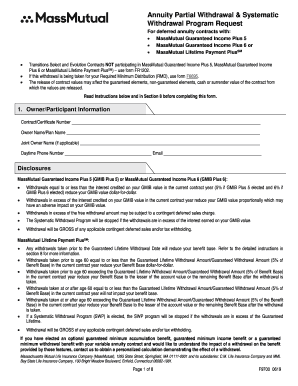

MassMutual F9700 2018 free printable template

Show details

For Every Action There Is a Reaction

Your SharePoint Checklist for Partial WithdrawalsWhile your annuity contract allows for partial withdrawals to help meet short term objectives, it

is important

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MassMutual F9700

Edit your MassMutual F9700 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MassMutual F9700 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MassMutual F9700 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MassMutual F9700. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MassMutual F9700 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MassMutual F9700

How to fill out MassMutual F9700

01

Obtain the MassMutual F9700 form from the official MassMutual website or your financial advisor.

02

Read the instructions provided with the form carefully to understand the purpose and requirements.

03

Fill in the personal information section, including your name, address, and contact details.

04

Provide the relevant policy or account information that is requested on the form.

05

Complete any sections related to beneficiary designations, if applicable.

06

Review all the information filled out to ensure accuracy and completeness.

07

Sign and date the form as required at the end of the document.

08

Submit the completed form as instructed, either through mail or electronically.

Who needs MassMutual F9700?

01

Individuals seeking to make beneficiary designations for their life insurance policies or financial accounts.

02

Policyholders who want to update or change their existing information with MassMutual.

03

Individuals looking to establish a trust or other financial arrangement through MassMutual products.

Instructions and Help about MassMutual F9700

Fill

form

: Try Risk Free

People Also Ask about

What is an example of an annuity income?

Example of an Annuity An example of an immediate annuity is when an individual pays a single premium, say $200,000, to an insurance company and receives monthly payments, say $5,000, for a fixed time period afterward. The payout amount for immediate annuities depends on market conditions and interest rates.

How much would a $250000 annuity pay?

How Much Does An $250,000 Annuity Pay? The guaranteed monthly payments you will receive for the rest of your life are roughly $1,094 if you purchase a $250,000 annuity at age 60. You will receive approximately $1,198 monthly at age 65 and approximately $1,302 at age 70 for the rest of your life.

How much does a $2 million annuity pay per month?

The earlier you purchase an annuity, the higher your monthly payout will be. A $2 million could pay approximately $10,000 to $20,000 monthly, depending on your contract and what age you purchase the policy. However, these are ballpark figures, and your individual payout can vary broadly.

How much would a $250 000 annuity pay?

How Much Does An $250,000 Annuity Pay? The guaranteed monthly payments you will receive for the rest of your life are roughly $1,094 if you purchase a $250,000 annuity at age 60. You will receive approximately $1,198 monthly at age 65 and approximately $1,302 at age 70 for the rest of your life.

How much does a $100 000 annuity pay per month?

How much does a $100,000 annuity pay per month? Our data revealed that a $100,000 annuity would pay between $448 and $1,524 monthly for life if you use a lifetime income rider. The payments are based on the age you buy the annuity contract and the time before taking the money.

How much would a $100000 annuity pay at the age of 60?

A $100,000 annuity would pay you approximately $508 each month for the rest of your life if you purchased the annuity at age 60 and began taking payments immediately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MassMutual F9700 on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing MassMutual F9700.

How do I complete MassMutual F9700 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your MassMutual F9700, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out MassMutual F9700 on an Android device?

On Android, use the pdfFiller mobile app to finish your MassMutual F9700. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is MassMutual F9700?

MassMutual F9700 is a specific tax form used by MassMutual to report certain financial information related to insurance products and services.

Who is required to file MassMutual F9700?

Individuals or entities that have transactions or accounts with MassMutual that require tax reporting are generally required to file MassMutual F9700.

How to fill out MassMutual F9700?

To fill out MassMutual F9700, gather the required financial information, follow the provided instructions on the form, and ensure that all sections are completed accurately before submission.

What is the purpose of MassMutual F9700?

The purpose of MassMutual F9700 is to accurately report financial information to the IRS for tax purposes, ensuring compliance with tax regulations.

What information must be reported on MassMutual F9700?

The information that must be reported on MassMutual F9700 includes details about income, distributions, transactions, and any relevant exemptions or deductions associated with MassMutual products.

Fill out your MassMutual F9700 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MassMutual f9700 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.