Get the free MUTUAL FUNDS PRE-AUTHORIZED CHEQUING AGREEMENT

Show details

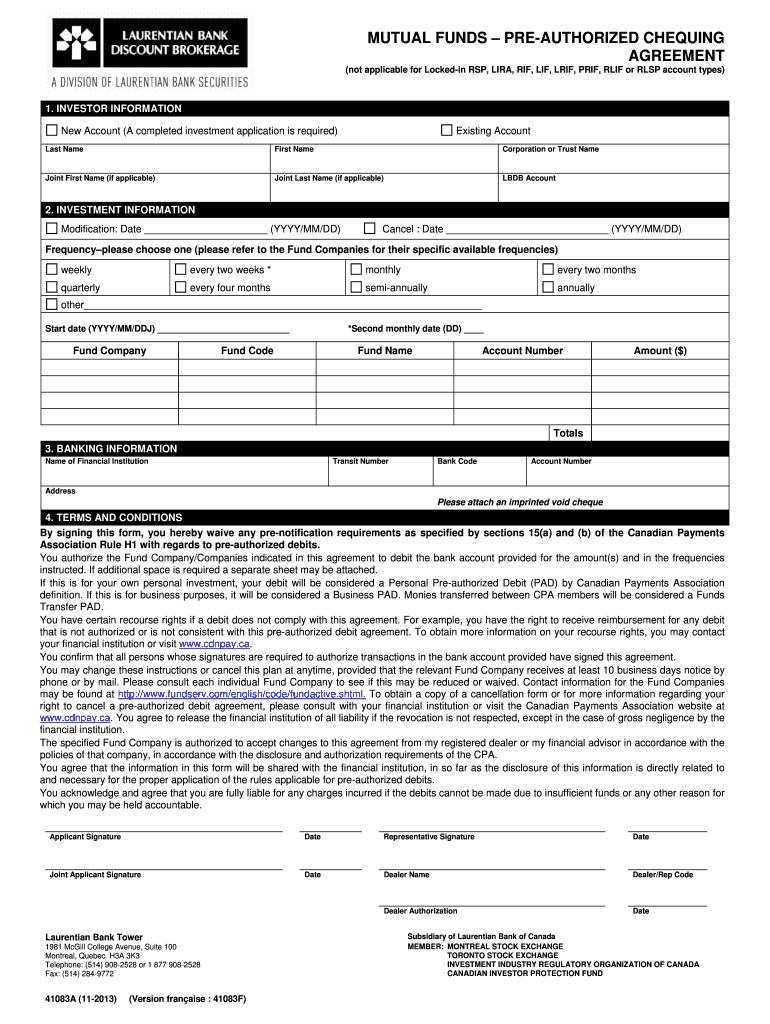

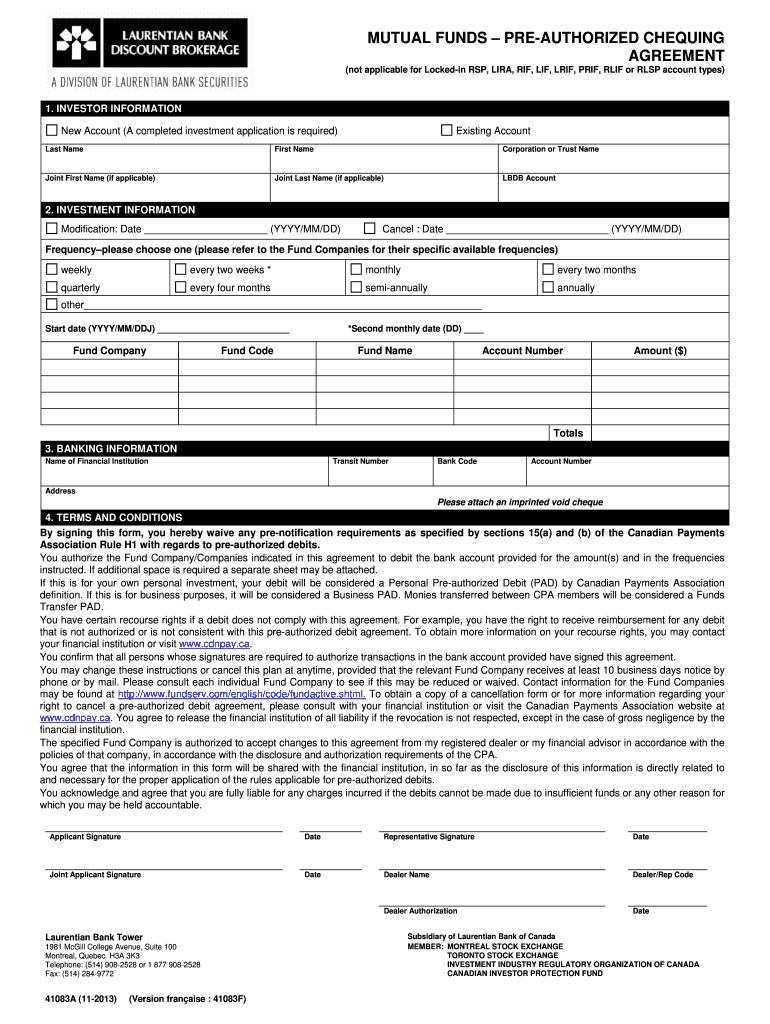

MUTUAL FUNDS PREAUTHORIZED CHEATING AGREEMENT (not applicable for Locke din RSP, LIRA, RIF, Elf, LEIF, PRI, RLI For LSP account types) 1. INVESTOR INFORMATION New Account (A completed investment application

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mutual funds pre-authorized chequing

Edit your mutual funds pre-authorized chequing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mutual funds pre-authorized chequing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mutual funds pre-authorized chequing online

To use the services of a skilled PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mutual funds pre-authorized chequing. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mutual funds pre-authorized chequing

How to fill out mutual funds pre-authorized chequing:

01

Obtain the necessary forms: Contact your financial institution or the mutual fund company to request the forms required to set up a pre-authorized chequing plan for your mutual funds investment.

02

Provide personal information: Fill out the forms with your personal details including your full name, address, social insurance number, and other requested information to establish your identity and allow for proper account setup.

03

Choose your investment options: Indicate which mutual funds you would like to invest in by providing the fund names, ticker symbols, or specific fund codes as specified by your financial institution or mutual fund company.

04

Determine the investment amount: Specify the amount you would like to invest in each mutual fund, either as a fixed dollar amount or as a percentage of your bank account balance.

05

Select the frequency of contributions: Decide how often you would like the contributions to be made from your bank account. Options may include monthly, quarterly, or semi-annually.

06

Provide bank account details: Fill in the required fields to provide the necessary banking information, including your bank account number, transit number, and institution number. This allows for the automatic transfer of funds from your bank account to your mutual funds.

07

Sign and date the forms: Read through the forms carefully, making sure all information is filled out accurately, and sign and date the documents where required.

08

Submit the forms: Once completed, submit the forms to your financial institution or the mutual fund company according to their specified instructions. It may be necessary to provide additional documentation such as a void cheque or a bank account verification form.

Who needs mutual funds pre-authorized chequing?

01

Investors with a long-term investment approach: Mutual funds pre-authorized chequing is beneficial for individuals who want to regularly contribute to their investment portfolio over an extended period. It allows for consistent investment contributions without the need for continuous manual transactions.

02

Individuals seeking convenience and automation: Pre-authorized chequing simplifies the investment process by automating contributions. It eliminates the need to remember and manually make regular deposits, making it a convenient option for busy individuals.

03

Those looking to benefit from dollar-cost averaging: Dollar-cost averaging is an investment strategy that involves regularly investing a fixed amount over time. By setting up pre-authorized chequing, individuals can take advantage of this strategy, potentially benefiting from purchasing more units of a mutual fund when prices are lower and fewer units when prices are higher.

Note: It is important to consult with a financial advisor or seek professional advice before making any investment decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mutual funds pre-authorized chequing for eSignature?

When you're ready to share your mutual funds pre-authorized chequing, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an electronic signature for signing my mutual funds pre-authorized chequing in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your mutual funds pre-authorized chequing right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit mutual funds pre-authorized chequing on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing mutual funds pre-authorized chequing.

What is mutual funds pre-authorized chequing?

Mutual funds pre-authorized chequing is a service that allows investors to automatically contribute a set amount of money at regular intervals to their mutual funds.

Who is required to file mutual funds pre-authorized chequing?

Investors who wish to set up automatic contributions to their mutual funds are required to file mutual funds pre-authorized chequing.

How to fill out mutual funds pre-authorized chequing?

To fill out mutual funds pre-authorized chequing, investors need to provide their banking information, the amount to be contributed, and the frequency of contributions.

What is the purpose of mutual funds pre-authorized chequing?

The purpose of mutual funds pre-authorized chequing is to help investors save and invest regularly without the need for manual contributions each time.

What information must be reported on mutual funds pre-authorized chequing?

On mutual funds pre-authorized chequing, investors must report their banking details, contribution amount, and contribution frequency.

Fill out your mutual funds pre-authorized chequing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mutual Funds Pre-Authorized Chequing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.