Treasury FS 3500 2016 free printable template

Show details

RESET FS Form 3500 (revised June 2016)Continuation Sheet for Listing Securities Print in ink or type all information. The bonds described on this form are included in the attached FS Form ISSUE DEFACE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Treasury FS 3500

Edit your Treasury FS 3500 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Treasury FS 3500 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Treasury FS 3500 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Treasury FS 3500. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Treasury FS 3500 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Treasury FS 3500

How to fill out Treasury FS 3500

01

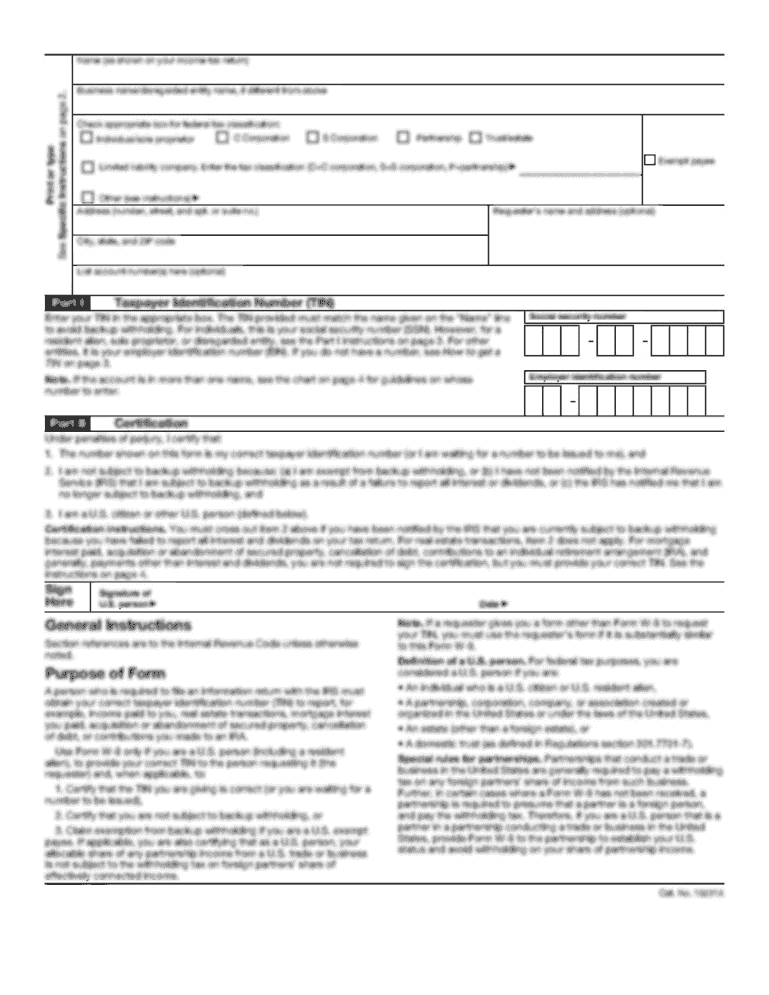

Obtain a copy of the Treasury FS 3500 form from the U.S. Department of the Treasury website.

02

Fill in the entity's name and address in the designated fields.

03

Provide the Employer Identification Number (EIN) assigned by the IRS.

04

Specify the type of entity (nonprofit, for-profit, government, etc.) in the appropriate section.

05

Indicate the purpose of the FS 3500 submission under the 'Reason for Application' section.

06

Complete all necessary financial information as required on the form.

07

Review the form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed FS 3500 form as instructed, either electronically or by mail.

Who needs Treasury FS 3500?

01

Organizations applying for a ruling under Internal Revenue Code Section 501(c)(3) for tax-exempt status.

02

Nonprofits seeking to establish their exemption from federal income tax.

03

Entities that need to clarify or amend their tax status with the IRS.

Fill

form

: Try Risk Free

People Also Ask about

Who pays taxes on inherited savings bonds?

Inheriting savings bonds can provide you with an unexpected windfall. However, there's one important question to ask: Do I have to pay tax on inherited savings bonds? The short answer is yes, you generally will be responsible for taxes owed on savings bonds you inherit from someone else.

Can a bank refuse to cash a savings bond?

There are circumstances under which a bank can refuse to issue payment for a bond, or in fact may be legally unable to do so. In these cases, the bearer may have to visit a Federal Reserve Bank Savings Bond Processing Site to redeem the bond.

Will I get a 1099 for cashing in savings bonds?

If you have cashed paper savings bonds, you will receive a 1099-INT in the mail. If you have paper HH savings bond that pay you interest every six months, you will also get a 1099-INT in the mail.

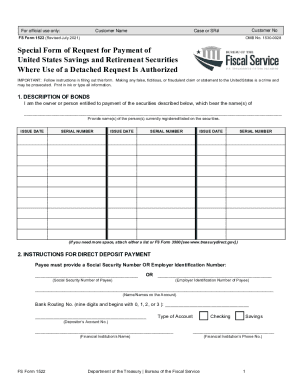

What is FS form 1522 used for?

USE OF FORM – Use this form to request payment of United States Savings Bonds, Savings Notes, Retirement Plan Bonds, and Individual Retirement Bonds.

Who is a certifying officer for TreasuryDirect?

Certifying Officer or Notary The bank account change form FS 5512 still only accepts the signature guarantee from a “certifying officer.” This officer can be someone at a bank, a credit union, or a brokerage firm. You sign in front of the officer. The officer signs the form after verifying your ID.

Do you need ID to cash a bond?

Required: Your financial institution is required to cash bonds/notes eligible for payment for a customer with the proper identification.

What is a FS form 5336?

The Bureau of the Fiscal Service of the U.S. Department of the Treasury, published a form (the FS Form 5336) that allows a Voluntary Representative to claim Savings Bonds belonging to a deceased individual.

Will TreasuryDirect accept a notary?

Your signature on Page 2 must be certified by an authorized certifying official. Certification by a Notary public is NOT acceptable. Acceptable certifications include a financial Institution's Official Seal or Stamp (such as Corporate Seal, Signature Guaranteed Stamp, or Medallion Stamp).

What is a FS form 5396?

If Series HH bonds are being reissued, the surviving registrant must also complete Direct Deposit Sign- Up Form (FS Form 5396) for direct deposit of the interest payments. The financial institution where the checking or savings account is maintained can assist with completing the form.

Who pays taxes on co owned savings bonds?

If a U.S. savings bond is issued in the names of co-owners, such as the taxpayer and a child, or the taxpayer and spouse, then the bond's interest is generally taxable to the co-owner who purchased the bond.

How do I cash an inherited savings bond?

Cash savings bonds in a non-administered estate Fill out FS Form 5336. WAIT to sign until you are in the presence of a certifying official, as explained on the form. Get a certified copy of the death certificate for everyone who has died who is named on any of the bonds. Send us the. Mail the package to us at.

How do you tell if a savings bond has been cashed?

You can call the Savings Bond Processing Site at (800) 553-2663 to check on the status of a savings bond.

What documents do I need to cash a savings bond?

Get FS Form 1522. Fill it out. Get your signature certified, if necessary. (If the value of the bond(s) you are cashing is more than $1,000, you must have your signature certified.

How do you cash savings bonds if owner is deceased?

Get a certified copy of the death certificate for everyone who has died who is named on any of the bonds. Have each person who is entitled to a distributed bond also fill out and sign the appropriate forms: If they want cash for their bond: FS Form 1522. If it is an EE or I bond and they want to keep it: FS Form 4000.

Can I cash savings bonds at any bank?

Banks and credit unions can redeem savings bonds over the counter.

Who counts as a certifying officer?

§ 346.14 Certifying officers. Any postmaster, acting postmaster, or inspector-in-charge, or other post office official or clerk designated for that purpose.

Can you cash the bonds of a deceased parent?

The customer must have a certified death certificate. Don't cash the bond. The customer must have a certified death certificate.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Treasury FS 3500 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your Treasury FS 3500 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify Treasury FS 3500 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your Treasury FS 3500 into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I sign the Treasury FS 3500 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your Treasury FS 3500 in seconds.

What is Treasury FS 3500?

Treasury FS 3500 is a form used by certain financial institutions to report customer deposits and withdrawals for purposes of regulatory compliance and anti-money laundering efforts.

Who is required to file Treasury FS 3500?

Financial institutions that accept deposits, such as banks and credit unions, are required to file Treasury FS 3500 when certain transaction thresholds are met.

How to fill out Treasury FS 3500?

To fill out Treasury FS 3500, institutions must gather necessary customer transaction data, complete the form with accurate details, and submit it to the appropriate regulatory body in accordance with filing guidelines.

What is the purpose of Treasury FS 3500?

The purpose of Treasury FS 3500 is to ensure compliance with financial laws and regulations, as well as to help detect and prevent money laundering and other financial crimes.

What information must be reported on Treasury FS 3500?

Information reported on Treasury FS 3500 includes customer identification details, transaction amounts, dates, and any suspicious activity that may require further investigation.

Fill out your Treasury FS 3500 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Treasury FS 3500 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.