Get the free ALABAMA FAMILY TRUST

Show details

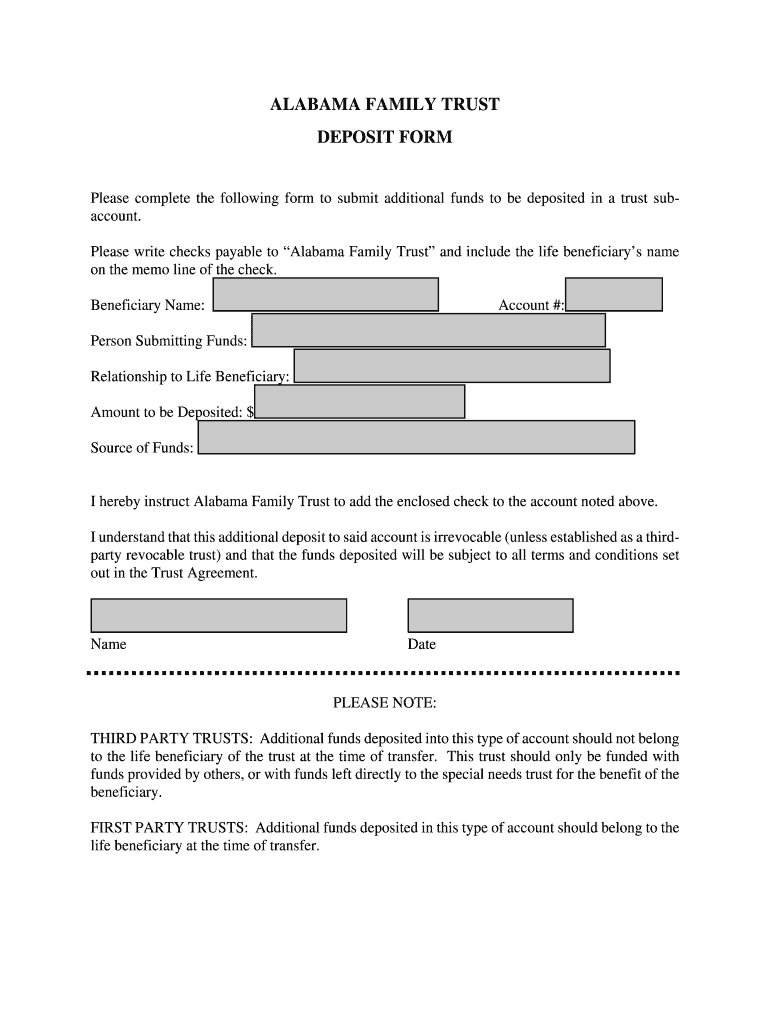

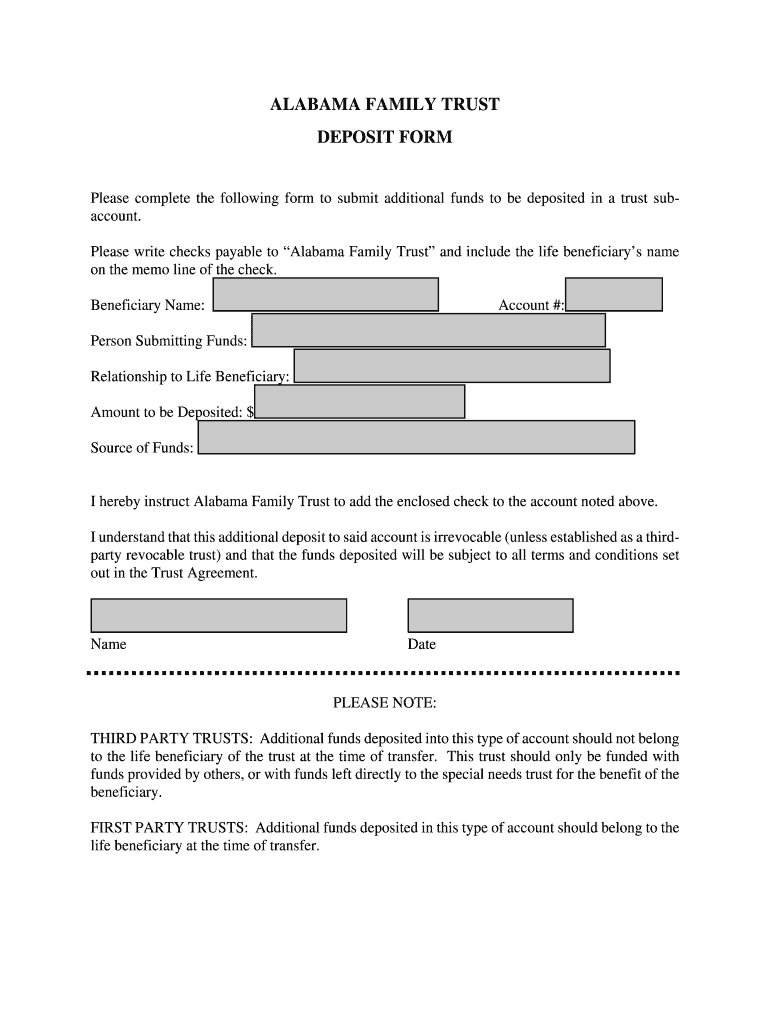

ALABAMA FAMILY TRUST DEPOSIT Formulas complete the following form to submit additional funds to be deposited in a trust subaccount. Please write checks payable to Alabama Family Trust and include

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign alabama family trust

Edit your alabama family trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your alabama family trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit alabama family trust online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit alabama family trust. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alabama family trust

How to fill out alabama family trust

01

To fill out an Alabama family trust, follow these steps:

02

Begin by gathering all necessary information, including the names and contact details of both the grantor and the trustee.

03

Determine the purpose and objectives of the trust, as well as the assets that will be included in the trust.

04

Consult with an attorney specializing in estate planning or trusts to ensure compliance with Alabama laws and to draft the trust document.

05

Provide detailed instructions on how the trust assets should be managed and distributed, including any specific conditions or restrictions.

06

Specify the beneficiaries of the trust and their respective shares or interests in the trust assets.

07

Consider appointing a successor trustee to manage the trust in case the original trustee is unable or unwilling to fulfill their duties.

08

Review and finalize the trust document, making sure all necessary provisions are included and accurately reflect your intentions.

09

Execute the trust document by signing it in the presence of a notary public or witnesses, as required by Alabama law.

10

Safely store the executed trust document and provide copies to relevant parties, such as the trustee and beneficiaries.

11

Regularly review and update the trust as circumstances change or new assets need to be added or removed.

12

Remember, it is always wise to consult with a qualified attorney for personalized guidance in setting up an Alabama family trust.

Who needs alabama family trust?

01

Alabama family trust may be beneficial for the following individuals or families:

02

- Those who wish to protect their assets and provide for their family members and loved ones after their death.

03

- Individuals who want to minimize estate taxes and avoid probate.

04

- Those who have minor children or dependents and want to ensure their financial security and proper management of assets.

05

- Families with complex financial situations, such as owning multiple properties or businesses, and requiring careful asset management and distribution.

06

- Individuals with special needs family members who require ongoing financial support and care.

07

- Those who wish to maintain privacy regarding their assets and avoid public disclosure through the probate process.

08

It is important to note that the suitability of an Alabama family trust will depend on individual circumstances, and consulting with a qualified attorney is recommended to determine if it is the right option for your specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my alabama family trust in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your alabama family trust and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I send alabama family trust for eSignature?

When your alabama family trust is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I edit alabama family trust on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing alabama family trust, you can start right away.

What is alabama family trust?

Alabama family trust is a legal arrangement where a trustee holds and manages assets on behalf of beneficiaries, typically family members.

Who is required to file alabama family trust?

The trustee of the alabama family trust is responsible for filing the necessary paperwork and tax returns.

How to fill out alabama family trust?

To fill out an alabama family trust, one must gather all relevant financial information, complete the required forms, and submit them to the appropriate authorities.

What is the purpose of alabama family trust?

The purpose of an alabama family trust is to protect and manage assets for the benefit of family members, provide financial security, and possibly reduce tax liabilities.

What information must be reported on alabama family trust?

Information such as income, expenses, assets, and distributions must be reported on an alabama family trust.

Fill out your alabama family trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Alabama Family Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.