CA Alta Montclair EBSA Authorization Form 2013-2026 free printable template

Show details

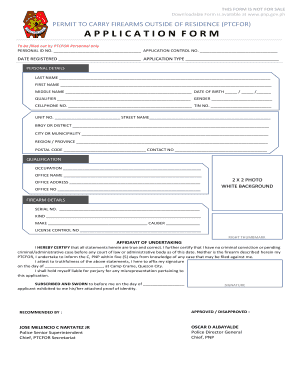

Authorization Form

2542 S. Mascot Avenue, Suite 100, Campbell, CA 95008 PH: (408) 3717661

PARTICIPANT INSTRUCTIONS PLEASE READ PRIOR TO SUBMISSION

An Authorization Form is mandatory for all requests

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign request return order form

Edit your CA Alta Montclair EBSA Authorization Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA Alta Montclair EBSA Authorization Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA Alta Montclair EBSA Authorization Form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA Alta Montclair EBSA Authorization Form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CA Alta Montclair EBSA Authorization Form

How to fill out CA Alta Montclair EBSA Authorization Form

01

Obtain the CA Alta Montclair EBSA Authorization Form from the official website or your workplace.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide the details of the benefits you are authorizing, specifying the type of information or services.

04

Sign the form to authorize the release of the specified information.

05

Date the form to indicate when the authorization was completed.

06

Submit the completed form to the designated authority or department as instructed.

Who needs CA Alta Montclair EBSA Authorization Form?

01

Individuals who are enrolled in benefits programs managed by CA Alta Montclair.

02

Beneficiaries seeking to authorize access to their personal health or benefits information.

03

Employees who need to allow their employer to share information with third-party providers.

Fill

form

: Try Risk Free

People Also Ask about

What is 1040?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Is 1040 the same as w2?

No, your W-2 and 1040 are different forms. A W-2 is the form that your employer will send to you with information on your income and tax rate, while a 1040 form is the form that you fill out and send to the IRS when filing your taxes.

What does a 1040 mean?

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

What is the form for income tax return?

Individuals residing in India with a total income of up to Rs 50 lakh are eligible. ITR-1 may be filed by someone who earns money from a job, a home, or other outlets. An NRI is unable to file an ITR-1. ITRs may be filed using Form 16 by salaried taxpayers.

How to fill out 1040 Form 2022?

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents. Step 2: Report Your Income. Step 3: Claim Your Deductions. Step 4: Calculate Your Tax. Step 5: Claim Tax Credits.

How do I file my ITR for the first time?

2. Online: Enter the relevant data directly online at e-filing portal and submit it. Taxpayer can file ITR 1 and ITR 4 online. PAN will be auto-populated. Select 'Assessment Year' Select 'ITR Form Number' Select 'Filing Type' as 'Original/Revised Return' Select 'Submission Mode' as 'Prepare and Submit Online'

How do I report my tax return?

You can file your own return online or have an accredited person file it for you. Since the regular filing deadline (April 30) falls on a Sunday this year, you have until May 1, 2023, to file your 2022 income tax return and pay any income tax you may owe. No interest or penalty will be charged.

How to file income tax return online step by step PDF?

Step 1: Calculation of Income and Tax. Step 2: Tax Deducted at Source (TDS) Certificates and Form 26AS. Step 3: Choose the right Income Tax Form. Step 4: Download ITR utility from Income Tax Portal. Step 5: Fill in your details in the Downloaded File. Step 6: Validate the Information Entered.

How do I fill out IRS?

How To Complete Form 1040 Step 1: Fill In Your Basic Information. The first half of Form 1040 asks some basic questions about your filing status, identification, contact information and dependents. Step 2: Report Your Income. Step 3: Claim Your Deductions. Step 4: Calculate Your Tax. Step 5: Claim Tax Credits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in CA Alta Montclair EBSA Authorization Form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing CA Alta Montclair EBSA Authorization Form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for signing my CA Alta Montclair EBSA Authorization Form in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your CA Alta Montclair EBSA Authorization Form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out CA Alta Montclair EBSA Authorization Form on an Android device?

On Android, use the pdfFiller mobile app to finish your CA Alta Montclair EBSA Authorization Form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is CA Alta Montclair EBSA Authorization Form?

The CA Alta Montclair EBSA Authorization Form is a document used to authorize the release of information or access to certain services related to employee benefits under the Employee Retirement Income Security Act (ERISA).

Who is required to file CA Alta Montclair EBSA Authorization Form?

Individuals who need to access or authorize the release of personal benefits information, such as employees, beneficiaries, or authorized representatives, are required to file the CA Alta Montclair EBSA Authorization Form.

How to fill out CA Alta Montclair EBSA Authorization Form?

To fill out the CA Alta Montclair EBSA Authorization Form, individuals must provide their personal information, specify the information to be released, identify the recipient of the information, and sign the form to acknowledge consent.

What is the purpose of CA Alta Montclair EBSA Authorization Form?

The purpose of the CA Alta Montclair EBSA Authorization Form is to ensure that individuals have control over their personal benefits information and to facilitate the process of sharing that information with authorized parties.

What information must be reported on CA Alta Montclair EBSA Authorization Form?

The information that must be reported on the CA Alta Montclair EBSA Authorization Form includes the individual's name, contact information, the specific benefits or information being authorized for release, the name of the entity receiving the information, and the individual's signature.

Fill out your CA Alta Montclair EBSA Authorization Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA Alta Montclair EBSA Authorization Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.