Get the free For former employees or dependents

Show details

Updated 10/6/2017Health Insurance 2018

For former employees or dependents

continuing health or dental coverage through

the state employee benefits program (COBRA)Table of Contention Enrollment 2018

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for former employees or

Edit your for former employees or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for former employees or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing for former employees or online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit for former employees or. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out for former employees or

How to fill out for former employees or

01

To fill out for former employees, follow these steps:

02

Collect all necessary information about the former employee, such as their full name, contact details, employment start and end dates, position held, and reason for leaving.

03

Prepare the necessary documents, including the employee's termination letter or resignation letter, any written agreements or contracts, and any relevant supporting documentation.

04

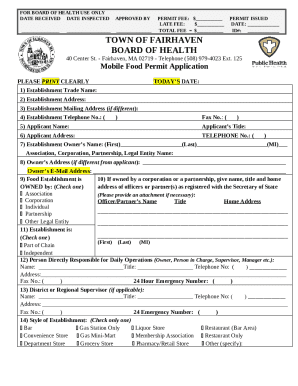

Obtain the appropriate form for former employees, which may vary depending on your country or jurisdiction. This form is typically called an 'Employee Departure Form' or 'Former Employee Information Form'.

05

Fill out the form accurately and completely, providing all requested information about the former employee. Double-check the information to ensure its accuracy.

06

If necessary, have the form reviewed and signed by the appropriate personnel, such as the HR department or a manager.

07

Keep a copy of the completed form for your records, and provide a copy to the former employee if required.

08

File the form as per your organization's policy, whether it's in a physical folder or digitally.

09

If there are any additional steps or requirements specific to your organization or local regulations, make sure to follow them accordingly.

10

Remember to handle the former employee's information with confidentiality and respect their privacy rights.

Who needs for former employees or?

01

Former employees may require various forms for different purposes, such as:

02

- Applying for unemployment benefits

03

- Requesting employment verification for future job applications

04

- Claiming pension or retirement benefits

05

- Addressing legal disputes or hearings related to their employment

06

- Reviewing their own employment history or performance evaluations

07

- Updating personal records with new contact information or emergency contacts

08

- Accessing any remaining employee benefits or stock options

09

- Seeking assistance from career counselors or job placement agencies

10

It is important to ensure that former employees have access to the necessary forms and documentation to fulfill their needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get for former employees or?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific for former employees or and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit for former employees or in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your for former employees or, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit for former employees or on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing for former employees or, you need to install and log in to the app.

What is for former employees or?

Form 1099-NEC is for former employees or contractors who were paid $600 or more during the tax year.

Who is required to file for former employees or?

Businesses or individuals who paid former employees or contractors $600 or more during the tax year are required to file Form 1099-NEC.

How to fill out for former employees or?

Form 1099-NEC should be filled out with the recipient's information, payment details, and the business's information before submitting it to the IRS.

What is the purpose of for former employees or?

The purpose of Form 1099-NEC is to report payments made to former employees or contractors so that they can report this income on their tax returns.

What information must be reported on for former employees or?

Form 1099-NEC must include the recipient's name, address, Social Security number or tax ID, payment amount, and any federal tax withheld.

Fill out your for former employees or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Former Employees Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.