Get the free - Accounting Services Ottawa - zakconsulting

Show details

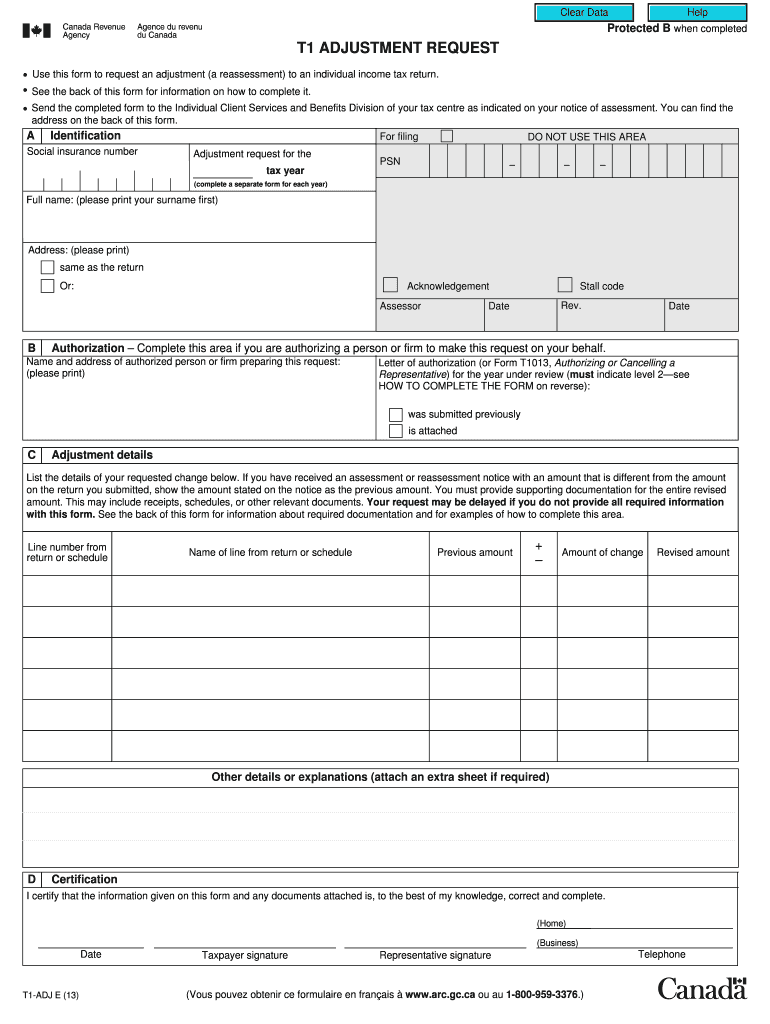

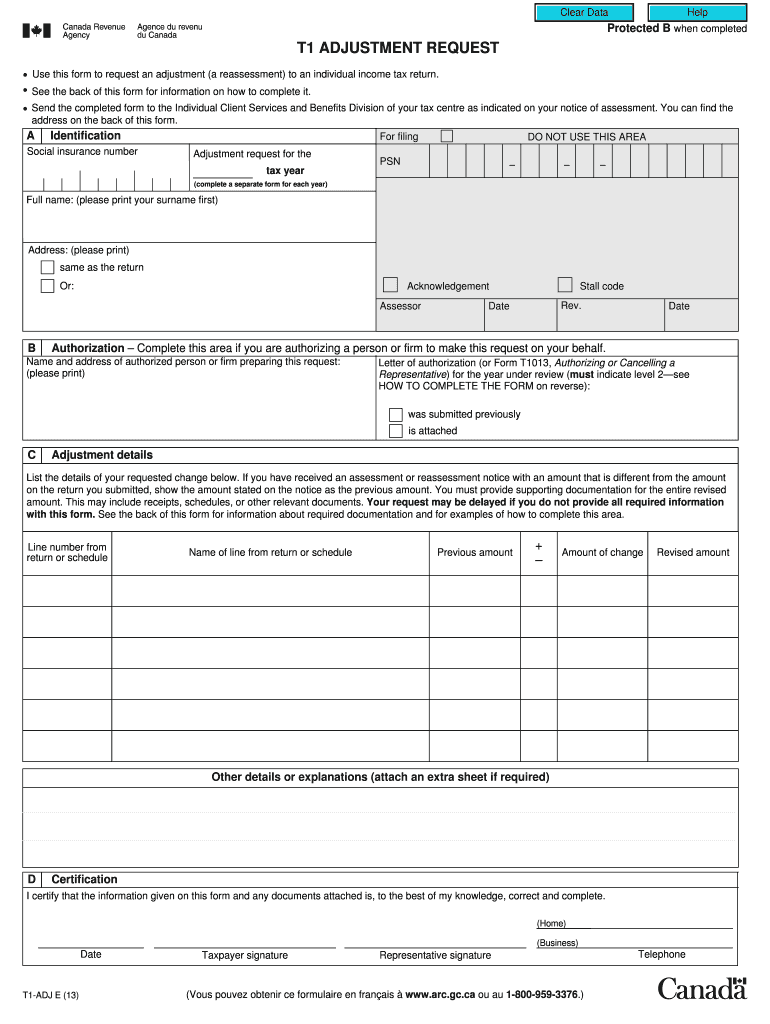

Clear Data Help Protected B when completed T1 ADJUSTMENT REQUEST Use this form to request an adjustment (a reassessment) to an individual income tax return. See the back of this form for information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting services ottawa

Edit your accounting services ottawa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting services ottawa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounting services ottawa online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit accounting services ottawa. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting services ottawa

How to fill out accounting services Ottawa:

01

Research and choose a reputable accounting firm in Ottawa that offers the services you need. Look for firms with experience and positive reviews from other clients.

02

Contact the accounting firm and inquire about their services. They may ask you for specific information about your business or financial situation to better understand your needs.

03

Schedule an initial consultation with the accounting firm. During this meeting, you will discuss your specific requirements, such as tax filings, bookkeeping, financial analysis, or auditing.

04

Provide the accounting firm with all necessary documents and information they require to begin their services. This may include bank statements, invoices, receipts, payroll records, and tax forms.

05

Work closely with the accounting firm to ensure that they have all the necessary information to accurately fill out the required accounting documents. Stay in regular communication with them throughout the process.

06

Review and approve the completed accounting documents before they are submitted to the relevant authorities. Take the time to carefully go through all the details to ensure accuracy.

07

Pay the accounting firm for their services based on their agreed-upon fee structure. Make sure to discuss payment terms and deadlines in advance to avoid any confusion or delays.

08

Continuously communicate with the accounting firm to keep them updated on any changes in your financial situation or requirements. This will help them provide ongoing support and ensure that your accounting needs are met.

Who needs accounting services Ottawa:

01

Small and medium-sized businesses: Accounting services in Ottawa are essential for businesses of all sizes. Whether it's bookkeeping, tax preparation, or financial analysis, professional accountants can help manage the financial aspects of running a business.

02

Startups and entrepreneurs: New businesses often lack the necessary accounting knowledge and expertise. By hiring accounting services in Ottawa, startups and entrepreneurs can ensure accurate financial records, tax compliance, and assistance with financial planning.

03

Individuals and families: Accounting services in Ottawa are not just for businesses. Individuals and families may require help with personal tax returns, financial planning, or estate planning. Accountants can provide valuable advice to optimize tax savings and manage personal finances effectively.

04

Non-profit organizations: Non-profit organizations in Ottawa also benefit from accounting services. These services can help ensure proper financial reporting, compliance with regulations, and transparency in financial matters.

05

Freelancers and self-employed professionals: Accounting services in Ottawa are crucial for individuals who work as freelancers or are self-employed. Professional accountants can assist with organizing financial records, preparing tax returns, and providing advice on managing business finances.

In conclusion, accounting services in Ottawa are essential for various individuals and entities, including small businesses, startups, individuals, non-profit organizations, and self-employed professionals. By outsourcing accounting services, they can receive expert financial assistance and ensure compliance with regulations and the optimization of financial operations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send accounting services ottawa for eSignature?

When you're ready to share your accounting services ottawa, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for the accounting services ottawa in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your accounting services ottawa in minutes.

Can I edit accounting services ottawa on an iOS device?

Create, modify, and share accounting services ottawa using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is accounting services ottawa?

Accounting services Ottawa refers to the financial and bookkeeping services provided by professional accountants in Ottawa to individuals and businesses.

Who is required to file accounting services ottawa?

Individuals and businesses in Ottawa who need assistance with their financial records and reporting are required to file accounting services Ottawa.

How to fill out accounting services ottawa?

To fill out accounting services Ottawa, individuals and businesses can hire professional accountants who will ensure accurate recording of financial transactions and compliance with relevant regulations.

What is the purpose of accounting services ottawa?

The purpose of accounting services Ottawa is to help individuals and businesses manage their finances effectively, make informed business decisions, and comply with tax regulations.

What information must be reported on accounting services ottawa?

Accounting services Ottawa typically include the reporting of income, expenses, assets, liabilities, and other financial information relevant to the individual or business.

Fill out your accounting services ottawa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting Services Ottawa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.