Get the free business savings account application form

Show details

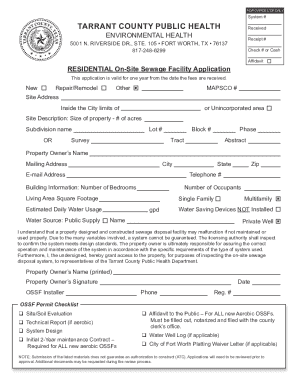

Business savingsBusiness Savings Account application form Sole Traders and PartnershipsBusiness Savings Account Application Form Please read the Terms and Conditions that apply to your chosen account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business savings account application

Edit your business savings account application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business savings account application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business savings account application online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit business savings account application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business savings account application

How to fill out business savings account application

01

To fill out a business savings account application, follow these steps:

02

Gather the necessary documents: You will typically need your business identification number, business license, and any other required legal documents.

03

Choose the right financial institution: Research different banks or credit unions that offer business savings accounts and compare their features, fees, and interest rates.

04

Visit the bank or credit union: Go to the selected financial institution's branch and ask for a business savings account application form.

05

Provide business information: Fill out the application form with accurate details about your business, including its legal name, address, contact information, and industry.

06

Provide personal information: In addition to business details, you may need to provide personal information about yourself, such as your name, address, and Social Security number.

07

Specify account requirements: Indicate whether you need any specific account features, such as online banking, debit cards, or a minimum balance requirement.

08

Submit the application: After completing the application form, submit it to the bank or credit union representative.

09

Verification process: The financial institution will review your application and may require additional documentation or verification before approving the account.

10

Account opening: Once your application is approved, you will receive the account details, including the account number and any other relevant information.

11

Fund the account: Transfer funds into the newly opened business savings account to start earning interest and managing your business finances.

12

Remember to carefully read the terms and conditions of the business savings account before proceeding with the application.

Who needs business savings account application?

01

Business owners or entities that want to separate their personal and business finances

02

Entrepreneurs looking to save money for future business expenses or emergencies

03

Companies aiming to earn interest on excess funds while keeping them readily accessible

04

Start-ups and small businesses that want to establish a financial relationship with a bank

05

Corporations or partnerships needing a designated account for specific financial goals or projects

06

Any business entity seeking to take advantage of the benefits and services offered by a business savings account.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my business savings account application in Gmail?

business savings account application and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get business savings account application?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific business savings account application and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the business savings account application in Gmail?

Create your eSignature using pdfFiller and then eSign your business savings account application immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is business savings account application?

A business savings account application is a form or request that a business submits to a financial institution in order to open a savings account specifically for their business.

Who is required to file business savings account application?

Any business entity or organization that wishes to open a savings account for their business is required to file a business savings account application.

How to fill out business savings account application?

To fill out a business savings account application, the business entity must provide information such as business name, type of business, business address, tax identification number, and any other required documentation requested by the financial institution.

What is the purpose of business savings account application?

The purpose of a business savings account application is to establish a separate savings account for the business to manage and grow their funds.

What information must be reported on business savings account application?

Information that must be reported on a business savings account application typically includes business name, type of business, business address, tax identification number, and any other relevant business information.

Fill out your business savings account application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Savings Account Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.