Get the free THE ASSAM ENTRY TAX RULES, 2008 FORM ET-2 Certificate of ... - tax assam gov

Show details

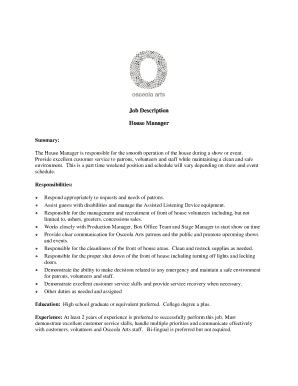

THE ASSAM ENTRY TAX RULES, 2008 FORM ET-2 Certificate of Registration See Rule 3(3) Registration Certificate No. Office of issue Circle : This is to certify that.....................................................(name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign the assam entry tax

Edit your the assam entry tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your the assam entry tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit the assam entry tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit the assam entry tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out the assam entry tax

How to fill out the Assam entry tax:

01

Determine if you are liable for the Assam entry tax. The tax is applicable to individuals or businesses bringing goods into the state of Assam for commercial purposes.

02

Collect all necessary information and documentation. You will need details about the goods being transported, such as their description, quantity, value, and origin. Additionally, you will need to provide details about the consignor (sender) and consignee (receiver).

03

Obtain the Assam entry tax form. You can either download it from the official website of the Assam government or obtain a physical copy from the designated authorities.

04

Fill in the required information on the form. Make sure to provide accurate and complete details to avoid any complications or penalties. Double-check all the information before submitting the form.

05

Calculate the entry tax payable. The tax rate varies based on the nature and value of the goods being brought into Assam. Refer to the Assam entry tax rules or consult with the tax authorities to determine the applicable rate and calculate the tax amount.

06

Pay the entry tax. You can make the payment online or offline, depending on the available options. Follow the guidelines provided by the Assam government to ensure a successful transaction.

07

Submit the completed form and payment receipt to the designated authorities. Ensure that all required documents are attached and that you have retained copies for your records.

Who needs the Assam entry tax?

01

Businesses engaged in inter-state trade: If you are involved in trading goods between Assam and other states, the Assam entry tax applies to your commercial transactions.

02

Importers/exporters: Individuals or companies importing goods into Assam or exporting goods from Assam are required to pay the entry tax.

03

Transporters: Transport companies or individuals responsible for moving goods into Assam on behalf of others need to comply with the Assam entry tax regulations.

It is important to consult the official guidelines provided by the Assam government or seek professional advice to ensure compliance with the specific requirements and obligations related to the Assam entry tax.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit the assam entry tax from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your the assam entry tax into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make changes in the assam entry tax?

The editing procedure is simple with pdfFiller. Open your the assam entry tax in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit the assam entry tax on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share the assam entry tax on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your the assam entry tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

The Assam Entry Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.