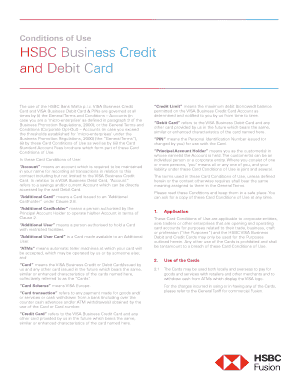

Get the free ESTATE PLANNING QUESTIONNAIRE. Limitation on Benefit (LOB) statement allows non-pers...

Show details

Initial Planning Conference Questionnaire Our future discussions in connection with your planning will be based on your specific personal and financial situation. Please provide the following information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estate planning questionnaire limitation

Edit your estate planning questionnaire limitation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estate planning questionnaire limitation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estate planning questionnaire limitation online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit estate planning questionnaire limitation. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estate planning questionnaire limitation

Who needs estate planning questionnaire limitation?

Individuals who are in the process of creating an estate plan or updating their existing one may need to fill out an estate planning questionnaire limitation. This questionnaire helps gather important information about their assets, debts, beneficiaries, and desired distribution of their estate after their death. It serves as a comprehensive tool to ensure that their wishes are accurately reflected in their estate plan.

How to fill out estate planning questionnaire limitation:

01

Begin by carefully reading the instructions provided with the questionnaire. Understanding the purpose and scope of the questionnaire is crucial before proceeding.

02

Start by filling out personal information such as full name, date of birth, and contact details. This ensures that the questionnaire is properly attributed to the individual completing it.

03

Provide detailed information about your assets. This may include real estate properties, bank accounts, investment portfolios, retirement accounts, life insurance policies, and any other valuable possessions. Include the approximate value of each asset, any outstanding mortgages or loans associated with it, and the current beneficiaries or joint owners, if any.

04

Disclose information about your debts and liabilities. This may include outstanding loans, credit card debts, mortgages, or any other financial obligations. Indicate the approximate amount owed for each debt and the corresponding creditor's contact information.

05

Specify your desired distribution of assets. This section allows you to outline how you want your estate to be distributed after your death. Name specific beneficiaries and their respective shares or provide instructions for any charitable donations or trusts.

06

Include additional information that may be relevant to the estate planning process. This could include specific funeral arrangements, instructions for the care of dependents or pets, or any special requests or considerations you would like to be addressed in your estate plan.

07

Review the filled questionnaire for accuracy and completeness. Double-check all the provided information to ensure it is up-to-date and accurate. Making any necessary corrections or additions at this stage can help avoid potential misunderstandings or discrepancies.

08

Seek professional advice if needed. If you are unsure about any aspect of the questionnaire or need assistance in completing it, consider consulting an estate planning attorney. They can provide guidance and ensure that the questionnaire is accurately completed, reflecting your specific circumstances and intentions.

By following these steps, you can efficiently fill out an estate planning questionnaire limitation, ensuring that your estate plan accurately reflects your wishes and provides a clear roadmap for the distribution of your assets after your passing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is estate planning questionnaire limitation?

The estate planning questionnaire limitation refers to the restrictions on the types of assets and information that can be included in the questionnaire.

Who is required to file estate planning questionnaire limitation?

Certain individuals such as those with large estates or complex financial situations may be required to file an estate planning questionnaire limitation.

How to fill out estate planning questionnaire limitation?

The estate planning questionnaire limitation can usually be filled out online or through a paper form provided by the relevant authority.

What is the purpose of estate planning questionnaire limitation?

The purpose of estate planning questionnaire limitation is to gather information about an individual's assets and financial situation to aid in the estate planning process.

What information must be reported on estate planning questionnaire limitation?

Information such as assets, liabilities, income sources, and beneficiaries may need to be reported on the estate planning questionnaire limitation.

How can I send estate planning questionnaire limitation for eSignature?

When you're ready to share your estate planning questionnaire limitation, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out estate planning questionnaire limitation using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign estate planning questionnaire limitation and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit estate planning questionnaire limitation on an iOS device?

Create, modify, and share estate planning questionnaire limitation using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your estate planning questionnaire limitation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estate Planning Questionnaire Limitation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.