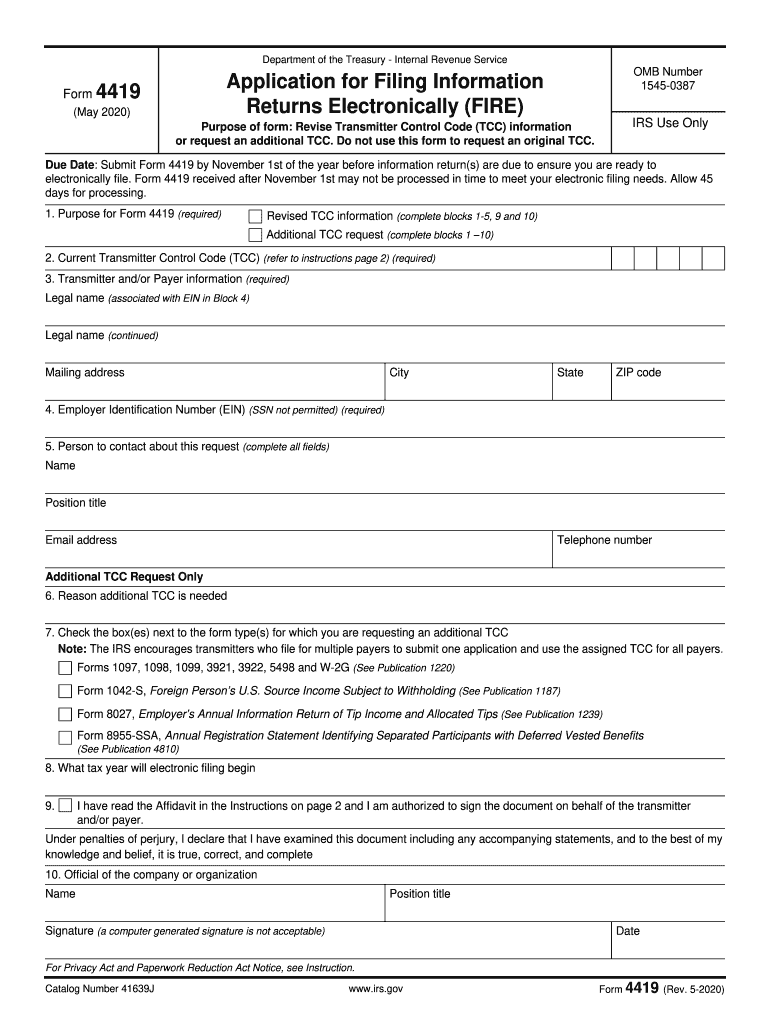

Who Needs Form 4419?

Everyone who needs to electronically file any tax forms, has to complete Form 4419. This may be a new user of the IRS e-file system.

What is Form 4419 for?

Form 4419 serves to get access to the IRS e-file system. The form is actually an application for a Transmitter Control Code assigned by the IRS to every e-filer. This is a five-digit code that a taxpayer gets after sending their Form 4419 to the IRS. The code allows a taxpayer to file specific tax forms electronically.

Is Form 4419 Accompanied by other Forms?

The form does not require additional documents. It should be sent in one copy.

When is Form 4419 Due?

Form 4419 is recommended for submission before the deadline of the tax return. So it is best to file Form 4419 forty-five days before the tax return is due.

How do I Fill out Form 4419?

Form 4419 is a one-page document with nine fields where a filer should provide:

- Name, address, EIN

- Contact information of a person who can be reached if any clarifications are needed

- Tax year when electronic filing begins

- The returns that a taxpayer chooses to file electronically

- Official name of the organization or the company

There is an instruction page that follows the form itself. So read the instructions before filling out your 4419.

Where do I Send Form 4419?

Form 4419 should be mailed or sent via Fax to the IRS.