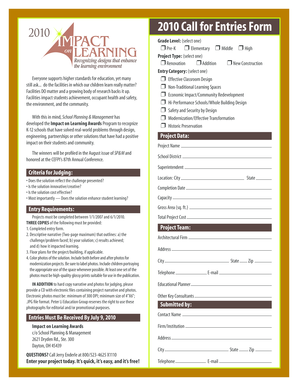

Get the free Charitable Will Bequests

Show details

Donation Form: Thank You for Your Support I/We are ready to improve the lives of children who have been adopted or in foster care and their families. Donor Information Name Address City State Zip

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable will bequests

Edit your charitable will bequests form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable will bequests form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable will bequests online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit charitable will bequests. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable will bequests

How to fill out charitable will bequests

01

To fill out charitable will bequests, follow these steps:

02

Consult with an attorney: It is recommended to seek legal advice from an attorney who specializes in estate planning to ensure that your wishes are properly documented.

03

Identify the charities: Determine which charitable organizations you wish to include in your will. Research their mission, reputation, and financial stability before making a decision.

04

Determine the amount or type of bequest: Decide whether you want to leave a specific dollar amount, a percentage of your estate, or certain assets to the charities.

05

Specify the bequest in your will: Clearly state the name of the charity, the specific amount or assets being bequeathed, and any other relevant details in your will.

06

Keep your will updated: Regularly review and update your will to reflect any changes or additions to your charitable bequests as your circumstances or preferences may change over time.

07

Inform the charities: It is beneficial to inform the charitable organizations about your intention to include them in your will and confirm that they have the necessary information to receive the bequest.

08

Consult with your attorney again: Before finalizing your will, consult with your attorney to ensure that all legal requirements are met and to address any specific considerations or questions you may have.

09

Store your will safely: Keep your original will in a secure location, such as a safe deposit box or with your attorney, and inform your loved ones of its whereabouts.

Who needs charitable will bequests?

01

Charitable will bequests may be suitable for individuals who:

02

- Have a philanthropic mindset and wish to leave a lasting impact on charitable organizations or causes they care about.

03

- Want to support causes they have been actively involved in during their lifetime, such as religious organizations, educational institutions, or healthcare charities.

04

- Have substantial assets and want to ensure that a portion of their estate is allocated towards charitable purposes.

05

- Desire to receive potential tax benefits associated with charitable donations through their estate.

06

- Seek to leave a positive legacy and make a difference in the world by supporting charitable initiatives.

07

However, it is essential to seek professional advice to determine if charitable will bequests align with an individual's overall estate planning goals and financial situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit charitable will bequests from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including charitable will bequests. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in charitable will bequests without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your charitable will bequests, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I sign the charitable will bequests electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your charitable will bequests.

What is charitable will bequests?

Charitable will bequests are gifts or donations made to charities through a person's last will and testament.

Who is required to file charitable will bequests?

Individuals who include charitable gifts in their last will and testament are required to file charitable will bequests.

How to fill out charitable will bequests?

To fill out charitable will bequests, individuals need to include the details of the charitable gifts in their will and ensure it complies with legal requirements.

What is the purpose of charitable will bequests?

The purpose of charitable will bequests is to support charitable organizations and causes that individuals care about even after their passing.

What information must be reported on charitable will bequests?

The information that must be reported on charitable will bequests includes the details of the charity receiving the gift, the amount or percentage of the gift, and any specific instructions.

Fill out your charitable will bequests online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Will Bequests is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.