TX MHD 1013 2018-2026 free printable template

Show details

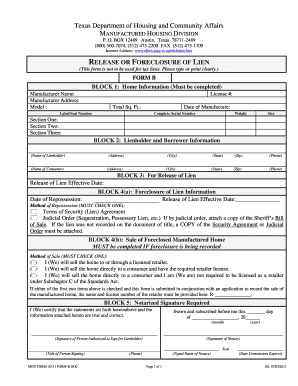

This document is used to release a lien or to document repossession of manufactured housing in Texas. It includes sections for home information, lienholder and borrower details, as well as sections

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pdffiller form

Edit your mhd 1013 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas mhd form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX MHD 1013 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TX MHD 1013. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX MHD 1013 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX MHD 1013

How to fill out TX MHD 1013

01

Obtain the TX MHD 1013 form from the official Texas Health and Human Services website or your healthcare provider.

02

Provide your personal information, including your full name, date of birth, and contact details.

03

Fill out the section for Medical History, noting any past medical conditions and treatments.

04

Complete the required information about your current medication and healthcare providers.

05

Review the form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the completed TX MHD 1013 form to the appropriate department or agency as instructed.

Who needs TX MHD 1013?

01

Individuals seeking services under the Texas Mental Health Code.

02

Patients applying for mental health treatment or services.

03

Healthcare providers or facilities submitting information on behalf of a patient.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1099-B form for taxes?

If you sold stock, bonds or other securities through a broker or had a barter exchange transaction (exchanged property or services rather than paying cash), you will likely receive a Form 1099-B. Regardless of whether you had a gain, loss, or broke even, you must report these transactions on your tax return.

Does 1099-B go to IRS?

Form 1099-B, Proceeds from Broker and Barter Exchange Transactions is the form issued to taxpayers that reports their capital gains and losses for the tax year. It is sent by the broker or barter exchange to clients and the IRS.

Is 1099-B reported to IRS?

Do I Have to Report 1099-B on My Taxes? While you don't send the actual Form 1099-B to the IRS with your tax return, you must include the information that's on it on Form 8949 and send that along with Schedule D, which is what you'll use to record your totals for all transactions shown on Form 8949.

Do I need to mail 1099-B to IRS?

You can still e-file your return, but you'll need to mail a paper copy of your 1099-B to the IRS along with Form 8453, which you can print from your online account or from the desktop software.

What is the new Schedule B tax form?

Schedule B is a tax schedule provided by the Internal Revenue Service (IRS) that helps taxpayers compute income tax due on interest paid from a bond and dividends earned. Individuals must complete this form and attach it to their annual tax returns if they received more than $1,500 in qualified interest or dividends.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TX MHD 1013 in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your TX MHD 1013 and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I edit TX MHD 1013 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share TX MHD 1013 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete TX MHD 1013 on an Android device?

Use the pdfFiller mobile app to complete your TX MHD 1013 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is TX MHD 1013?

TX MHD 1013 is a form used in Texas for reporting certain health data, specifically related to mental health disorders. It is utilized by facilities providing mental health services.

Who is required to file TX MHD 1013?

Facilities that provide mental health services and are licensed by the state of Texas are required to file TX MHD 1013.

How to fill out TX MHD 1013?

To fill out TX MHD 1013, you need to provide information including the facility's details, patient demographics, and specific data regarding mental health treatments administered.

What is the purpose of TX MHD 1013?

The purpose of TX MHD 1013 is to collect and report data on mental health services provided in Texas, which helps in monitoring and improving mental health care.

What information must be reported on TX MHD 1013?

Required information includes the facility's name and address, patient identification, type of mental health services provided, and outcomes of those services.

Fill out your TX MHD 1013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX MHD 1013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.