CA CALSTRS MS0002 2018 free printable template

Show details

IMPORTANT FACTS This form remains in effect until either you submit another valid Recipient Designation form or your membership in CalSTRS is terminated by a refund of your accumulated contributions. RECIPIENT DESIGNATION INSTRUCTIONS REV 01/18 PAGE 1 OF 2 Print clearly in dark ink or type all information requested. Initial all corrections on the form. Check the appropriate box to identify your CalSTRS membership status. To be valid this form must be received and accepted by CalSTRS before...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CALSTRS MS0002

Edit your CA CALSTRS MS0002 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CALSTRS MS0002 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA CALSTRS MS0002 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA CALSTRS MS0002. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CALSTRS MS0002 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CALSTRS MS0002

How to fill out CA CALSTRS MS0002

01

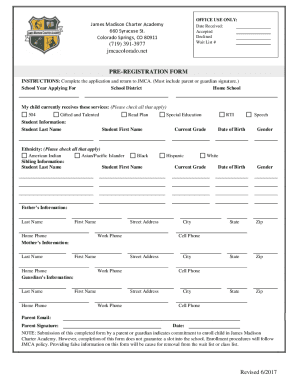

Obtain the CA CALSTRS MS0002 form from the appropriate California State Teachers' Retirement System (CalSTRS) website or office.

02

Fill in your personal information, including your name, Social Security number, and contact details in the designated fields.

03

Indicate your employment status by checking the appropriate boxes provided on the form.

04

Provide details about your employment history, including the school district or agency name, start and end dates, and position held.

05

Review the form for accuracy and make sure all required fields are completed.

06

Sign and date the form at the bottom where indicated.

07

Submit the completed form as instructed, either by mailing it to CalSTRS or delivering it in person.

Who needs CA CALSTRS MS0002?

01

Individuals who have been employed as California educators and wish to apply for retirement benefits.

02

Any member of the California State Teachers' Retirement System who needs to report service credit for their employment.

03

Employees transitioning from one CalSTRS-covered position to another may also need to fill out this form.

Fill

form

: Try Risk Free

People Also Ask about

Do I need a beneficiary designation?

Designated beneficiaries are typically only required for assets such as life insurance, annuities, and retirement savings accounts (IRAs, 401Ks, etc.) A Will encompasses all of your assets, including any real estate property, family heirlooms, checking accounts, and any sentimental possessions.

How do I access my CalSTRS account?

Log in to myCalSTRS to access all of your personal CalSTRS benefit information, including all benefit payment statements from your direct deposit account.

What is the final compensation for CalSTRS?

If you are a member under CalSTRS 2% at 62, you are not eligible for the one-year final compensation enhancement. Your final compensation is based on your highest 36 consecutive months of creditable compensation.Benefit enhancements. If you earned:You will receive monthly:30 years$20031 years$30032 or more years$400

What is the beneficiary designation?

Beneficiary designations allow you to transfer assets directly to individuals, regardless of the terms of your will. Beneficiary designations are often made when a financial account, retirement account, or life insurance policy is established.

What is a beneficiary designation form?

The beneficiary designation forms allow you to name primary and secondary beneficiaries. Your “primary beneficiaries” are the first people or entities that you want to receive your benefit after you die.

Does everyone get the $255 death benefit from Social Security?

Only the widow, widower or child of a Social Security beneficiary can collect the $255 death benefit, also known as a lump-sum death payment. Priority goes to a surviving spouse if any of the following apply: The widow or widower was living with the deceased at the time of death.

Why does Social Security only pay $255 one-time death benefit?

The cap of $255 on the LSDB was introduced by law in 1954. Two years prior to this legislative change, the maximum PIA payable under Social Security had reached the $85 level. Thus 3 X the PIA for these maximum cases would yield a LSDB of $255.

Who gets the one-time death benefit?

Do we pay death benefits? A one-time lump-sum death payment of $255 can be paid to the surviving spouse if they were living with the deceased. If living apart, they were receiving certain Social Security benefits on the deceased's record.

Does CalSTRS have a death benefit?

CalSTRS pays a one-time death benefit payment of $6,903 to your named recipient or recipients if you're a retired member. The amount of the payment may be adjusted periodically by the Teachers' Retirement Board.

Does STRS have survivor benefits?

The Defined Benefit Program provides benefits to your survivors whether your death occurs before or after retirement. There are two types of coverage: Coverage A (family allowance) and Coverage B (survivor benefit).

Can you print Social Security award letter online?

You can request one online by using your my Social Security account, which will allow you to immediately view, print, and save a copy of the letter.

How do I get my pension award letter?

If you need to replace your original award letter, you can request a copy by calling Social Security at 800-772-1213 or visiting your local SSA office.

How much is the one-time death benefit?

Pension Sense blog | September 28, 2022 | Barbara Zumwalt With this increase, the payment following the death of a retired member is $6,903 (up from $6,480). For a death prior to retirement, the payment for Coverage A members is also $6,903, while the payment for Coverage B members is $27,612 (up from $25,920).

Who gets a pension death benefit?

The beneficiary is the person who will receive your pension when you die. Much like naming a beneficiary on a life insurance policy, you can name one or more individuals to receive the benefits of your pension.

How do I get an award letter from CalSTRS?

Your letter will be accessible only through your secure online myCalSTRS account. It will not be mailed or faxed by us to you or a third party.

Why beneficiary designation is important?

Designating one's beneficiaries and reviewing them at frequent intervals is important, as these designations are the mechanism for distributing the policy's federal income tax-free death benefit under current tax law.

Does CalSTRS have survivor benefits?

Under Coverage A, if you die before retirement, CalSTRS pays a $6,903 one-time death benefit to your designated recipient or recipients. This amount is adjusted periodically by the Teachers' Retirement Board.

What is a one-time death benefit?

The one-time death benefit is a separate designation from the election of an option beneficiary at retirement. If you elect an option, your option beneficiary will receive a monthly lifetime benefit when you die, while your one-time death benefit recipient will receive a one-time, lump-sum payment after your death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CA CALSTRS MS0002 online?

Completing and signing CA CALSTRS MS0002 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I edit CA CALSTRS MS0002 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share CA CALSTRS MS0002 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I complete CA CALSTRS MS0002 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your CA CALSTRS MS0002 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is CA CALSTRS MS0002?

CA CALSTRS MS0002 is a form used for reporting salary information for members of the California State Teachers' Retirement System (CalSTRS).

Who is required to file CA CALSTRS MS0002?

Employers who have employees participating in the California State Teachers' Retirement System are required to file CA CALSTRS MS0002.

How to fill out CA CALSTRS MS0002?

To fill out CA CALSTRS MS0002, employers must provide accurate salary information for each employee, ensuring all applicable fields are completed according to the instructions provided by CalSTRS.

What is the purpose of CA CALSTRS MS0002?

The purpose of CA CALSTRS MS0002 is to report member salaries to ensure proper calculations for retirement benefits and contributions.

What information must be reported on CA CALSTRS MS0002?

The information that must be reported on CA CALSTRS MS0002 includes employee name, social security number, position, salary amount, and contributions to CalSTRS.

Fill out your CA CALSTRS MS0002 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CALSTRS ms0002 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.