Get the free wr1 form

Show details

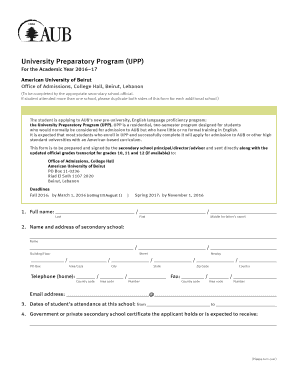

Form WR1 This form should be filled in English Block Letters - Please see instructions overleaf before filling the form. Employees Provident Fund MEMBER REGISTRATION FORM FOR ONLINE EPF ACCOUNT ENQUIRY FACILITY Employee s Full Name as Appearing in the National Identity Card NIC Attach a copy of the NIC certified by Name with Initials the Current Employer Initials Last Name D NIC No M Y Date of Issue Date of Birth Sex Male Female 6. Instructions to fill the Form WR1 Upon registration at the...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign wr1 form

Edit your wr1 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wr1 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wr1 form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit wr1 form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wr1 form

How to fill out the WR1 form:

01

Start by gathering all the necessary information. You will need to have the employee's full name, address, Social Security number, and employment start date.

02

Fill in the employee's personal information in the designated fields on the WR1 form. Double-check for any errors or misspellings to ensure accuracy.

03

Next, indicate the type of employment being reported on the form. This can include full-time, part-time, temporary, or seasonal employment.

04

Provide the employee's wage information. Include the hourly rate, weekly salary, or any other compensation details as required. Make sure to accurately report the amount earned by the employee.

05

Calculate any deductions that need to be made. This can include federal and state taxes, social security contributions, or any other applicable deductions. Ensure that the deductions are accurately calculated and reflected on the form.

06

If applicable, indicate any overtime or bonus payments made to the employee during the reporting period. These should be listed separately from regular wages.

07

Review the completed WR1 form for any errors or omissions. Double-check all the information provided to ensure its accuracy and completeness.

08

Once you are satisfied with the accuracy of the form, sign and date it. Make sure to indicate your position or title next to your signature.

Who needs the WR1 form?

01

Employers are required to fill out the WR1 form. This form serves as a wage report and must be submitted to the relevant tax authorities.

02

The WR1 form is used to report wage information to ensure accurate tax calculations, payment of social security contributions, and compliance with employment regulations.

03

Employers of all types, including businesses, nonprofit organizations, government entities, and household employers, need to fill out the WR1 form for their employees.

04

It is essential to note that the specific requirements for filing the WR1 form may vary depending on the jurisdiction and the applicable tax laws. Therefore, it is recommended to consult local tax authorities or seek professional advice to ensure compliance with the regulations in your area.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send wr1 form for eSignature?

Once your wr1 form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit wr1 form online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your wr1 form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit wr1 form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing wr1 form right away.

What is epf wr1 form?

The EPF WR1 form is a document required for the Employees' Provident Fund (EPF) in Malaysia, used for reporting employee contributions and other related information.

Who is required to file epf wr1 form?

Employers in Malaysia who have employees that are contributing to the Employees' Provident Fund (EPF) are required to file the EPF WR1 form.

How to fill out epf wr1 form?

To fill out the EPF WR1 form, employers need to provide details such as employee information, contribution amounts, and submit it along with the required payment to the EPF.

What is the purpose of epf wr1 form?

The purpose of the EPF WR1 form is to ensure accurate reporting of employee contributions to the Employee Provident Fund, facilitating proper management of retirement savings.

What information must be reported on epf wr1 form?

The information that must be reported on the EPF WR1 form includes employee names, identification numbers, salary details, and the respective contributions made to the EPF.

Fill out your wr1 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

wr1 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.