Get the free Home Buyers Plan (HBP) - Regina Mortgage Broker

Show details

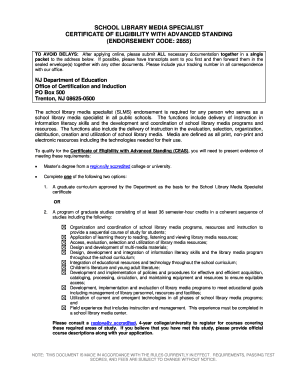

Home Buyers Plan (HBP) Includes Form T1036 RC4135(E) Rev.11 Before you start Is this guide for you? Use this guide if you want information about the rules that apply to the Home Buyers Plan (HBP).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home buyers plan hbp

Edit your home buyers plan hbp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home buyers plan hbp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home buyers plan hbp online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit home buyers plan hbp. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home buyers plan hbp

How to Fill Out Home Buyers Plan (HBP):

01

Determine eligibility: Before filling out the Home Buyers Plan (HBP) application, ensure that you meet the eligibility criteria. You must be considered a first-time homebuyer, which means you have not owned a home in the past four years. Additionally, you should have a written agreement to buy or build a qualifying home.

02

Obtain Form T1036: To apply for the HBP, you need to complete Form T1036, which is available on the Canada Revenue Agency (CRA) website. Download the form or request a copy from your local tax office.

03

Gather necessary information: Before starting to fill out the form, collect all the required information. This includes your social insurance number (SIN), the RRSP issuer's account number, and the amount you wish to withdraw from your RRSP.

04

Complete Section 1: Begin by filling out Section 1 of Form T1036. Provide your personal information, including your name, address, and SIN. Double-check the accuracy of the information entered to avoid delays or complications.

05

Complete Section 2: In Section 2, you need to enter details about your RRSP issuer, including their name, address, and account number. Ensure that the information matches your RRSP account exactly.

06

Calculate the withdrawal amount: Determine the exact amount you want to withdraw from your RRSP under the HBP. Remember that the maximum amount allowed is $35,000 per person. If you're purchasing the home with a spouse or partner, you can collectively withdraw up to $70,000.

07

Complete Section 3: In Section 3, you will indicate the total withdrawal amount and the repayment period you choose. The default repayment period is 15 years, but you can opt for a shorter repayment period by entering the desired number of years.

08

Sign and date the form: Once you have filled out all the necessary sections of Form T1036, review the information for accuracy. Sign and date the form to certify the accuracy of the information provided.

09

Submit the form to your RRSP issuer: Submit the completed Form T1036 to your RRSP issuer. They will process your request and withdraw the approved amount from your RRSP account. Ensure that you maintain a copy of the form for your records.

Who Needs Home Buyers Plan (HBP)?

01

First-time homebuyers: The HBP is specifically designed for individuals who are purchasing their first home. If you haven't owned a home within the last four years, you qualify as a first-time homebuyer and may benefit from the HBP.

02

Individuals with RRSP savings: The HBP allows individuals to withdraw funds from their Registered Retirement Savings Plan (RRSP) to finance the purchase of a home. If you have accumulated RRSP savings and want to utilize them for a down payment or other home-related expenses, the HBP can be a valuable option.

03

Individuals interested in tax savings: Participating in the HBP can provide tax advantages. By withdrawing funds from your RRSP under the HBP, you can defer paying tax on that amount until it is repaid or included in your income. This can result in immediate tax savings for individuals in certain financial situations.

Overall, the HBP is suitable for individuals who meet the eligibility criteria and want to utilize their RRSP savings to facilitate homeownership while potentially benefiting from tax advantages.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is home buyers plan hbp?

The Home Buyers' Plan (HBP) is a program that allows first-time home buyers to withdraw up to $35,000 from their registered retirement savings plan (RRSP) to purchase or build a home.

Who is required to file home buyers plan hbp?

Individuals who qualify as first-time home buyers and have a registered retirement savings plan (RRSP) are required to file for the Home Buyers' Plan (HBP).

How to fill out home buyers plan hbp?

To fill out the Home Buyers' Plan (HBP), individuals must complete Form T1036 and submit it to the Canada Revenue Agency (CRA) along with their RRSP withdrawal request form.

What is the purpose of home buyers plan hbp?

The purpose of the Home Buyers' Plan (HBP) is to assist first-time home buyers in purchasing or building a home by allowing them to withdraw funds from their RRSP without incurring tax penalties.

What information must be reported on home buyers plan hbp?

The Home Buyers' Plan (HBP) requires information such as the individual's RRSP account details, the amount to be withdrawn, and the home purchase or construction details to be reported.

How can I edit home buyers plan hbp from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your home buyers plan hbp into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the home buyers plan hbp in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your home buyers plan hbp in minutes.

Can I edit home buyers plan hbp on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share home buyers plan hbp on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your home buyers plan hbp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Buyers Plan Hbp is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.