Get the free ANNUITY PARTIAL SURRENDER REQUEST

Show details

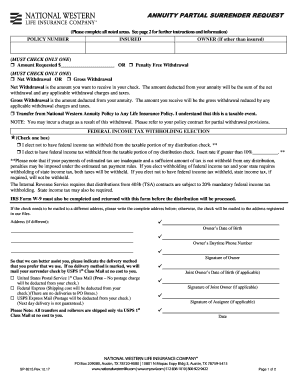

ANNUITY PARTIAL SURRENDER REQUEST (Please complete all noted areas. See page 2 for further instructions and information) POLICY NUMBERINSUREDOWNER (If other than insured)(MUST CHECK ONLY ONE) Amount

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annuity partial surrender request

Edit your annuity partial surrender request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annuity partial surrender request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annuity partial surrender request online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit annuity partial surrender request. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annuity partial surrender request

How to fill out annuity partial surrender request

01

To fill out an annuity partial surrender request, follow these steps:

02

Obtain the annuity partial surrender request form from the insurance company or financial institution that issued the annuity.

03

Fill in your personal details, such as your name, address, and contact information.

04

Provide the policy or contract number of the annuity for which you are requesting a partial surrender.

05

Indicate the amount you wish to surrender from your annuity. This may be a specific dollar amount or a percentage of the total value.

06

Specify the reason for the partial surrender request, such as a financial need or investment opportunity.

07

Review the information you have provided to ensure accuracy and completeness.

08

Sign and date the annuity partial surrender request form.

09

Submit the completed form to the insurance company or financial institution according to their instructions. This may involve mailing the form or submitting it online.

10

Keep a copy of the completed form for your records.

11

Wait for confirmation from the insurance company or financial institution regarding the processing of your annuity partial surrender request.

Who needs annuity partial surrender request?

01

Annuity partial surrender request is typically needed by individuals who hold annuities and wish to withdraw a portion of the funds before the maturity or surrender period of the annuity contract.

02

Common reasons for requesting an annuity partial surrender include:

03

- Financial emergencies or unexpected expenses

04

- Investment opportunities

05

- Debt repayment

06

- Home repairs or renovations

07

- Education expenses

08

- Medical bills

09

It is important to carefully consider the terms and consequences of a partial surrender before making the request, as it may impact the future value and benefits of the annuity.

Fill

form

: Try Risk Free

People Also Ask about

How much does it cost to surrender an annuity?

A typical annuity surrender fee could be 10% of the funds contributed to the contract within the first year it is effective. For each successive year of the contract, the surrender fee might drop by 1%.

What happens when annuity is out of surrender?

Once the surrender period is over there are no surrender charges, Market Value Adjustment, or any non-forfeiture of premium bonus.

Can annuities be surrendered?

A "surrender charge" is a type of sales charge you must pay if you sell or withdraw money from a variable annuity during the "surrender period" – a set period of time that typically lasts six to eight years after you purchase the annuity. Surrender charges will reduce the value and the return of your investment.

How much is a surrender charge on an annuity?

Surrender charge periods vary in length and typically decrease the fee charged during the period. For example… … if $10,000 was withdrawn in the second year the surrender charge would be $500 ($10,000 X 5 percent). This is just an example.

Is an annuity surrender the same as withdrawal?

The surrender period is the time frame in which an investor cannot withdraw funds from an annuity without paying a surrender fee. The surrender period can run several years, and annuitants can incur significant penalties if invested funds are withdrawn before that period has expired.

Can I cancel an annuity and get my money back?

An annuity can be cashed out at any time before annuitizing the contract. If the annuity is cashed out before the deferred annuity's term has been met, a surrender charge can be applied. Generally, the annuity can be cashed out without a penalty after the term has been completed.

Who gets the annuity surrender value?

Cash surrender value is money an insurance company pays to a policyholder or an annuity contract owner if their policy is voluntarily terminated before maturity or an insured event occurs.

How do I get my money out of an annuity?

If you need to cash out your annuity, the first step is to contact your insurance company and request an annuity surrender form. Next, decide whether to surrender the entire amount or a partial amount. Then, fill out the surrender form and send it back to the insurance company.

What does annuity out of surrender mean?

What does out of surrender mean on an annuity? Out of surrender means you are no longer subject to the surrender charge. This typically happens after the surrender charge period has expired. Once you are out of surrender, you can cash in your annuity without paying a fee.

How do you surrender an annuity?

When you surrender your annuity, you exchange all or a portion of your annuity for its cash value before the end of the annuity contract term. In other words, you surrender your annuity when you make early withdrawals. For this, you will incur a fee.

What does it mean to surrender an annuity?

A "surrender charge" is a type of sales charge you must pay if you sell or withdraw money from a variable annuity during the "surrender period" – a set period of time that typically lasts six to eight years after you purchase the annuity. Surrender charges will reduce the value and the return of your investment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify annuity partial surrender request without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your annuity partial surrender request into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit annuity partial surrender request online?

With pdfFiller, it's easy to make changes. Open your annuity partial surrender request in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit annuity partial surrender request straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing annuity partial surrender request right away.

What is annuity partial surrender request?

An annuity partial surrender request is a formal request made by the policyholder to withdraw a portion of the funds from their annuity contract.

Who is required to file annuity partial surrender request?

The policyholder or contract owner is required to file an annuity partial surrender request.

How to fill out annuity partial surrender request?

To fill out an annuity partial surrender request, the policyholder must typically provide their name, policy number, requested withdrawal amount, and signature.

What is the purpose of annuity partial surrender request?

The purpose of an annuity partial surrender request is to access a portion of the funds in the annuity contract before the maturity date.

What information must be reported on annuity partial surrender request?

The information required on an annuity partial surrender request typically includes the policyholder's details, requested withdrawal amount, and any relevant tax withholding information.

Fill out your annuity partial surrender request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annuity Partial Surrender Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.