Get the free Short Form Mortgage Application (Mini-1003) - Spider Mortgage Sites

Show details

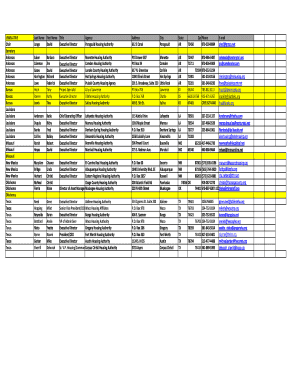

Short Form Mortgage Application (Mini1003)Page 1 of 2DATE: TIME: LOAN OFFICER: PURPOSE OF LOAN: REFINANCE PURCHASE CONSTRUCTION EQUITY LINE PRIMARY BORROWER: DOB: / /19 SSNs: PHONE (H): () PHONE (W):

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short form mortgage application

Edit your short form mortgage application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short form mortgage application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing short form mortgage application online

Follow the steps below to take advantage of the professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit short form mortgage application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

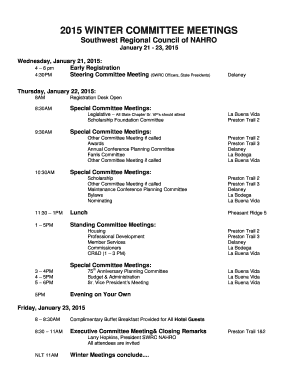

How to fill out short form mortgage application

How to fill out a short form mortgage application:

01

Start by gathering all the required documents and information. These may include personal identification documents, income statements, employment history, and details about the property you are seeking a mortgage for.

02

Carefully read through the application form, ensuring you understand each section and the information required.

03

Begin by filling out your personal information, including your full name, contact details, and social security number.

04

Provide accurate information about your employment history, including your current employer and their contact details, as well as any previous employers within the last few years.

05

Fill in your income details, including your annual salary or wages, any additional sources of income, and any applicable tax information.

06

Include details about the property you are seeking a mortgage for, such as its address, the sales price, and the type of property (e.g., single-family home, condominium).

07

Disclose any other financial obligations you may have, such as existing loans or credit card debt.

08

Review the completed application form for any errors or missing information before submitting it. Consider getting a second pair of eyes to check it as well.

09

Sign and date the application form, affirming that all the information provided is accurate to the best of your knowledge.

10

Submit the completed application form to the relevant mortgage lender or financial institution.

Who needs a short form mortgage application?

01

Individuals who are looking to apply for a mortgage loan to purchase a property.

02

Anyone seeking to refinance their current mortgage.

03

Borrowers who want to take advantage of lower interest rates or better loan terms.

04

Individuals in need of additional funds for renovation or other purposes, using their property as collateral.

Note: The specific requirements for a short form mortgage application may vary depending on the lender and local regulations. It is always advisable to consult with a mortgage professional for personalized advice.

Fill

form

: Try Risk Free

People Also Ask about

What are the 3 types of mortgage?

Types of Mortgages: Conventional Mortgages. Fixed-Rate Mortgages. Adjustable-Rate Mortgages. FHA Loans. USDA Loans. VA Loans. Jumbo Loans.

What is a 1008?

The Uniform Underwriting and Transmittal Summary Form 1008 summarizes key data from the loan application package. Lenders use this information in reaching the underwriting decision. Form 1008 (or a similar document) must be retained in the mortgage file for manually underwritten mortgage loans.

What does a short form mortgage mean?

The Short Form Security Instrument is the Mortgage or Deed of Trust recorded for each individual Mortgage made and recorded in the recording jurisdiction where the Master Form Security Instrument is recorded; the Short Form Security Instrument contains loan-specific information and incorporates by reference the

What is the form 1003 Urla?

The 1003 Form is Fannie Mae's form number for the Uniform Residential Loan Application (URLA). Freddie Mac refers to this as Form 65. The URLA, 1003, and Form 65 are all the same forms and serve as a mortgage loan application.

What form is a 1003?

The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use. The application asks questions about the borrower's employment, income, assets, and debts, as well as requiring information about the property.

What does Urla mean?

What is the Uniform Residential Loan Application? The URLA (also known as the Freddie Mac Form 65 / Fannie Mae Form 1003) is a standardized document used by borrowers to apply for a mortgage. The URLA is jointly published by the GSEs and has been in use for more than 40 years in all U.S. States and Territories. Q2.

How many sections are in 1003 application?

It's known within the mortgage industry as Fannie Mae Form 1003, and borrowers enter income, asset credit and other personal financial information into the redesigned form's nine sections.

What is a 1003 disclosure?

Most recently amended Jan. 1, 2022. Regulation C requires many financial institutions to collect, report, and disclose certain information about their mortgage lending activity.

What is the difference between long form and short form title?

Long Form policies cannot be issued until the recording information has been received back from the county recorder's office. Short Form policies, on the other hand, can be issued immediately after the loan has been successfully funded, making them the preferred form for qualifying transactions.

What changed with Urla?

Biggest changes on the form The redesigned URLA will replace Freddie Mac Form 65 and Fannie Mae Form 1003 and will require lenders to request more borrower information than ever. The new data fields include a wide range of information, such as: Borrower's mobile number(s) Borrower's email address(es)

What is the purpose of 1003?

Form 1003 is one of the most crucial documents when it comes to mortgage lending risk assessment. Mortgage lenders have to process hundreds of forms to analyze the financial security and reliability of the borrower.

What is the purpose of the Urla?

What is the Uniform Residential Loan Application? The URLA (also known as the Freddie Mac Form 65 / Fannie Mae Form 1003) is a standardized document used by borrowers to apply for a mortgage. The URLA is jointly published by the GSEs and has been in use for more than 40 years in all U.S. States and Territories.

What is included on the 1003?

The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use. The application asks questions about the borrower's employment, income, assets, and debts, as well as requiring information about the property.

How many times is 1003 completed during the mortgage transaction?

The Form 1003 Mortgage Application is only one step in the mortgage loan process. You might have to fill it out twice: once at the beginning of your application and then again before closing. The second completion will verify that all information is still accurate and will confirm the loan's terms and rate.

What is a 1003 mortgage application?

The Uniform Residential Loan Application is used by lenders to determine your creditworthiness for a home loan. It's known within the mortgage industry as Fannie Mae Form 1003, and borrowers enter income, asset credit and other personal financial information into the redesigned form's nine sections.

What is short form mortgage?

Summary: Mortgage Abbreviation There are two common abbreviations of mortgage: mtg. and mtge.

What is short form loan policy?

A short form title insurance policy is a type of lender's title insurance. It recognizes that not all real estate purchases are created equal, which is to say multi-million dollar transactions require far more paperwork and thoroughness than those involving small homes.

Is Urla required?

Uniform Residential Loan Application (URLA/Form 1003) * Component required for all loan applications. All other components are to be used as needed.

What is the new 1003 called?

The 1003 loan application, or Uniform Residential Loan Application, is the standardized form most mortgage lenders in the U.S. use. The application asks questions about the borrower's employment, income, assets, and debts, as well as requiring information about the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in short form mortgage application?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your short form mortgage application to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in short form mortgage application without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing short form mortgage application and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out short form mortgage application on an Android device?

Use the pdfFiller mobile app to complete your short form mortgage application on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

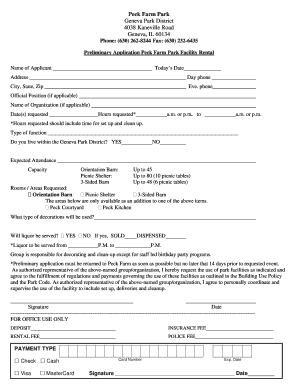

What is short form mortgage application?

A short form mortgage application is a simplified version of a standard mortgage application used to collect essential information from a borrower quickly and efficiently.

Who is required to file short form mortgage application?

Typically, borrowers seeking a faster and more straightforward approval process for a mortgage may file a short form mortgage application, especially when the loan amount is lower or the borrower's financial situation is clear.

How to fill out short form mortgage application?

To fill out a short form mortgage application, a borrower needs to provide basic personal information, employment details, income, assets, liabilities, and the purpose of the loan. Most lenders will provide guidelines on what specific information is needed.

What is the purpose of short form mortgage application?

The purpose of a short form mortgage application is to streamline the mortgage application process, making it quicker for borrowers to apply for a loan while still collecting necessary information for the lender to assess the borrower's eligibility.

What information must be reported on short form mortgage application?

The short form mortgage application typically requires reporting personal identification details, income information, employment history, outstanding debts, assets, and the purpose of the loan.

Fill out your short form mortgage application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short Form Mortgage Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.