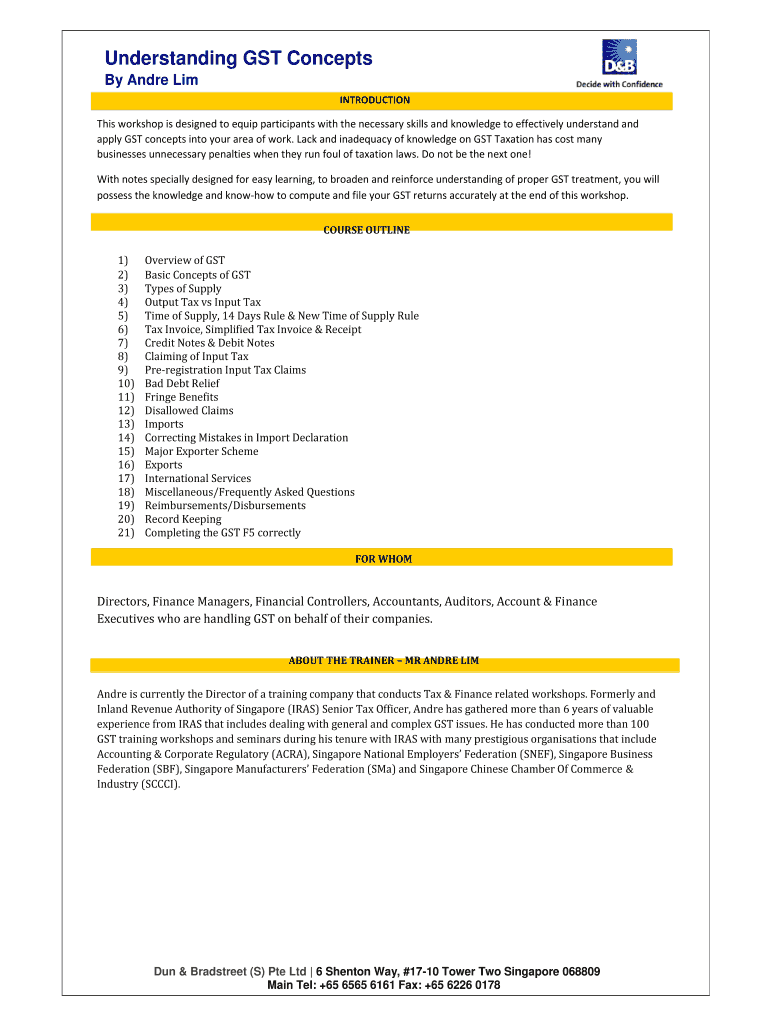

Get the free Understanding GST Concepts

Show details

Apply GST concepts into your area of work. Lack and ... With notes specially designed for easy learning, to broaden and reinforce understanding of proper GST treatment, you will ... 13) Imports ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding gst concepts

Edit your understanding gst concepts form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding gst concepts form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit understanding gst concepts online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit understanding gst concepts. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding gst concepts

01

Start by familiarizing yourself with the basic concepts of GST. Understand how GST works, including the input tax credit mechanism, tax rates, and different types of GST returns.

02

Stay updated on the latest GST regulations and changes. This is crucial as GST laws can undergo modifications periodically, so it is essential to be aware of any updates or amendments.

03

Seek professional help if needed. If you find it challenging to grasp certain GST concepts, consider consulting with a tax advisor or attending GST training programs to enhance your understanding.

04

Engage in self-study. There are various resources available online, such as official government websites, books, and articles that can provide in-depth knowledge about GST concepts. Make use of these resources to expand your understanding.

05

Keep track of your business transactions. Maintaining accurate records of all your sales, purchases, and expenses is essential for filling out GST returns correctly. Make sure to organize your financial documents and keep them up-to-date.

06

Familiarize yourself with GST software. If you are using accounting software, ensure that it is GST-compliant and can handle the necessary calculations and reporting requirements.

07

Regularly review and reconcile your GST returns. Take the time to cross-check your GST returns with the relevant financial records to ensure accuracy and avoid any discrepancies.

08

Seek clarity on doubts or queries. If you encounter any confusion or uncertainty while filling out GST returns, don't hesitate to seek clarification from experts or refer to official guidelines and FAQs provided by the tax authorities.

Who needs to understand GST concepts?

01

Business owners and entrepreneurs: Understanding GST concepts is crucial for business owners as they are responsible for complying with GST laws and regulations. This knowledge helps in accurate tax calculation, claiming input tax credits, and filling out GST returns.

02

Tax professionals and accountants: Professionals in the field of taxation and accounting need to have a thorough understanding of GST concepts to provide accurate advice and assistance to their clients. They play a crucial role in ensuring GST compliance for businesses.

03

Individuals involved in finance and procurement: Individuals involved in finance and procurement functions within organizations also require an understanding of GST concepts. This knowledge helps them make informed decisions about pricing, cost control, and managing tax liabilities.

04

Individuals planning to start a business: Aspiring entrepreneurs should have a basic understanding of GST concepts before starting a business. This knowledge will help them navigate through GST compliance requirements right from the beginning, avoiding any potential penalties or legal issues.

05

Consumers: While consumers are not directly responsible for GST compliance, having a general understanding of GST concepts can help them make informed purchasing decisions. Understanding how GST affects prices and value-added tax can assist consumers in budgeting and planning their expenses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit understanding gst concepts from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your understanding gst concepts into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit understanding gst concepts in Chrome?

understanding gst concepts can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete understanding gst concepts on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your understanding gst concepts. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is understanding gst concepts?

Understanding GST concepts involves familiarizing oneself with the Goods and Services Tax system, including its principles, regulations, and processes.

Who is required to file understanding gst concepts?

Any individual or business involved in the buying or selling of goods or services is required to have an understanding of GST concepts.

How to fill out understanding gst concepts?

Understanding GST concepts can be filled out by studying relevant resources, attending training sessions, or consulting with tax professionals.

What is the purpose of understanding gst concepts?

The purpose of understanding GST concepts is to ensure compliance with tax laws, accurately report taxes, and prevent any penalties or fines.

What information must be reported on understanding gst concepts?

Information such as taxable sales, input tax credits, GST collected, and GST paid must be reported on the understanding GST concepts form.

Fill out your understanding gst concepts online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding Gst Concepts is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.