments.

Fill out your AU Hesta 5051 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU Hesta 5051 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.