Get the free Ndividual Education Savings Plan Form

Show details

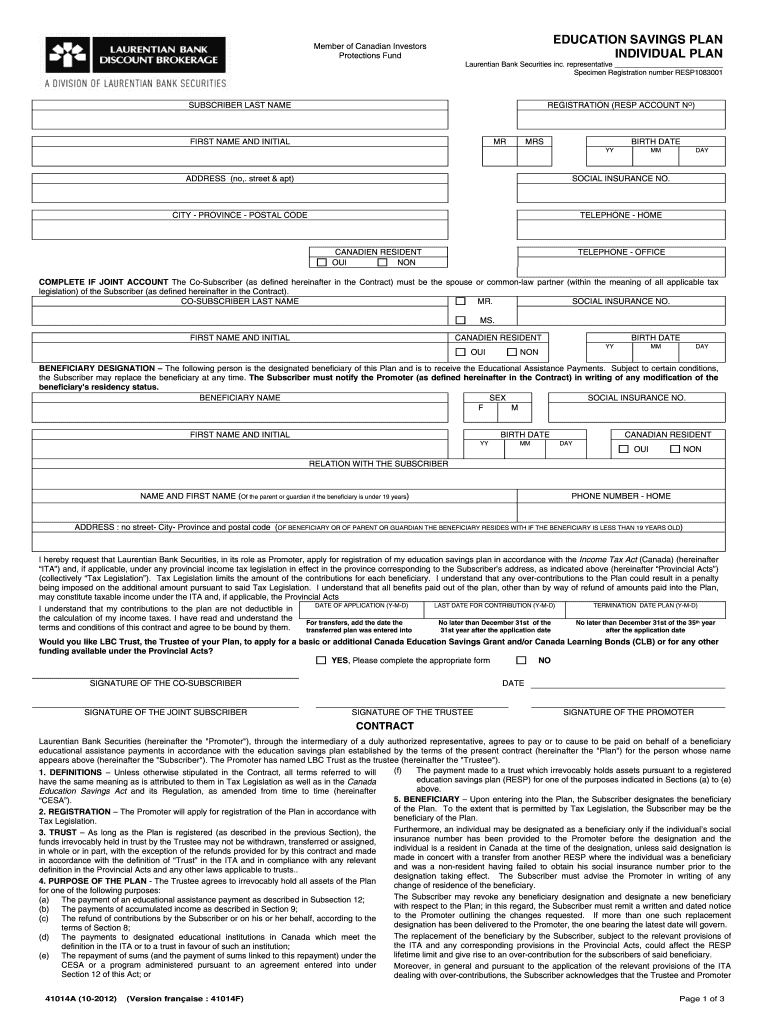

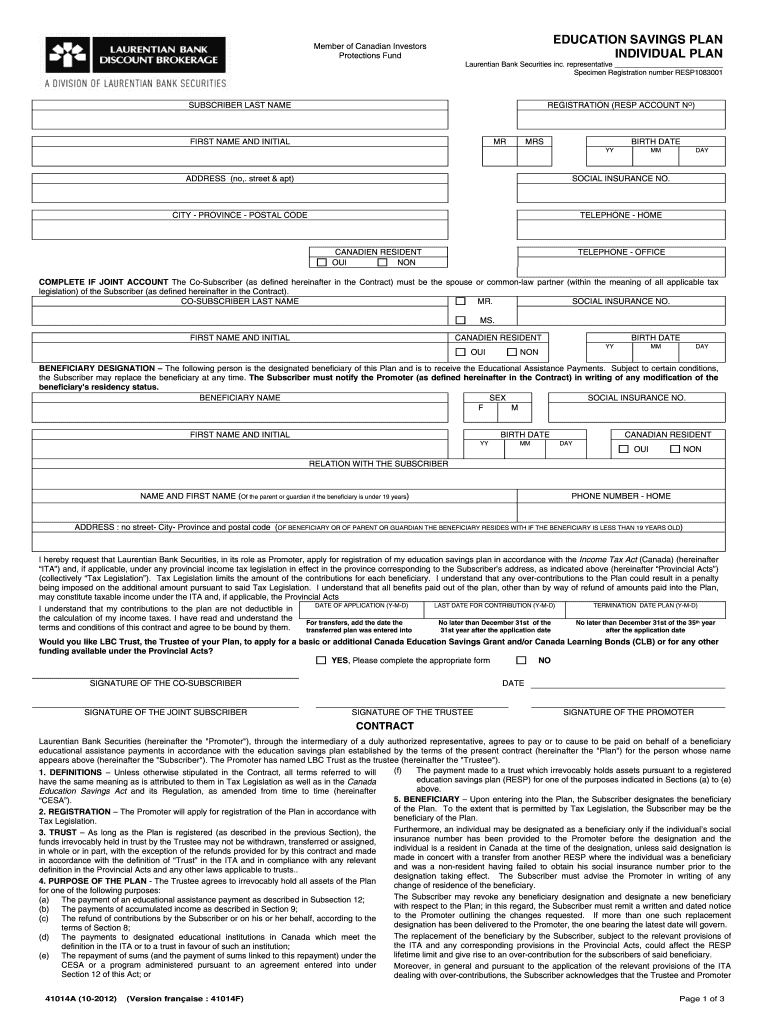

EDUCATION SAVINGS PLAN INDIVIDUAL PLAN Member of Canadian Investors Protections Fund Laurentian Bank Securities inc. representative Specimen Registration number RESP1083001 SUBSCRIBER LAST NAME REGISTRATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ndividual education savings plan

Edit your ndividual education savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ndividual education savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ndividual education savings plan online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ndividual education savings plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ndividual education savings plan

How to fill out individual education savings plan:

01

Start by researching and choosing the right financial institution or plan provider that offers individual education savings plans. Consider factors such as fees, investment options, and reputation.

02

Gather all the necessary documents and information, including your personal identification, social security number, and the beneficiary's information (such as their name, date of birth, and social security number).

03

Carefully read and understand the terms and conditions of the individual education savings plan. It is important to be aware of contribution limits, withdrawal rules, and any potential penalties or fees.

04

Determine the contribution amount you are comfortable with and establish a regular savings plan. Individual education savings plans often allow you to contribute either a lump sum or make periodic contributions.

05

Select the investment options within the plan that align with your risk tolerance and long-term goals. Depending on the plan, you may have access to various investment vehicles such as mutual funds or index funds.

06

Fill out the required forms provided by the financial institution or plan provider accurately. Double-check all the information before submitting it to ensure there are no errors or omissions.

07

Consider setting up automatic contributions to your individual education savings plan to ensure consistent savings without the need for manual transfers.

08

Monitor your individual education savings plan periodically to evaluate its performance and make any necessary adjustments. It is crucial to stay informed about changes in the plan's terms, investment options, or contribution limits.

09

Keep track of any educational expenses that may qualify for tax advantages, such as tuition fees or educational supplies. Consult a tax professional to understand the specific tax benefits related to individual education savings plans.

Who needs an individual education savings plan?

01

Parents or guardians who wish to save and invest for their child or children's future education expenses.

02

Students who want to contribute to their own education funds and take advantage of potential tax benefits.

03

Grandparents or other family members who want to help financially support a child or grandchild's education.

04

Individuals who believe in the importance of education and want to ensure they have sufficient funds to afford educational expenses in the future.

05

Anyone looking for a tax-advantaged investment option specifically designed for educational purposes. An individual education savings plan can provide potential tax benefits and help accumulate savings over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ndividual education savings plan for eSignature?

When you're ready to share your ndividual education savings plan, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my ndividual education savings plan in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your ndividual education savings plan right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit ndividual education savings plan on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing ndividual education savings plan.

What is ndividual education savings plan?

An Individual Education Savings Plan is a tax-advantaged savings account used to save for future education expenses.

Who is required to file ndividual education savings plan?

Parents or guardians looking to save for their child's education expenses are required to file an Individual Education Savings Plan.

How to fill out ndividual education savings plan?

To fill out an Individual Education Savings Plan, one must provide personal information, financial details, and select investment options.

What is the purpose of ndividual education savings plan?

The purpose of an Individual Education Savings Plan is to help families save for education expenses, such as tuition, books, and supplies.

What information must be reported on ndividual education savings plan?

Information such as account holder details, beneficiary details, contribution amounts, and investment selections must be reported on an Individual Education Savings Plan.

Fill out your ndividual education savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ndividual Education Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.