MI Arbor Financial Credit Union Switch Kit Form 2016-2025 free printable template

Show details

SWITCH KIT FORM DIRECT DEPOSIT Date Whom It May Concern: I have switched financial institutions. Effective immediately, please switch my direct deposit to my new account as follows: Arbor Financial

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI Arbor Financial Credit Union Switch

Edit your MI Arbor Financial Credit Union Switch form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI Arbor Financial Credit Union Switch form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI Arbor Financial Credit Union Switch online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MI Arbor Financial Credit Union Switch. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

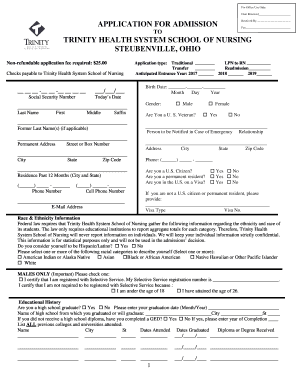

How to fill out MI Arbor Financial Credit Union Switch

How to fill out MI Arbor Financial Credit Union Switch Kit

01

Obtain the MI Arbor Financial Credit Union Switch Kit from their website or branch.

02

Read the instructions and terms carefully to understand the process.

03

Fill out the personal information section with your full name, address, and contact details.

04

Provide your current bank account information, including bank name and account numbers.

05

Specify the types of accounts you are switching (checking, savings, etc.).

06

Complete the authorization section to allow the transfer of funds.

07

If you have direct deposits, fill out the section for transferring those to your new account.

08

List any automatic payments linked to your current account and plan to redirect them.

09

Review all information for accuracy before submitting the Switch Kit.

10

Submit the completed Switch Kit to MI Arbor Financial Credit Union either online or at a branch.

Who needs MI Arbor Financial Credit Union Switch Kit?

01

Individuals currently banking with another financial institution who wish to switch to MI Arbor Financial Credit Union.

02

New members seeking to open an account and transfer funds from their existing bank.

03

People looking for better banking options and services offered by MI Arbor Financial Credit Union.

Fill

form

: Try Risk Free

People Also Ask about

What was the old name of addition financial?

Originally named Orange County Teachers' Federal Credit Union, our story began when 23 educators from Orange County got together to create a better financial alternative than what banks were offering.

How big is Arbor Financial Credit Union assets?

More than 40,000 people are Arbor Financial members. The credit union has over $600 million in assets.

Who is the CEO of Arbor Financial Credit Union?

Executive Summary. Based on our data team's research, Julie Blitchok is the Arbor Financial Credit Union's CEO.

What is the routing number 272481871?

Receive your paycheck through direct deposit and set up your electronic payments via your Arbor Financial Checking account. It's easy. All you need is: Our routing number - 272481871.

Are credit unions larger than banks?

Credit unions tend to offer fewer products than banks, especially in the commercial banking arena. Credit unions—which tend to be considerably smaller than banks—also typically offer fewer investment products and are often limited to checking and savings accounts as well as credit cards.

Who owns Robins Financial Credit Union?

As a member-owned, not-for-profit financial cooperative, each member has an ownership stake in the credit union, rather than shareholders like at a bank. Robins Financial Credit Union operates in ance with its vision to enhance the financial well-being of their members and community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my MI Arbor Financial Credit Union Switch in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your MI Arbor Financial Credit Union Switch as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send MI Arbor Financial Credit Union Switch to be eSigned by others?

Once you are ready to share your MI Arbor Financial Credit Union Switch, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I complete MI Arbor Financial Credit Union Switch on an Android device?

Use the pdfFiller mobile app to complete your MI Arbor Financial Credit Union Switch on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is MI Arbor Financial Credit Union Switch Kit?

The MI Arbor Financial Credit Union Switch Kit is a toolkit designed to help individuals transition their banking services to Arbor Financial Credit Union, including transferring direct deposits and automatic payments.

Who is required to file MI Arbor Financial Credit Union Switch Kit?

Individuals who wish to switch their banking services to Arbor Financial Credit Union are required to file the MI Arbor Financial Credit Union Switch Kit.

How to fill out MI Arbor Financial Credit Union Switch Kit?

To fill out the MI Arbor Financial Credit Union Switch Kit, download the kit from the Arbor Financial website, complete the necessary forms provided, including information about your old account and new Arbor account, and submit it as instructed.

What is the purpose of MI Arbor Financial Credit Union Switch Kit?

The purpose of the MI Arbor Financial Credit Union Switch Kit is to facilitate a smooth transition for customers switching from another bank or credit union to Arbor Financial, ensuring all financial services are updated accordingly.

What information must be reported on MI Arbor Financial Credit Union Switch Kit?

The MI Arbor Financial Credit Union Switch Kit must report information such as the account numbers of the old account, the new Arbor account information, details of direct deposits, automatic withdrawals, and any other relevant banking information.

Fill out your MI Arbor Financial Credit Union Switch online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI Arbor Financial Credit Union Switch is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.