Get the free Livelihood Protection Policy

Show details

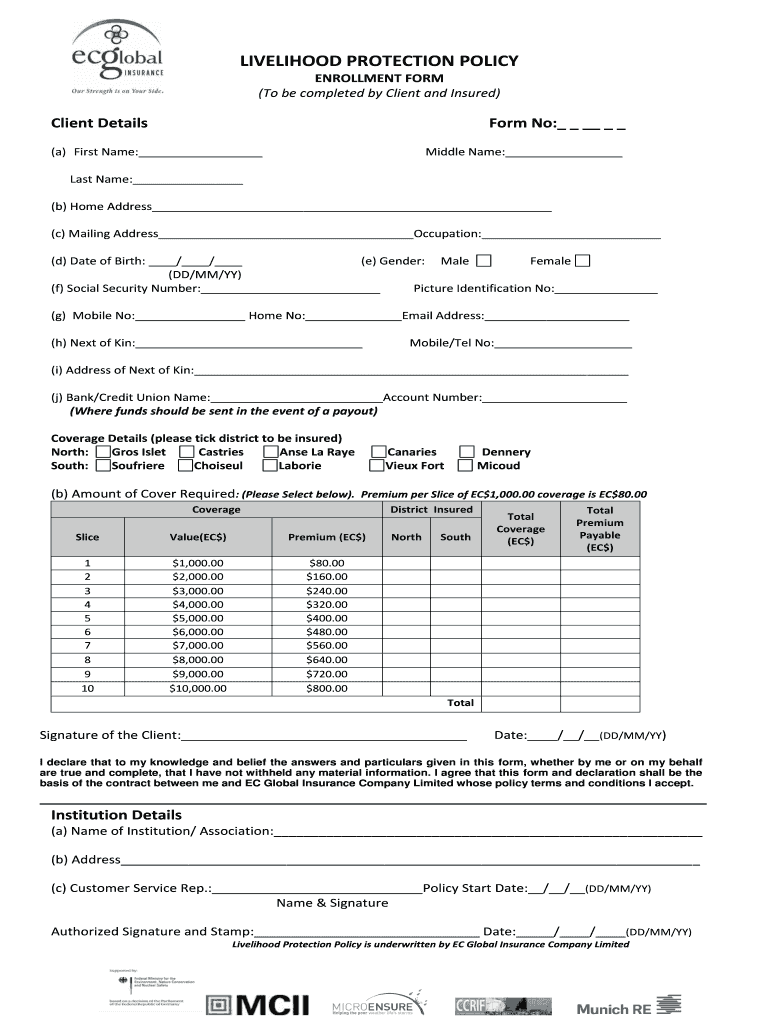

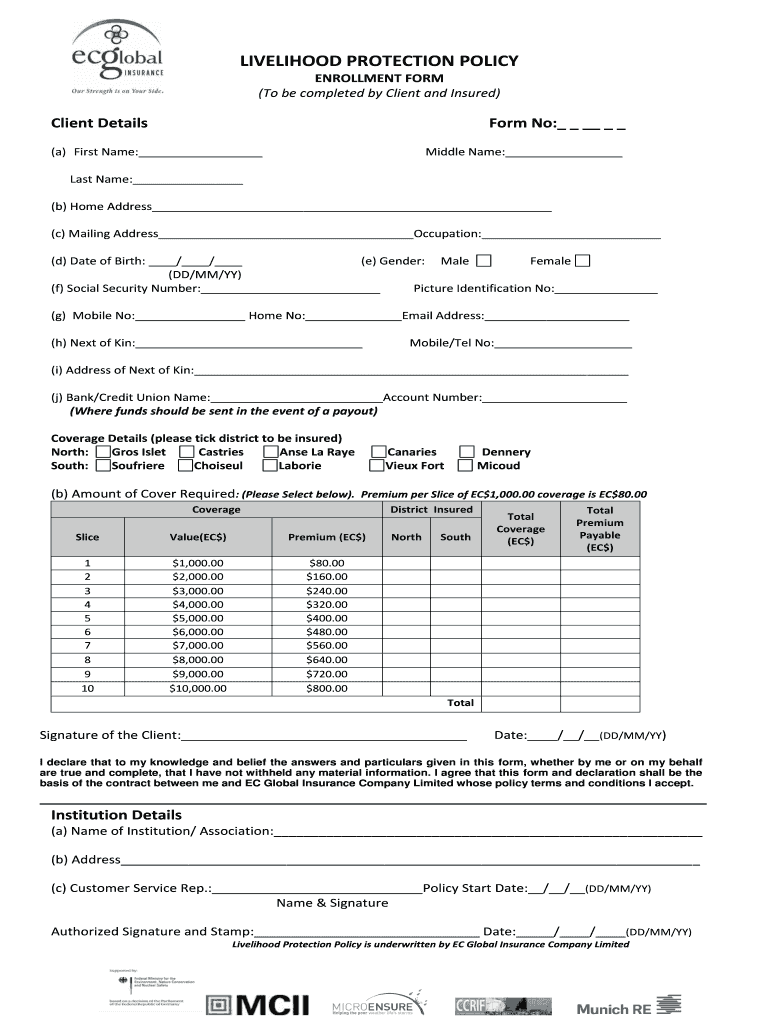

LIVELIHOOD PROTECTION POLICY ENROLLMENT FORM (To be completed by Client and Insured)Client DetailsForm No: (a) First Name: Middle Name: Last Name: (b) Home Address (c) Mailing Address Occupation:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign livelihood protection policy

Edit your livelihood protection policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your livelihood protection policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing livelihood protection policy online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit livelihood protection policy. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out livelihood protection policy

How to fill out livelihood protection policy

01

Gather all the necessary documents that may be required for filling out the livelihood protection policy, such as proof of income, identification documents, and any supporting documents related to your livelihood.

02

Start by reading the policy carefully to understand the coverage, terms, and conditions. Pay attention to any specific requirements or exclusions mentioned in the policy.

03

Fill out the personal information section accurately, providing details such as your full name, address, contact number, and email address.

04

Provide the required information regarding your livelihood, including the type of occupation or business you are engaged in, the annual income or revenue generated, and any other relevant details.

05

Carefully review the coverage options available and choose the one that best suits your needs. Consider factors such as the sum insured, premium amount, and the extent of coverage offered for various perils or risks.

06

Fill out the beneficiary details section, specifying the individuals or entities who would receive the benefits in case of any unfortunate events affecting your livelihood.

07

Review all the entered information thoroughly to ensure accuracy and completeness. Make any necessary corrections or additions before submitting the policy.

08

Carefully read and understand the declaration and terms and conditions section. Ensure that you agree to abide by the terms mentioned in the policy.

09

Sign and date the policy form, indicating your consent and acceptance of the terms and conditions.

10

Submit the duly filled and signed livelihood protection policy form along with the necessary supporting documents to the designated insurance provider or agent.

11

Keep a copy of the filled policy form and all supporting documents for your records. It is essential to have documentation in case of any future claims or queries.

Who needs livelihood protection policy?

01

Anyone who relies on a particular livelihood for income or financial stability can benefit from having a livelihood protection policy.

02

Small business owners, self-employed individuals, freelancers, and entrepreneurs who heavily depend on their livelihoods should consider obtaining this policy.

03

Individuals working in high-risk occupations or industries with potential hazards or uncertainties, such as construction, mining, agriculture, or manufacturing, can benefit from livelihood protection coverage.

04

People who lack alternative sources of income or financial support in case of a significant disruption or loss of their livelihood should seriously consider having this policy.

05

Individuals with financial dependents, such as family members or employees, who rely on their livelihood for sustenance and support, should prioritize obtaining this policy for their security and well-being.

06

It is crucial for individuals or businesses that have liabilities or financial obligations, such as loans, debts, or legal obligations, related to their livelihood to have protection in place to minimize potential risks or losses.

07

Ultimately, anyone who values financial stability, wishes to mitigate risks, and secure their livelihood against unforeseen events should consider getting a livelihood protection policy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit livelihood protection policy from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your livelihood protection policy into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send livelihood protection policy for eSignature?

Once your livelihood protection policy is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I complete livelihood protection policy online?

Easy online livelihood protection policy completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

What is livelihood protection policy?

Livelihood protection policy is a policy that aims to protect the means of living or income sources of individuals or groups.

Who is required to file livelihood protection policy?

Individuals or groups who are at risk of losing their livelihoods are required to file a livelihood protection policy.

How to fill out livelihood protection policy?

To fill out a livelihood protection policy, one must provide detailed information about their current livelihood sources, potential risks, and proposed measures for protection.

What is the purpose of livelihood protection policy?

The purpose of livelihood protection policy is to safeguard individuals or groups from losing their primary sources of income.

What information must be reported on livelihood protection policy?

Information such as current livelihood sources, possible threats to income, and strategies for protecting livelihoods must be reported on a livelihood protection policy.

Fill out your livelihood protection policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Livelihood Protection Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.