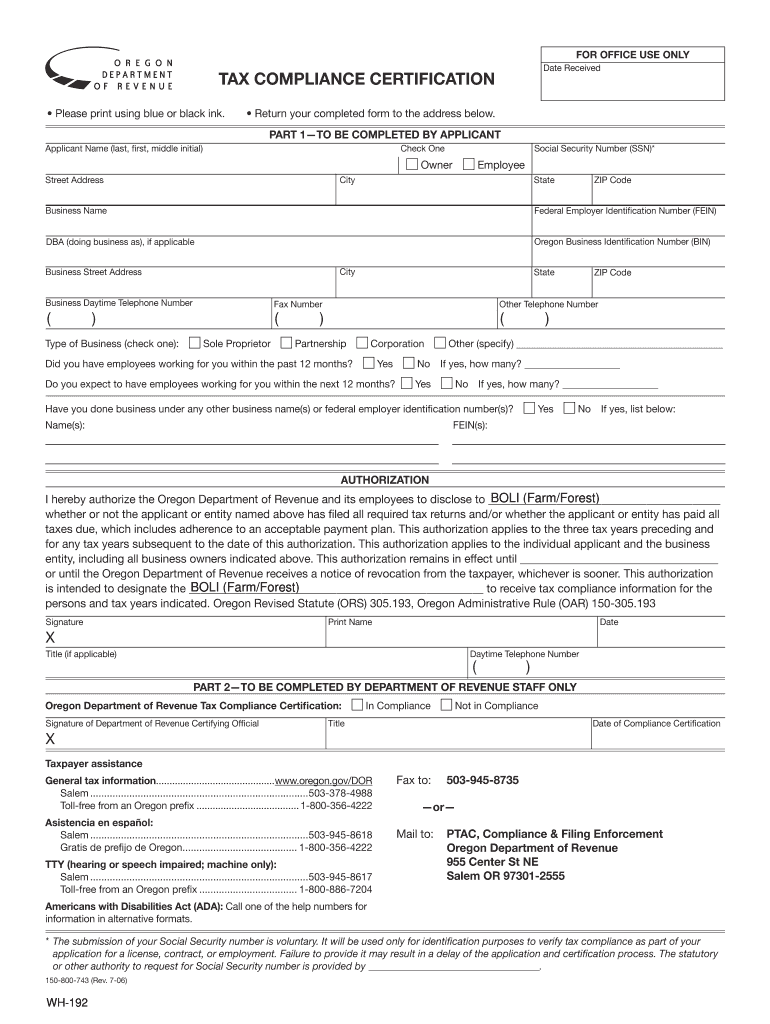

OR DoR 150-800-743 2006 free printable template

Get, Create, Make and Sign OR DoR 150-800-743

How to edit OR DoR 150-800-743 online

Uncompromising security for your PDF editing and eSignature needs

OR DoR 150-800-743 Form Versions

How to fill out OR DoR 150-800-743

How to fill out OR DoR 150-800-743

Who needs OR DoR 150-800-743?

Instructions and Help about OR DoR 150-800-743

So what is the kicker in 1980 voters approved a law to return or kick excess tax money back to the people here's how it works at the start of a budget cycle state economists estimate how much tax revenue they expect to collect over the next two years if in the end it turns out they low-balled it by more than two percent the entire surplus is returned to the voters in the form of a tax rebate sound complicated it is Oregon is the only state in the nation to have such a system so how much are we talking in May 2015 economists predicted the kicker would amount to 473 million dollars a median payout to taxpayers of 144 dollars but for any given person or household the amount you get back depends on how much income tax you paid in the first place the kicker is a flat return percentage of your income taxes meaning rich people who paid the most taxes will also get the most back for example the top 1 of Oregonians could get more than 5000 from their 2014 tax returns while the bottom 20 could get as little as 11 dollars how much will you get check out our kicker calculator on Oregon live com slash politics starting Wednesday morning to find out

People Also Ask about

What is the Oregon partnership tax rate?

Why do I owe state taxes Oregon?

What is the minimum tax for a partnership in Oregon?

What is the Oregon excise tax?

What is the tax rate on partnership income?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit OR DoR 150-800-743 from Google Drive?

How can I send OR DoR 150-800-743 to be eSigned by others?

How do I make edits in OR DoR 150-800-743 without leaving Chrome?

What is OR DoR 150-800-743?

Who is required to file OR DoR 150-800-743?

How to fill out OR DoR 150-800-743?

What is the purpose of OR DoR 150-800-743?

What information must be reported on OR DoR 150-800-743?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.