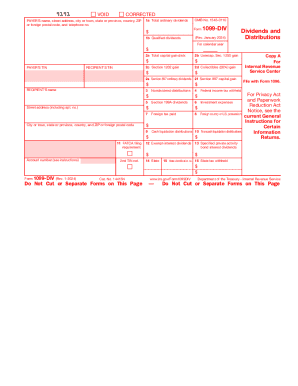

IRS 1099-DIV 2018 free printable template

Show details

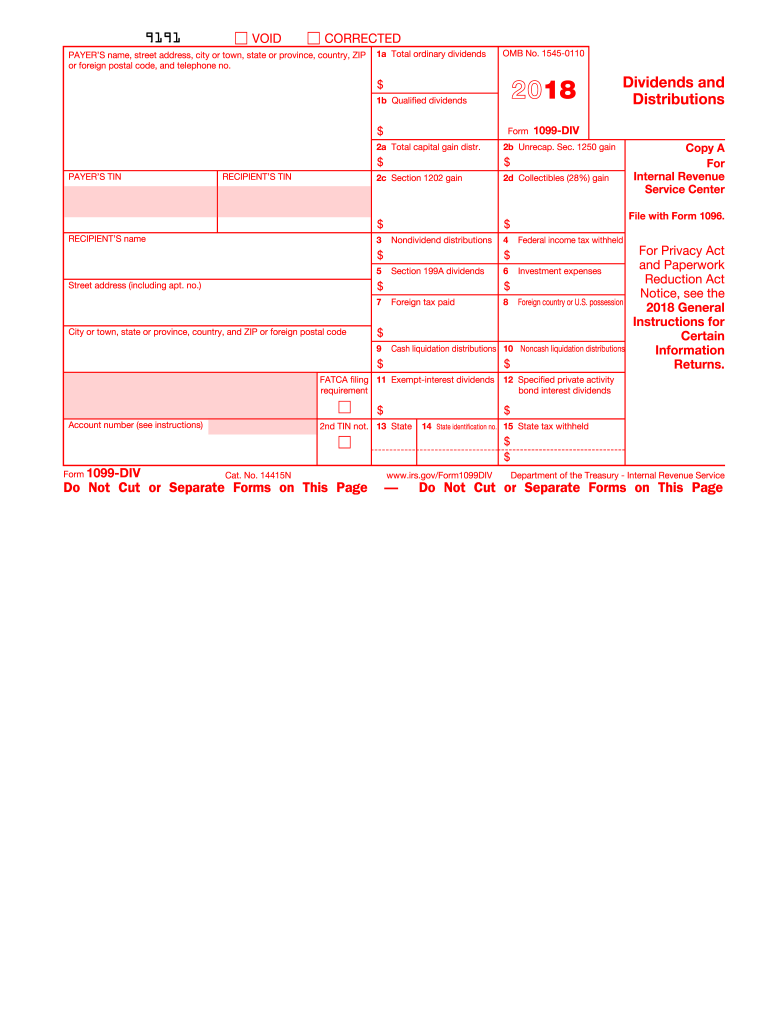

You must file Form 1099-DIV with a Form 1096 with the IRS for each of the other owners to show their share of the income and you must furnish a Form 1099-DIV to each. To be filed with recipient s state income tax return when required. Copy 2 Copy C For Payer To complete Form 1099-DIV use Returns and The 2018 Instructions for Form 1099-DIV. Future developments. For the latest information about developments related to Form 1099-DIV and its instructions such as legislation enacted after they were...published go to www.irs.gov/Form1099DIV. Street address including apt. no. 1099-DIV 2a Total capital gain distr. Dividends and Distributions For Privacy Act and Paperwork Reduction Act Notice see the 2018 General Certain Information Returns. 15 State tax withheld Form 1099-DIV Cat. No. 14415N Do Not Cut or Separate Forms on This Page www.irs.gov/Form1099DIV Department of the Treasury - Internal Revenue Service Copy 1 For State Tax Department 13 State CORRECTED if checked Copy B For Recipient...This is important tax information and is being furnished to the IRS. If you are required to file a return a negligence penalty or other sanction may be imposed on you if this income is taxable and the IRS determines that it has not been reported. keep for your records Recipient s taxpayer identification number TIN. You also may have a filing requirement. See the assigned to distinguish your account. Box 1a. Shows total ordinary dividends that are taxable. Include this amount on the Ordinary...dividends line of Form 1040. Also report it on Schedule B 1040 if required. Box 1b. VOID CORRECTED PAYER S name street address city or town state or province country ZIP or foreign postal code and telephone no. 1a Total ordinary dividends OMB No. 1545-0110 1b Qualified dividends PAYER S TIN RECIPIENT S TIN RECIPIENT S name Form 2b Unrecap. Sec. 1250 gain 2c Section 1202 gain 2d Collectibles 28 gain Nondividend distributions Section 199A dividends Foreign tax paid City or town state or province...country and ZIP or foreign postal code Investment expenses Foreign country or U.S. possession Cash liquidation distributions 10 Noncash liquidation distributions FATCA filing 11 Exempt-interest dividends requirement Account number see instructions Federal income tax withheld Copy A Internal Revenue Service Center File with Form 1096. Attention Copy A of this form is provided for informational purposes only. Copy A appears in red similar to the official IRS form* The official printed version of...Copy A of this IRS form is scannable but the online version of it printed from this website is not. Do not print and file copy A downloaded from this website a penalty may be imposed for filing with the IRS information return forms that can t be scanned* See part O in the current General Instructions for Certain Information Returns available at www*irs*gov/form1099 for more information about penalties. Please note that Copy B and other copies of this form which appear in black may be downloaded...and printed and used to satisfy the requirement to provide the information to the recipient.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-DIV

How to edit IRS 1099-DIV

How to fill out IRS 1099-DIV

Instructions and Help about IRS 1099-DIV

How to edit IRS 1099-DIV

To edit IRS 1099-DIV, you can use tools that allow for proper modification of the tax form. Start by ensuring that you have the correct version of the form that corresponds to the tax year relevant to your filing. If you need to make changes to the form, utilize a platform like pdfFiller that provides editing features specifically designed for tax forms. Make necessary edits, review your changes for accuracy, and save the updated form for submission.

How to fill out IRS 1099-DIV

To fill out IRS 1099-DIV properly, follow these steps:

01

Start by entering the payer's information in the designated fields. This includes their name, address, and TIN (Tax Identification Number).

02

In the next section, fill in the recipient’s details, including their name, address, and TIN.

03

Report the dividend payments in the appropriate boxes, ensuring to classify the types of dividends accurately, including ordinary dividends, qualified dividends, and total capital gains distributions.

04

Complete any other applicable sections, such as federal income tax withheld, if necessary, and review your entries for correctness.

About IRS 1099-DIV 2018 previous version

What is IRS 1099-DIV?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-DIV 2018 previous version

What is IRS 1099-DIV?

IRS 1099-DIV is a tax form used to report dividends and distributions to taxpayers. It is issued by banks, mutual funds, and other financial institutions to individuals who have earned dividend income throughout the tax year. This form plays a crucial role in ensuring that recipients accurately report their income to the IRS, aiding in compliance with tax obligations.

What is the purpose of this form?

The primary purpose of IRS 1099-DIV is to inform taxpayers about dividend income received during a tax year. It details the amount of dividends paid, including any capital gain distributions, and serves as proof of income for tax reporting purposes. Understanding the information on this form is vital for accurately reporting income to the IRS and for individual financial planning.

Who needs the form?

Individuals who receive dividend payments totaling $10 or more in a tax year are required to receive IRS 1099-DIV from the payer. This includes shareholders of stocks, mutual funds, and certain trusts that pay out dividends. Additionally, tax-exempt organizations and U.S. government entities may also receive this form if they earn dividends.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out IRS 1099-DIV if they do not receive any qualified dividends or if their dividend income does not meet the required threshold of $10. Moreover, certain entities like tax-exempt organizations may also be exempt from the necessity of reporting this form, as their income is not taxable.

Components of the form

IRS 1099-DIV consists of several key components, which include:

01

Box 1a: Reports ordinary dividends.

02

Box 1b: Reports qualified dividends.

03

Box 2a: Represents total capital gain distributions.

04

Box 3: Indicates non-dividend distributions.

05

Box 4: Shows federal income tax withheld.

Each of these components plays a critical role in determining the recipient’s tax liabilities and needs to be filled out accurately to avoid discrepancies with the IRS.

What are the penalties for not issuing the form?

If a payer fails to issue IRS 1099-DIV when required, they may be subject to penalties imposed by the IRS. These penalties can vary based on the time delay in issuing the form and can range from $50 to $270 per form, depending on how late the form is submitted. Furthermore, taxpayers may face difficulties when trying to reconcile their reported income without this necessary documentation.

What information do you need when you file the form?

When filing IRS 1099-DIV, the following information is essential:

01

Recipient's name, address, and TIN.

02

Payer's name, address, and TIN.

03

Total ordinary dividends received.

04

Total qualified dividends.

05

Any federal income tax withheld.

Collecting this information beforehand ensures a smooth filing process and helps avoid errors that may result in penalties.

Is the form accompanied by other forms?

IRS 1099-DIV may be accompanied by other forms depending on the circumstances of the payer and the types of payments issued. Typically, if federal tax was withheld, Form 945, Annual Return of Withheld Federal Income Tax, may need to accompany it. Additionally, recipients may need to file Form 1040 to report the income from the 1099-DIV when preparing their tax returns.

Where do I send the form?

IRS 1099-DIV must be sent to the IRS at the appropriate address, which varies based on the state from which you are filing and whether you are enclosing a payment. Additionally, the recipient should receive their copy by January 31 of the following tax year. It is crucial to ensure that all copies are accurately addressed and sent to the correct destinations to comply with IRS guidelines.

See what our users say