MO MODES-10B 2016 free printable template

Show details

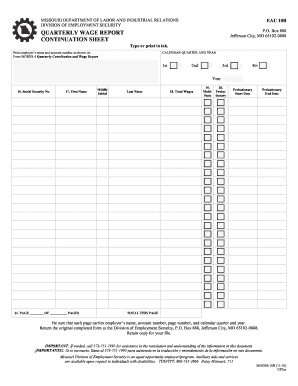

MISSOURI DEPARTMENT OF LABOR AND INDUSTRIAL RELATIONS DIVISION OF EMPLOYMENT SECURITY EAU 10BQUARTERLY WAGE REPORT CONTINUATION SHEEP. O. Box 888 Jefferson City, MO 651020888Type or print in ink.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MO MODES-10B

Edit your MO MODES-10B form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MO MODES-10B form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MO MODES-10B online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MO MODES-10B. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MO MODES-10B Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MO MODES-10B

How to fill out MO MODES-10B

01

Gather all necessary personal and financial information.

02

Begin filling out the identification section with your name, address, and contact information.

03

Provide your Social Security number as well as any other required identification numbers.

04

Enter your income details for the specified time periods.

05

Include any relevant deductions or adjustments you may be eligible for.

06

Double-check all entered information for accuracy.

07

Sign and date the form as required.

Who needs MO MODES-10B?

01

Individuals applying for benefits or assistance programs.

02

Taxpayers who need to report specific financial information.

Instructions and Help about MO MODES-10B

Fill

form

: Try Risk Free

People Also Ask about

How do I report unpaid wages in Missouri?

If the amount due in back wages is less than $5,000, workers may file their claim in Small Claims Court, where costs are less and it is easier to proceed without hiring private legal counsel. Individuals attempting to recover amounts above $5,000 should pursue a private right of action in circuit court.

Is Missouri a prevailing wage state?

Missouri's Prevailing Wage Law establishes a minimum wage rate that must be paid to workers on public works construction projects valued at more than $75,000, such as bridges, roads, and government buildings.

Does Missouri have reporting time pay?

Show up or reporting time. Missouri law does not require employers to pay employees for reporting or showing up to work if no work is performed. An employer is also not required to pay an employee a minimum number of hours if the employer dismisses the employee from work prior to completing their scheduled shift.

What is the statute of limitations on wage claims in Missouri?

Any agreement between the employee and the employer to work for less than the wage rate shall be no defense to the action. All actions for the collection of any deficiency in wages shall be commenced within three years of the accrual of the cause of action.

What is the prevailing wage in St Louis MO?

The current prevailing wage in the city of St. Louis ranges from $34 an hour to nearly $70 an hour, depending on the job, ing to information from the state of Missouri.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MO MODES-10B directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign MO MODES-10B and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I edit MO MODES-10B on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign MO MODES-10B on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete MO MODES-10B on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your MO MODES-10B. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is MO MODES-10B?

MO MODES-10B is a form used in the state of Missouri for reporting various tax-related information, often pertaining to businesses and their operations.

Who is required to file MO MODES-10B?

Businesses operating in Missouri that meet certain criteria regarding their income or business activities may be required to file MO MODES-10B.

How to fill out MO MODES-10B?

To fill out MO MODES-10B, you need to gather relevant business information, complete the form as per the instructions provided, and ensure that all required fields are accurately filled before submitting it.

What is the purpose of MO MODES-10B?

The purpose of MO MODES-10B is to collect specific tax information from businesses operating in Missouri to ensure compliance with state tax laws.

What information must be reported on MO MODES-10B?

MO MODES-10B typically requires businesses to report details such as business name, address, tax identification number, revenue figures, and other relevant financial data.

Fill out your MO MODES-10B online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MO MODES-10b is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.