Get the free whole life policy loan request - Texas Life Insurance Company

Show details

WHOLE LIFE POLICY LOAN REQUEST

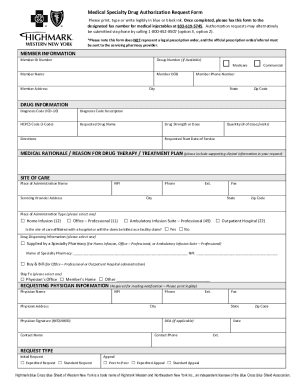

Policy Number:

Insured Name:INSTRUCTIONS: Use this form to request a loan on your Whole Life policy. This form must be completed in its entirety,

dated, and signed by

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign whole life policy loan

Edit your whole life policy loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your whole life policy loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit whole life policy loan online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit whole life policy loan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out whole life policy loan

How to fill out whole life policy loan

01

To fill out a whole life policy loan, follow these steps:

02

Contact your insurance provider or agent to inquire about the policy loan process.

03

Request the necessary loan application forms and review them carefully.

04

Fill out the loan application form accurately, providing all the required personal and policy information.

05

Determine the amount of loan you need and indicate it on the application form.

06

Attach any supporting documents required by the insurance provider, such as proof of identity or policy ownership.

07

Review the completed application form and supporting documents to ensure everything is in order.

08

Submit the application form and supporting documents to your insurance provider or agent.

09

Wait for the loan application to be processed and approved by the insurance provider.

10

Once approved, review the loan terms and conditions provided by the insurance provider.

11

Sign any necessary loan agreements or documents as required by the insurance provider.

12

Receive the loan amount through the chosen disbursement method, such as a direct deposit into your bank account.

13

Repay the loan according to the repayment schedule provided by the insurance provider, including any interest or fees.

14

Keep track of your loan payments and ensure they are made on time to avoid any potential consequences.

15

If you have any questions or concerns regarding the loan, contact your insurance provider or agent for assistance.

Who needs whole life policy loan?

01

Individuals who have a whole life insurance policy and require funds for various purposes may need a whole life policy loan.

02

Some common reasons why someone might need a whole life policy loan include:

03

- Emergency expenses: When faced with unexpected financial needs, a policy loan can provide quick access to funds without the need for a credit check.

04

- Debt consolidation: Consolidating high-interest debts into a single loan at a potentially lower interest rate can help individuals manage their finances more effectively.

05

- Education expenses: Policy loans can be used to cover educational costs, such as tuition fees or student loans.

06

- Business funding: Entrepreneurs or small business owners may consider using a policy loan as a source of capital for their business endeavors.

07

- Home improvements: Funding home renovation or repairs through a policy loan might be a cost-effective option.

08

It's important to note that taking a policy loan will reduce the available death benefit, and borrowers should consider the potential impact on their beneficiaries and long-term financial plans. Consulting with a financial advisor or insurance professional is recommended to understand the implications of taking a whole life policy loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my whole life policy loan directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your whole life policy loan as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Where do I find whole life policy loan?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the whole life policy loan in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit whole life policy loan on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share whole life policy loan on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is whole life policy loan?

A whole life policy loan is a loan taken against the cash value of a whole life insurance policy.

Who is required to file whole life policy loan?

The policyholder is required to file for a whole life policy loan.

How to fill out whole life policy loan?

To fill out a whole life policy loan, the policyholder must contact the insurance company and request the loan form. They will need to provide personal information, policy details, and the amount of the loan requested.

What is the purpose of whole life policy loan?

The purpose of a whole life policy loan is to provide the policyholder with access to cash from the accumulated cash value of the policy, without having to surrender the policy.

What information must be reported on whole life policy loan?

The information that must be reported on a whole life policy loan includes the policyholder's personal information, policy details, loan amount, interest rate, and repayment terms.

Fill out your whole life policy loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Whole Life Policy Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.