How do I update my TCC?

TCC does not have an upgrade feature. Upgrading TCC involves installing the newer TCC, moving certain files from the existing TCC installation, and performing some other configuration tasks. TCC is normally backwards compatible.

How do I get a transmitter control code?

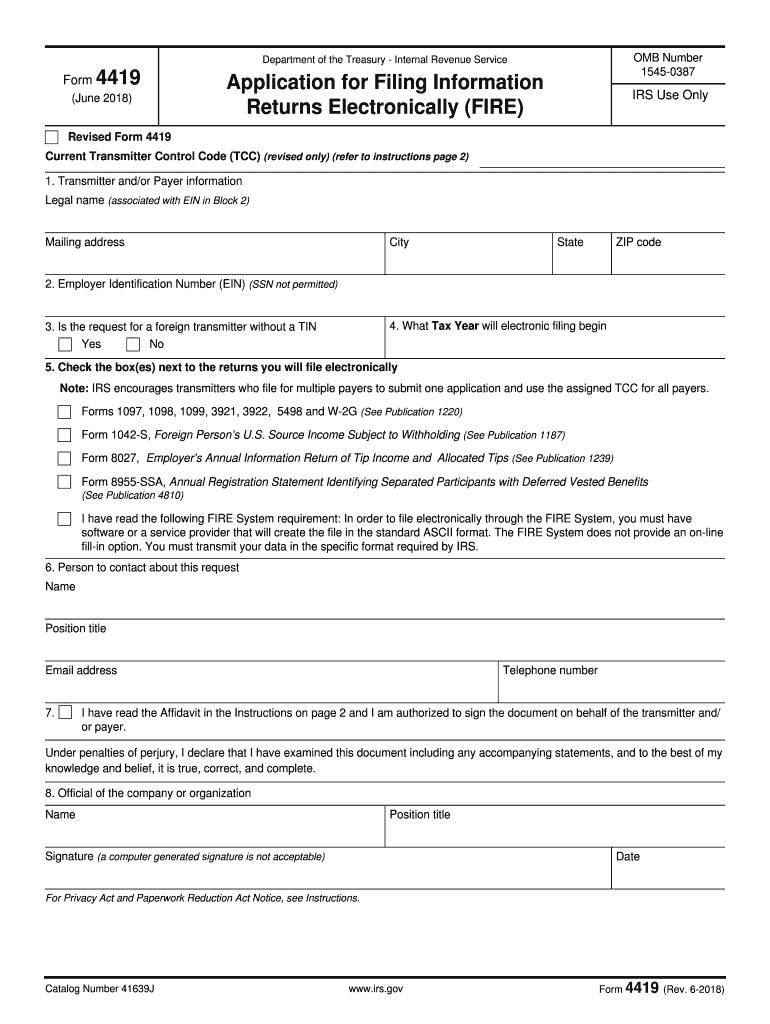

Before filers can use FIRE, they must get a TCC by completing an IR Application for TCC, formerly Form 4419, Application for Filing Information Returns Electronically. The TCC is a 5-digit code that identifies the business transmitting the electronic returns.

Do I need a new TCC code every year?

Note: If you use the TCC regularly, you do not need to apply again. If the TCC is not used for 2 years in a row, the IRS deletes it and you will need to re-apply for one.

What is a 4419?

About Form 4419, Application for Filing Information Returns Electronically (FIRE) | Internal Revenue Service.

Can I send a PDF of my tax return to the IRS?

Click on the PDF icon for the tax return you want to mail in which will open the PDF in a new window. Print this full document as you will need various parts of it. Separate the printed document into sections: Federal return.

Does TCC expire?

Will the TCC be deactivated if not used in two consecutive years? (added August 25, 2021) A. No, at the two year mark the customer will be sent a letter to advise they have not used their TCC in two years. If it is not used it will be made inactive in the third year.

Can I upload my tax return to the IRS?

Yes, you can file an original Form 1040 series tax return electronically using any filing status. Filing your return electronically is faster, safer, and more accurate than mailing your tax return because it's transmitted electronically to the IRS computer systems.

How do I get an IRS transmitter control code?

Before filers can use FIRE, they must get a TCC by completing an IR Application for TCC, formerly Form 4419, Application for Filing Information Returns Electronically. The TCC is a 5-digit code that identifies the business transmitting the electronic returns.

How long does it take to get a transmitter control code?

Once you've filled out this form, the IRS will issue you a TCC. Be sure to apply before you're actually planning to file your forms—it could take up to 45 days before you actually receive your code from the IRS.

How do I upload my income tax return?

Step 1: Log in to the e-Filing portal using your User ID and password. Step 2: Click e-File > Income Tax Forms > File Income Tax Forms.

How do I get a new TCC?

Steps for New FIRE TCC Applicants Log into the IR Application for TCC. Validate your identity. You will be prompted to create a 5-digit PIN to sign the application if you haven't already done so. Complete the online application.

How do I get my IRS TCC code?

(866) 455-7438 (Toll-free) • (304) 263-8700 (International not toll-free) • (304) 579-4827 for Telecommunications Device for the Deaf (TDD) (Not toll-free) Request a New Transmitter Control Code (TCC): If you are a corporation, partnership, employer, estate and/or trust, required to file 250 or more information returns

What is the transmitter code?

The Transmitter Control Code (TCC) is an identifier that the IRS uses to distinguish different electronic filing companies. It's necessary when you need to file for a correction. Getting a TCC depends on how you file your 1099 forms.

What does a transmitter control code look like?

A TCC number is a five-character number that typically consists of 2 digits, then 1 letter, then 2 more digits. To get a TCC number assigned to your business, download, fill out and submit Form 4419, Application for Filing Information Returns Electronically (FIRE).

Who can use the IRS fire system?

Any entity that needs to file information returns can file electronically via the FIRE System. Any corporation, partnership, employer, estate or trust that files 250 or more information returns for any calendar year must file electronically.

How can I upload documents to IRS?

You may use your existing email account to send your encrypted documents to your assigned IRS employee at the email address they gave you. If you're uncomfortable emailing your documents, you can send them to your assigned IRS employee with eFax, established secure messaging systems or mail.

How long does it take to get Transmitter control code from the IRS?

Submit the request by November 1st of the year before information returns are due and allow 45 days for processing. If your application is approved, a five-character alphanumeric TCC is assigned to your business.

How long does it take to get a TCC from IRS?

Submit the request by November 1st of the year before information returns are due and allow 45 days for processing. If your application is approved, a five-character alphanumeric TCC is assigned to your business.

Can I send a copy of my tax return to the IRS?

Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer. By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail.